-- Published: Sunday, 26 June 2016 | Print | Disqus

By Jordan Roy-Byrne CMT, MFTA

What a last 24 hours for markets! At one point Gold was up $100/oz, S&P futures were limit down and the British Pound was down over 8%! The volatility has subsided, perhaps temporarily and Gold settled around $1320/oz with Silver settling below key resistance at $18. The miners predictably gapped up but the strength was sold. As miners remain below 2014 resistance we expect Gold to retest $1300/oz before moving higher.

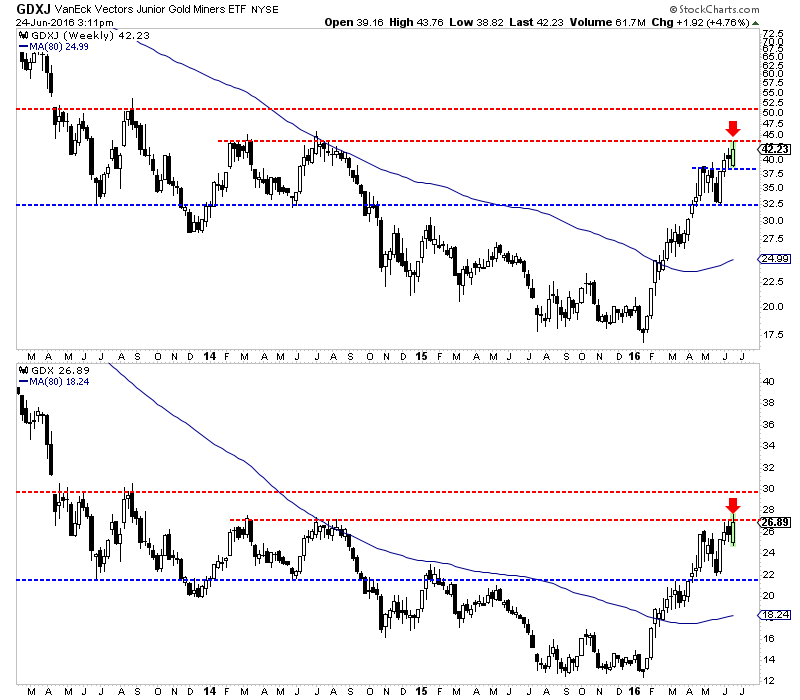

The chart below plots the weekly candlestick charts of GDXJ (top) and GDX. The miners gained 5% to 6% on the week thanks to Brexit but note that miners sold off today after testing 2014 resistance. GDXJ, which has resistance at $43-$45 reached $43.76 today before declining and GDX, which has resistance at $27-$28, reached $27.71 before declining.

GDX, GDXJ Weekly Candles

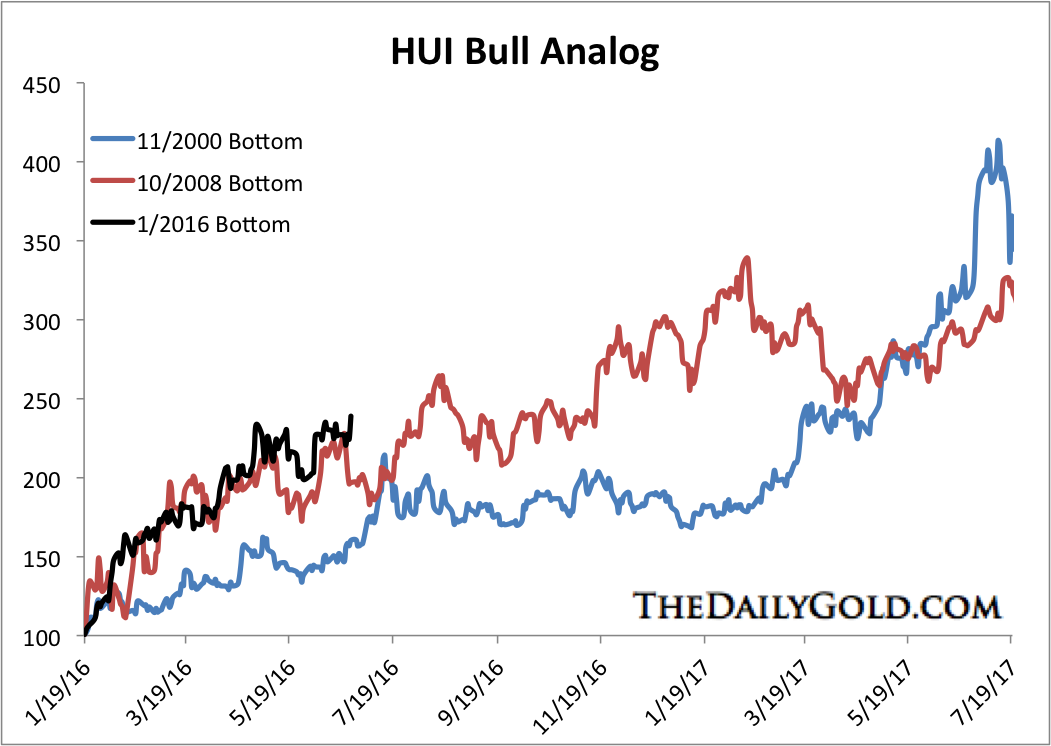

We should also note that the miners remain stretched when viewed through the lenses of history. Specifically, Brexit pushed the rebound above the 2008-2009 rebound.

HUI Bull Analog

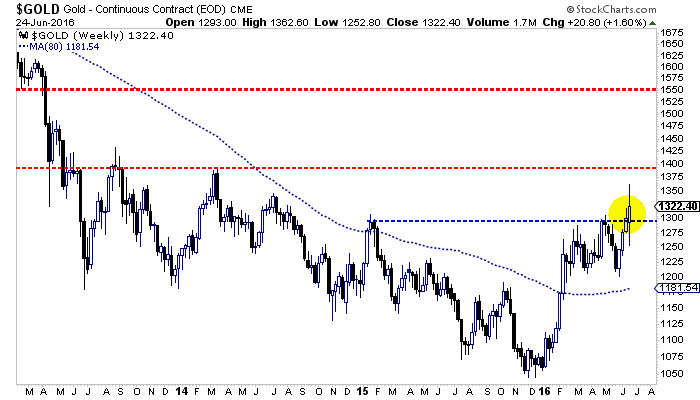

Given the action in the miners today and their historically overbought condition, coupled with Gold selling off from much higher levels, I expect Gold to retest $1300/oz next week. A retest is only that and nothing more. While Gold has technically not formed a reverse head and shoulders bottom, it nevertheless has a potential measured target of $1550/oz. There is some resistance at $1330 and $1380 to $1400. However, there is very little resistance from $1400 to $1550.

Gold Weekly Candles

News events rarely change market trends as the market typically leads news but Brexit could be an indication of a new bullish development for precious metals. That would be the long-term disintegration of Europe which would be very negative for the Euro, the world’s second largest currency. This news propelled Gold through $1300 and could be the catalyst to take it towards $1400 over the next few months. Meanwhile, the gold stocks could back and fill just a bit before again testing 2014 resistance levels. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Sunday, 26 June 2016 | E-Mail | Print | Source: GoldSeek.com