-- Published: Thursday, 5 May 2016 | Print | Disqus

By Graham Summers

Europe has banned the use of €500 bills.

The reason?

They claim these bills are used in money laundering and for drugs. And if you believe that is the concern, you probably believe the earth is flat.

The fact of the matter is that Europe is now the center for misguided Central Planning for monetary policy. ECB President Mario Draghi has cut interest rates not once, not twice, not even thrice, but FOUR times into NIRP.

The end result has been two items:

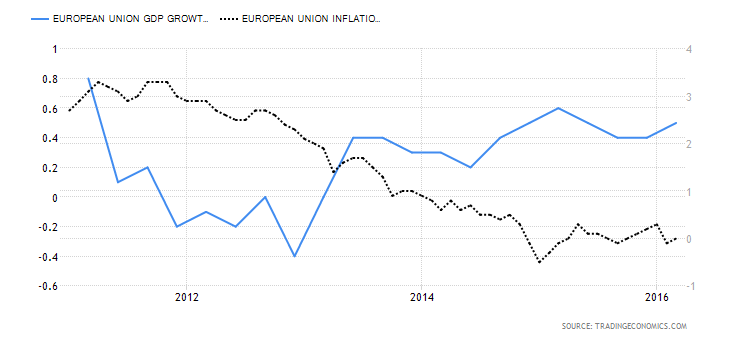

1) A barely noticeable blip in EU inflation and GDP growth (the former has already rolled over while the latter began to move up even before NIRP)

2) Savers and investors to begin to hoard cash rather than go out and spend it or even better (according to Draghi’s thinking) take out loans and spend them too.

NIRP is highly DE-flationary. It is a current tax on capital as well as a future tax on interest income payments. NIRP, in a vulgar fashion, is telling you that you are “screwed” no matter what you do.

Even a basic understanding of human nature suggests that the natural reaction to this is to panic and begin hoard cashing. If you KNOW that the bank is going to charge you for having a deposit, why not take the money out of the bank and put it in a safe where it won’t be charged?

This, not drug money and certainly not money laundering, is why the EU decided to ban €500 bills: to stop people from taking their money out of the banks.

After all, if you’re moving €20,000 or more into cash, you don’t want small denominated bills. It’s much too large a pile to comfortably move around.

This is just one weapon in the growing War on Cash.

If you think this sounds like some kind of conspiracy theory, consider that France has banned any transaction over €1,000 Euros from using physical cash. Spain has already banned transactions over €2,500. Uruguay has banned transactions over $5,000. And on and on.

The next step, if this fails, will be to implement a carry tax on actual physical cash.

The idea here is that since it costs relatively little to store physical cash (the cost of buying a safe), Governments should be permitted to “tax” physical cash to force cash holders to spend it (put it back into the banking system) or invest it.

The way this would work is that the cash would have some kind of magnetic strip that would record the date that it was withdrawn. Whenever the bill was finally deposited in a bank again, the receiving bank would use this data to deduct a certain percentage of the bill’s value as a “tax” for holding it.

For instance, if the rate was 5% per month and you took out a €100 bill for two months and then deposited it, the receiving bank would only register the bill as being worth €90.25 (€100* 0.95=€95 or the first month, and then €95 *0.95= €90.25 for the second month).

It sounds like absolute insanity, but I can assure you that Central Banks take these sorts of proposals very seriously.

This includes the Fed… which has already begun discussing NIRP and Helicopter Money in policy meetings.

Indeed, we've uncovered a secret document written by a strategic advisor to multiple Central Banks, which lays out ALL of the above plans.

The paper, written before the 2008 Crisis, suggests that IF a Crisis were to hit and ZIRP didn’t result in a recovery, Central Banks should:

1) Buy assets (QE)

2) Begin money transfers (the so called “Helicopter money” policy)

3) Implement a carry tax or ban physical cash.

Best Regards

Phoenix Capital Research

| Digg This Article

-- Published: Thursday, 5 May 2016 | E-Mail | Print | Source: GoldSeek.com