-- Published: Tuesday, 24 May 2016 | Print | Disqus

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

First it was Stan Druckenmiller, now it’s George Soros. Following billionaire former hedge fund manager Druckenmiller’s announcement that gold was his family office fund’s largest currency allocation, we learned last week that his old boss, billionaire investor George Soros, purchased a $264 million stake in Barrick Gold, the world’s largest gold producer, after liquidating $3.5 billion in U.S.-listed stocks. Additionally, he disclosed owning call options on a gold ETF.

Soros’ investment can be held up as further proof that sentiment toward gold has decidedly shifted positive, following the challenging last three years.

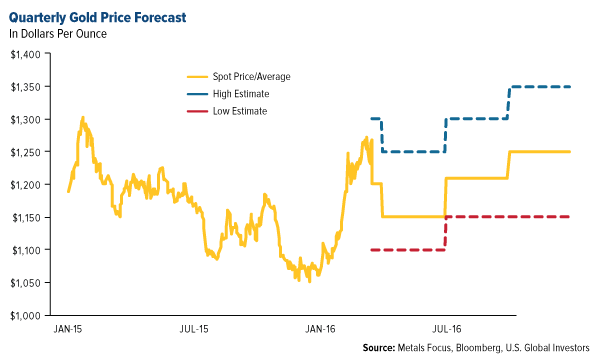

London-based precious metals consultancy Metals Focus just released its Gold Focus 2016 report in which the group calls an end to the gold bear market that began in late 2011, after the metal hit its all-time high of $1,900 per ounce. “We are optimistic about gold over the rest of this year and our projections see it peaking at $1,350 in the fourth quarter,” the group writes. Global negative interest rate policy fears have reawakened investors’ confidence in gold as a reliable currency and store of value.

The group adds: “In the near term, there may well be some liquidations of tactical positions.” This is to be expected, especially around the start of summer, based on historical precedent

Will Gold Follow Its Short or Long-Term Trading Pattern?

We’ve noticed that mining companies which have deleveraged their balance sheets this year have been some of the biggest gainers. Barrick, now Soros’s largest U.S.-listed allocation, started 18 months ago.

Glencore, Teck Resources and higher-risk junior producers such as Gran Colombia bounced off the canvas after being knocked down.

Gold equities always have a higher beta than bullion. Usually a ±1 percent move translates into 2 to 3 percent in gold stocks.

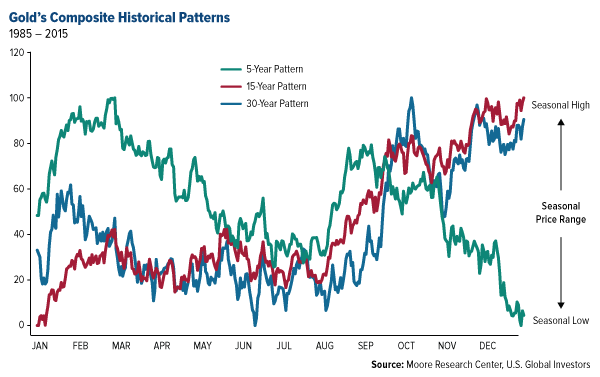

Regardless of it being a bull or bear market, there are still fairly predictable intra-year trends in the price of gold. Below is an updated composite chart of the metal’s historical yearly patterns over the last five, 15 and 30 years, courtesy of Moore Research.

click to enlarge

In all periods, gold contracted in May to early summer, then rallied in anticipation of Ramadan—this year beginning June 4—and India’s festival of lights and wedding season. India has one of the largest Muslim populations in the world, and for at least 5,000 years they’ve adhered to the tradition of giving gold as gifts during religious and other celebrations. .

Predictably so, the yellow metal has retreated somewhat this month, following its best start to a year in 30 years and its best-ever first quarter for demand. As I told Daniela Cambone during last week’s Gold Game Film, this pullback provides an attractive buying opportunity

The five-year period decoupled from the other two starting in mid-autumn, but the annual losses in 2013 (when the yellow metal fell 28 percent), 2014 and 2015 skewed the data. Metals Focus sees gold following its more typical trading pattern this year, possibly climbing to as high as $1,350 an ounce

click to enlarge

In the near-term, gold is threatened by a rate hike, possibly as early as next month’s Federal Open Market Committee meeting. The metal fell to a three-week low this week on hawkish Fed minutes. If the Fed ends up delaying a hike, it could give gold the chance to take off.

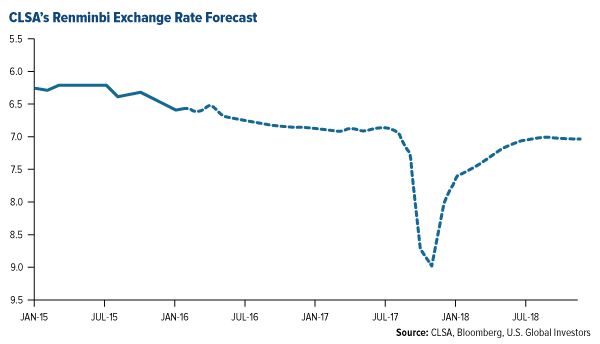

Analysts See a Possible 25 Percent Depreciation in China’s Currency

One of the concerns the Fed has right now is the depreciation of the Chinese renminbi. In a special report, CLSA estimates it could fall as much as 25 percent before rebounding somewhat. Because the trade volume with China is so massive, the fear is that it could affect the U.S. economy

click to enlarge

This would have many obvious negative consequences. For one, because China’s oil contracts with the Middle East are denominated in renminbi, not dollars, Middle East suppliers would be hurt.

CLSA points to several winners, however, including investors. The devaluation could very well “represent the best opportunity to buy Chinese assets that investors have had since the financial crisis,” the investment banking firm writes. China’s materials sector, local exporting producers and mainland gold producers should also benefit. The renminbi will “inevitably” fall, CLSA says, “irrespective of economic fundamentals, as a free market works out what it is worth.”

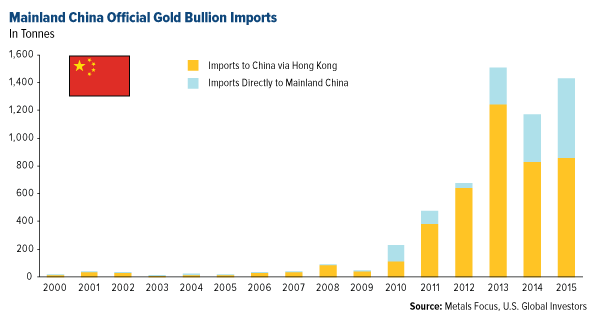

It’s little wonder then that, in the meantime, the country’s consumption of gold has skyrocketed in recent years as it vies to become one of the world’s key gold price makers. (Remember, China just introduced a new renminbi-denominated gold fix price.)

click to enlarge

In addition, it was reported last week that Chinese bank ICBC Standard just purchased one of Europe’s largest gold vaults from Barclays, located in London, for $90 billion. This will help give the country greater control over gold transactions around the world, about $5 trillion of which are cleared in London every year

Should They Stay or Should They Go?

Likely to help gold this summer are geopolitical events, specifically the potential “Brexit” next month when U.K. voters decide on whether to remain members of or leave the European Union.

Various analysts have warned that such an event could trigger a crisis with both the euro and pound, which might spread to other economies. A recent Bank of America Merrill Lynch survey found, in fact, that the idea of a Brexit has risen to the top of global investors’ worries. What’s more, no consensus was reached during a meeting among G7 nations this past weekend on how to deal with fiscal policy, other than to take a “go your own way” approach.

In the past, gold has been used as a hedge against the risk of not only negative interest rates but also inflation.

High inflation might also be coming to the U.S. thanks to the Labor Department’s new regulation on overtime pay, which doubles the eligibility threshold from $23,660 a year to $47,476 a year, on condition that the worker puts in more than 40 hours a week. It’s estimated that the ruling will affect 2.2 million retail and restaurant workers, among others.

President Barack Obama’s heart is certainly in the right place by wanting to boost workers’ wages. But it’s important to be aware of the unintended consequences that have often accompanied such sweeping edicts throughout history. We could end up with rampant inflation as companies will have little choice but to raise prices to offset the increased expense. Again, having part of your portfolio invested in gold and gold stocks, as much as 10 percent, could help counterbalance inflationary pressures on your wealth.

Learn how you can prepare your portfolio for inflation.

Defense Stocks Hit All-Time Highs on Terrorism Jitters

Global fears of terrorism persist, of course, with a Cairo-bound EgyptAir flight crashing in the Mediterranean Sea last week. Although the cause of the crash is not clear at this point, officials have not ruled out terrorism. In light of this and other tragedies—the attacks in Belgium, for instance—defense and military stocks have made huge moves in recent weeks. Shares of Northrop Grumman, Raytheon and L-3 Communications all hit all-time highs the week before last.

In a recent call, an analyst with Cornerstone Macro predicted that a presidential victory for Donald Trump would be good for defense stocks, as he’s made promises to “rebuild” the military should he make it into the White House. It appears the market is already betting on such a win.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2016: Barrick Gold Corp., Gran Colombia Gold Corp., Northrop Grumman Corp., Raytheon Co.

| Digg This Article

-- Published: Tuesday, 24 May 2016 | E-Mail | Print | Source: GoldSeek.com