-- Published: Tuesday, 24 May 2016 | Print | Disqus

By: Stephan Bogner

Between 2011 and 2015, the gold price consolidated along the (red-dotted) trendlines. In early 2016, the middle (red-dotted) resistance was broken successfully, and the price managed to hold above it, thus a buy-signal is active. Next resistance at the (green) resistance at approximately 375%, whereafter the major (red-dotted) resistance at approximately 410% must be broken in order for the next phase of the new bullmarket to start. Sell-signal when breaching the (green) support slightly below the 325% level, whereas a major sell-signal is generated when breching the (red-dotted) support currently at approximately 310%.

Live version: http://schrts.co/Z4hp68

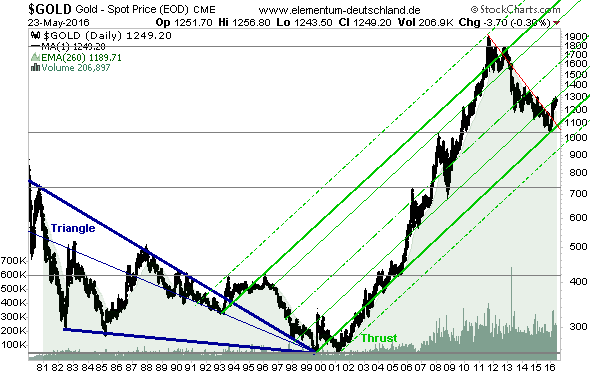

The bullmarket since 2001 is a thrust (final movement out) of the (blue) triangle between 1980-1999. The thrust moves upwards within the (green) trendchannel and as such is generating buy-signals at the lower (green) trendlines and sell-signals at the upper (green) trendlines. As the (red) resistance was broken successfully recently, a new upward trend is anticipated. However most recently, the price has reached the (green) resistance at $1,300, so a next buy-signal is only given once this resistance acts supportive.

Live version: http://schrts.co/Kf4tfy

As the (red) resistance was successfully broken a few months ago, a new upward movement (in form of a thrust) is expected. However, no pullback occurred since breaking above the (red) resistance - typically, a pullback occurs when the apex of the (red-blue) triangle is in coincidence, hence a short but sharp pullback may occur soon (if the price is bullish enough, a pullback does not always correct all the way back the apex).

Live version: http://schrts.co/NKb5FT

When looking at the nearer term picture, a bullish trend change was accomplished when breaking and holding above the (green-dotted) support at $1,200. As the price already pulled back to confirm this trendline as new support, a buy-signal is active (sell-signal when breaching this $1,200 support). The next horizontal resistances are at $1,300 and $1,380. If the horizontal resistance at $1,440 can be broken, a strong upward move to the $1,580 level of the 2011-2012 (red-green) triangle is anticipated. Once the horizontal resistance at $1,610 acts supportive, a major new bull phase is expected to occur thereafter with the goal to transform the former high ($1,900) into new support in order for a new upward trend to start thereafter.

Live version: http://schrts.co/o2h6Am

The silver price also managed to form a double bottom in mid- and late 2015, whereafter the (red) resistance was broken successfully and thus generating a buy-signal. The current pullback to the (green) support is considered positive as it must be confirmed as new support in order for a new upward to materialize sustainably thereafter. Thus, a sell-signal is generated when breaching the (green and red) support lines, i.e. trading below $15. If these support lines hold, a strong upward trend to the (green-dotted) resistance at $20 is anticipated.

Live version: http://schrts.co/mFfeGb

The consolidation in 2011-2016 occurred along the (red-green) trendlines and as such a major buy-signal was generated when breaking above the (red-dotted) resistance. Although a pullback is currently occurring since that breakout, a buy-signal is still active (sell-signal when falling below the 260-days EMA curve currently at $15.78, whereas a major sell-signal is given once the price breaches the (green) horizontal support slightly below the $15 level).

Live version: http://schrts.co/x40hMs

Silver´s bullmarket since 2002 moves within the (green) trend channel and as such is generating buy-signals at the lower trendlines and sell-signals at the upper trendlines. After strong upward moves, the price tends to consolidate in (red) triangles. As the price managed to break above the (red) resistance in early 2016, a thrust to the upside is anticipated as the goal of such a thrust is to rise to the high of the triangle ($50). Next major resistance at the middle (green) trend channel at approximately $24, whereas a horizontal resistance lies at approximately $22. A major sell-signal is generated only when falling below the lowermost (green) trend channel currently at approximately $14.

Live version: http://schrts.co/bDDghf

When looking at the longer term picture, it becomes clear that the consolidation in 2011-2016 was "merely" a pullback to the horizontal trendline at approximately $14 as this level marked a major resistance in the 1980s. In 2006-2009, this major resistance was broken successfully and a subsequent breakout to the $50 level occurred, however no real pullback occurred thereafter in order to test and confirm the former resistance as new support. As the price managed to hold above this new support, and confirm it as new support, the price started to trend upwards again. Thus, a new bull phase is expected, yet another pullback could still happen. Major sell-signal only when breaching this horizontal support at $14.

Live version: http://schrts.co/qxgufU

Stephan Bogner

http://rockstone-research.com

Disclaimer: The above does not represent a recommendation to buy, sell or even hold any market, stock or the like. Kindly act on your own responsibility and due diligence. Please read the full disclaimer on www.rockstone-research.com

| Digg This Article

-- Published: Tuesday, 24 May 2016 | E-Mail | Print | Source: GoldSeek.com