-- Published: Wednesday, 22 June 2016 | Print | Disqus

By Gary Tanashian

I am prompted to write this article because TA’s are starting to pick up on the Semiconductor index’s bullishness and even the overwhelmingly bearish website, the Daily Reckoning is calling bull on the Semiconductor sector.

These Tech Stocks Are Ready to Lead the Market. Before Buying, Read This…

The author uses only charts to clue readers in to this little secret (Semis led the market down and now they are leading it up) but there is much more to the story, and since it has been our story (for its upside and downside market leadership) since 2013 I’ll lay claim before the whole enchilada opens up and every wise guy with a chart or a stock pick is touting the Semis.

In NFTRH we have been noting the relatively bullish status of the SOX (and this week, in light of the May book-to-bill, begun charting equipment stocks in NFTRH+), along with a few other ‘relative bull’ sectors. But I came across the most compelling evidence of a Semiconductor revival quite by accident while running through the US market indexes. Well, it was on purpose, but I was surprised at the timing as you’ll see. Here’s a clip from NFTRH 400…

<begin excerpt>

I took a long on the Banks [edit: quick profit taken on Monday, along with another on rising rates vehicle TBT] as BKX dropped to support. That did not reflect a view on the pigs, it reflected a view on the hysteria surrounding declining interest rates, inflation expectations, etc. The warning here is that hysterias can last longer than your trade tolerance, so I’ll not be too patient. SOX is still bullish and the book-to-bill data will be out on… folks, we interrupt our regularly scheduled programming for (see below)…

Attn: Stock Market Players & Gold Bugs Alike

I just went to check the date of the coming SEMI equipment sector book-to-bill data release and what did I find? This is what I found. Unexpectedly, it is already out.

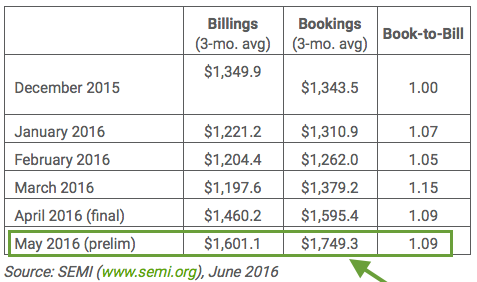

Booking, Billings and Book-to-Bill for May are a knock out. What’s more, we now have a 3 month trend in Semiconductor equipment bookings. With the strong billings as well, we probably have the makings of a good reporting season for Q2 (April-June) unless the world ends this month.

From SEMI: “Bookings and billings for new semiconductor equipment continue to improve,” said Denny McGuirk, president and CEO of SEMI. “The data are consistent with higher spending expectations for the second half of the year.” Full report here.

Here I want to make some notes to my gold bug friends, of which there are many in the subscriber base. Just as we noted Q2’s reporting may see some degradation in Q2 reporting for the miners due to the sharp rise in oil vs. gold, we note that the likes of AMAT, LRCX, MKSI, etc. are likely to continue to show why the SOX index has been firm and leading the US markets of late, when Q2 is reported.

I felt squeamish in noting the Semi Equipment strength and its economic implications to you back in January of 2013 and in hindsight, these are the financial markets and there is no place for squeamish. The facts are the facts and Semi Equipment is ramping up again. This furthers our recent theme about the potential for a whopper of an inflation phase forthcoming as the Fed rolls over time and time again, ignoring price signals like those in the services sectors and lately, in the ‘prices paid’ in manufacturing reports.

I am getting very bullish on inflation. So this time the Semi ramp does not need to mean destruction for the precious metals. Indeed, if silver picks up on this and takes over, we could get a heck of an inflationary ride, eventually. But remember, we are early and the mainstream is all screwed up over the deflation the Fed is pretending to see, BREXIT, global NIRP, etc. This all reaffirms what I wrote in the opening segment [edit: also excerpted, for NFTRH’s 400 milestone].

Frankly, I am getting so excited I have to settle down and remember that you can be right but you can be early. But with this SEMI release, combined with recent inflation data and price signals, combined with the state of the global market’s mass psyche (oh no… deflation is everywhere!!), I think there is an opportunity here to make like Old Turkey* and be right, start to position for inflation, and sit tight.

There will be more to come in NFTRH reports, and in updates we will track the process and identify trading opportunities. Another note for gold bugs; if we go ‘inflation’ the recently expressed preference for exploration and especially Royalty companies over pure gold miners will become a priority theme going forward.

Back on the US market, SOX continues to lead US indexes in a bullish manner since leading the market bearishness of last summer. Is this signaling a new bull cycle out ahead? Stay tuned.

If this divergence holds through the current market upset and whatever is directly ahead we should consider it a positive divergence on the stock market and the economy.

* The famous character (also known as Mr. Partridge) from Edwin Lefèvre’s Reminiscences of a Stock Operator (“well, this is a bull market you know!”).

<end excerpt>

The point of the above is that you have got to have fundamental facts supporting your squiggly lines, AKA charts, otherwise the likes of the Semiconductor sector is just a ‘momo’ play, potentially sucking you in at the behest of chart jockeys. I had awaited the 3rd month on the book-to-bill as a fundamental trend confirmation, and it was a knock out.

Gold bugs, who I have noticed are generally in full obsession mode (as in, ‘I am a gold stock trader’ as if it is the only sector out there) should be careful going forward. While we are working on a theme that could swing inflationary (benefiting the metals and Royalty companies if not as much gold miners) the relief that would be signaled if our view of the Semis (as upside leaders) is correct could hammer gold’s risk ‘off’ premium, along with that of Treasury bonds.

The main point is however, that we have got to deal with whatever the facts are. One fact is that the Semiconductor Equipment sector’s ‘bookings’ are very important to the entire sector’s food chain. In other words, if new Fabs are being built and equipped then down the road Semiconductor manufacturers are expecting a ramp up in business. That is why I call the Equipment stocks the “Canary’s Canary”, with the sector as a whole being a leader but the Equipment sector’s book-to-bill being an even earlier indicator.

There, now we have put some context to the coming phase when every momo, stock picker and chart jockey on the planet are going to get on the tout.

Post-Script

I remember in 2002, 2003, 2004… as I became extremely bullish on gold I had Robert Prechter constantly in my ear telling me why 320 was the top and then 370 was the top and then 420, etc… it made me a stronger investor to read this (I did and still do respect this scary man’s views).

On the current situation with the Semis, I was taken to task by a subscriber (I invite and welcome critical feedback at all times) a couple weeks ago (included in this post: It Must be a Gold Bull Market Because…)…

“[Otto at IKN] says buy hold win and you are saying this is a blowoff [in gold] and people saying stocks are overbought are not right either. Bill Fleckenstein, Fred Hickey and Jesse Felder are all taking opposite stance on semis and the stock market and I don’t consider them robots. I guess this makes markets.”

I have not called it a blow off in gold. I have called it a launch to a potential new bull market. And in holding gold since 2003, I have to be believe I am in the “buy, hold, win” club. But the point is that experts will often challenge your stance (Fred Hickey is evidently a technology expert bearish on tech in general, Semis in particular, and bullish on gold and gold stocks) but going with your own analysis or at least vetting that of others ultimately makes you a stronger investor or trader.

There do not need to be dividing lines like ‘I am a gold bug and so that is mutually exclusive to other market views’. There just needs to be right, within the context of time frames. At this point of the current cycle the Semiconductors are leading again and that has in the past meant positive future economic prospects. However, with the Fed sitting like a mother hen on its measly 1/4 point Fed Funds rate, inflationary chickens could well be coming home to roost on this cycle as well.

NFTRH.com and Biiwii.com

| Digg This Article

-- Published: Wednesday, 22 June 2016 | E-Mail | Print | Source: GoldSeek.com