-- Published: Thursday, 5 May 2016 | Print | Disqus

By Frank Holmes

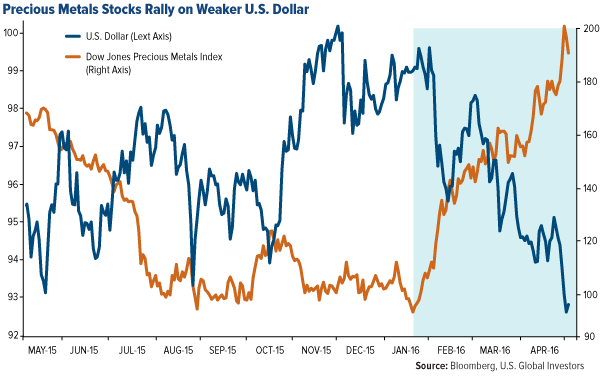

Precious metals are going insane right now, thanks in large part to the weaker U.S. dollar. Year-to-date, palladium is up 7 percent, platinum 19 percent, gold 21 percent and silver 25 percent. A correction at this point would be healthy, but looking ahead, this rally appears to have legs.

click to enlarge

Many analysts are already making comparisons between now and 2007, when commodities skyrocketed in an unprecedented bull market that ended in September 2011 with gold hitting its all-time high of $1,900 an ounce.

Now, Paradigm Capital analysts observe that “a new upcycle has begun in the gold sector,” estimating that “a ‘standard’ upcycle would take us to $1,800 an ounce over the next three to four years.” Another analyst sees it climbing to $3,000.

Whether or not this turns out to be the case, it’s clear that sentiment in precious metals has shifted dramatically, giving the group newfound momentum.

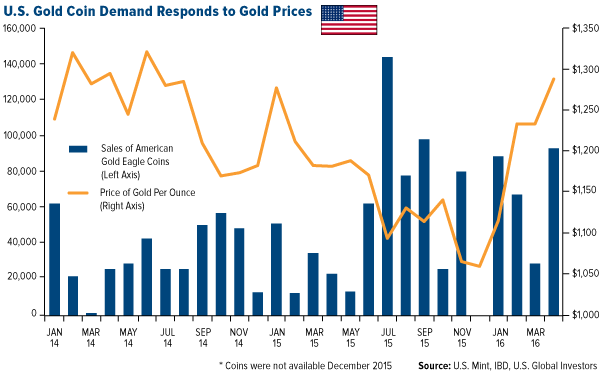

Bullion Bonanza

This shift has helped fuel demand for American Eagle gold (and silver) coins. Spirited sales preceded gold’s recent bottom late in 2015 and have remained strong even as the precious metal rebounded in its best opening in 30 years, with many coins selling out within minutes of becoming available for purchase. Sales in April jumped nearly 180 percent from March and 257 percent from the same time in 2015. Silver coins are also moving fast after hitting an all-time sales record of 44.8 million ounces in 2015.

click to enlarge

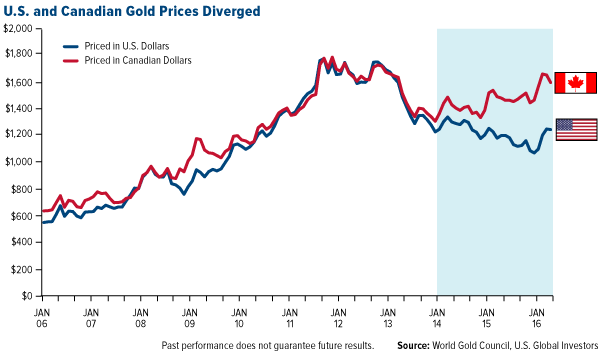

Canada’s appetite for physical metals has surged as well. In its third quarter 2015 report, the Royal Canadian Mint reported record bullion sales on the weak Canadian dollar relative to the greenback, which made the yellow metal more attractive to buyers in the Great White North.

click to enlarge

And it’s not just Canadian citizens who are buying. During the third quarter, the Canadian Mint shipped to a reported 12 countries, up from nine countries during the same period a year earlier.

Celebrating Two Years of Gold Game Film

I’m very proud to say that for two years now, Kitco and U.S. Global Investors have shared an extremely rewarding, mutually beneficial partnership. Our weekly Gold Game Film, hosted by the talented Daniela Cambone and presented by TheStreet, tackles the economic and financial news of the hour and presents what I hope is a refreshingly balanced approach to the world of gold investing.

I invite you to check out this week’s Gold Game Film, where we discuss the likelihood of gold extending its 2016 gains. Be sure to look out for the latest edition every week!

Past performance does not guarantee future results.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

The Dow Jones Precious Metals Index represents the performance of U.S.-trading stocks of companies engaged in the exploration and production of gold, silver and platinum-group metals.

| Digg This Article

-- Published: Thursday, 5 May 2016 | E-Mail | Print | Source: GoldSeek.com