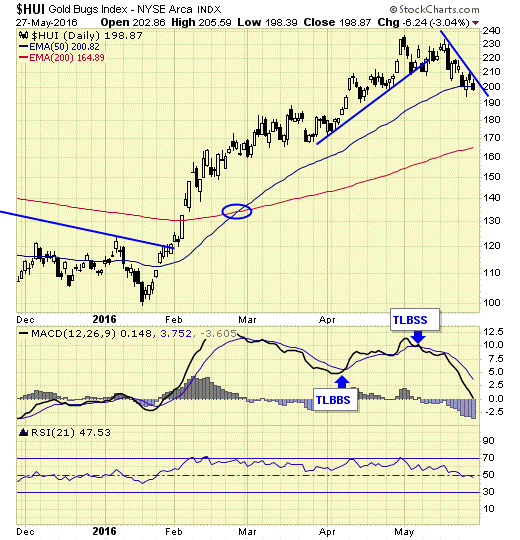

Gold stocks remain on short term sell signal, and if we are in a bull market, prices should find support at the 200ema, which may be an excellent entry.

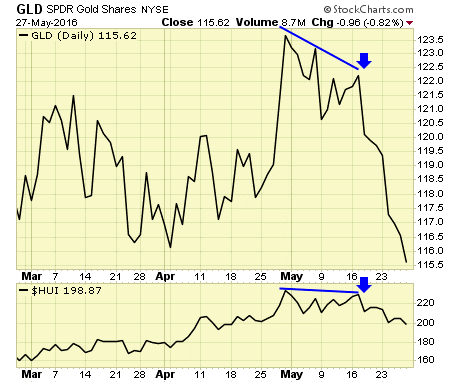

The divergence as noted in the last report has resulted in lower prices in both gold and gold stocks.

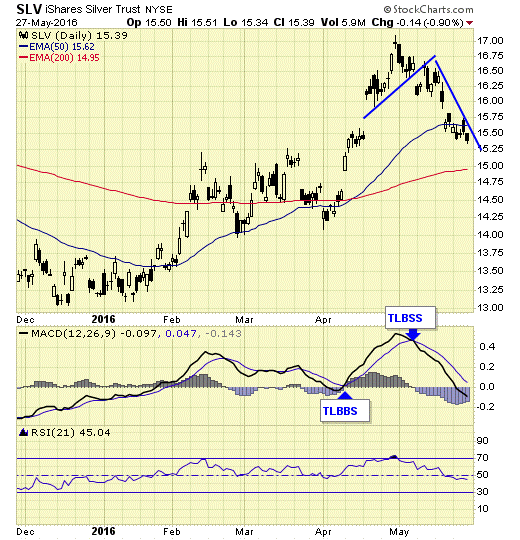

SLV – we took profits on our short position and will wait for a new set up.

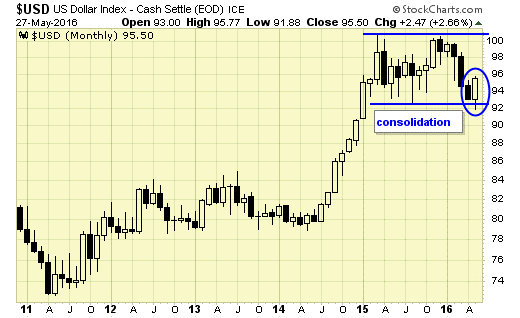

With one session left in the month, the US Dollar (USD) bounced off the lower trading range of this over a year-long consolidation with an outside reversal monthly candlestick, which suggests that the correction is complete and more strength ahead in coming months. A rising dollar is not friendly to the metals.

Summary

A correction is in progress in the gold sector, while the cycle has just turned down recently. Expect lower prices overall until the cycle bottoms and COT data becomes favorable.

Jack Chan is the editor of Simply Profits, established in 2006. Jack bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when—and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the US dollar bottom in 2011.