-- Published: Tuesday, 28 June 2016 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

This could be the year that the mainstream investor finally pushes the gold market over the edge. While a fraction of investors continue to acquire a lot of physical gold, the mainstream investor is the key to driving the gold market and price going forward.

Why? Because the diehard precious metal investors don’t have the sort of leverage as do the mainstream investors, which account for 99% of the market. I have stated several times in articles and interviews that it will be the surge of gold buying by the mainstream investor that will finally overwhelm the gold market.

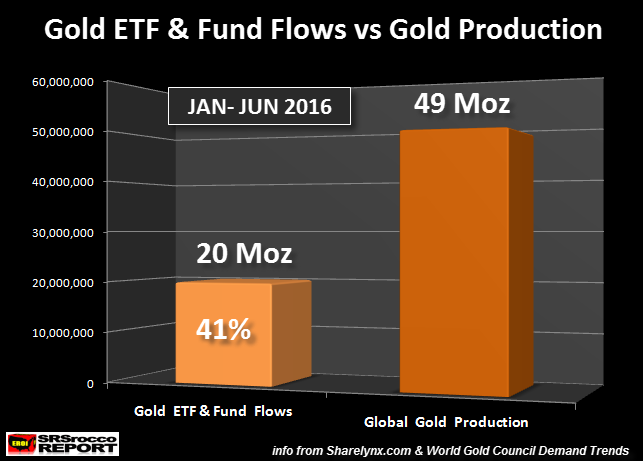

This next chart shows just how much leverage the mainstream investor has on the gold market. When the Dow Jones Index fell a lousy 2,000 points during the first quarter of 2016, mainstream investors flooded into Gold ETF’s & Funds. This continued into the second quarter, including the surge in buying after the BREXIT “Leave Vote” this past Friday:

According to the data put out by Nick Laird at Sharelynx.com, total transparent global gold holdings increased nearly 20 million oz (Moz) since the beginning of 2016. Nearly half of that figure, 9.7 Moz (supposedly) went into the GLD ETF. This is an amazing amount of gold as it represents 41% of total global mine supply.

For those investors who don’t trust the amount of gold backing these Gold ETF’s, I don’t either. However, I could care less if the GLD has all the gold it reports. What is more important is the mainstream investor LEVERAGE on the market and price. This is the Key.

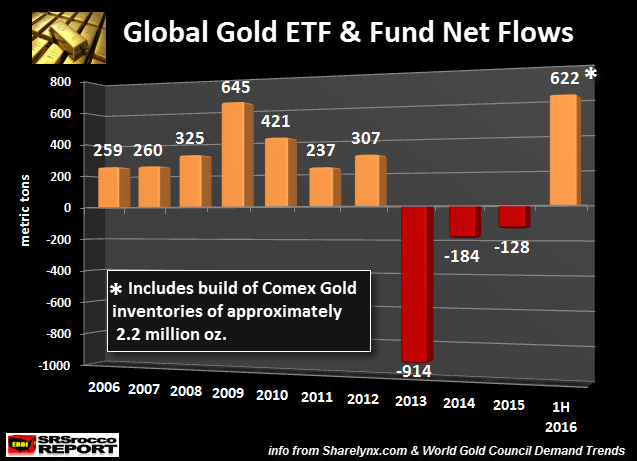

This next chart shows the annual net flows of gold into ETF’s & Funds:

The record amount of flows into Gold ETF’s & Funds took place in 2009. The majority of the 645 metric ton (mt) figure took place during the first quarter of 2009 when the broader markets were crashing to their lows. In Q1 2009, a record 465 mt of gold flooded into Gold ETF’s & Funds that quarter, accounting for 72% of the year’s total.

However, the first half of 2016 is turning out to be one hell of a strong start as global gold holdings have already increased 622 mt. Part of this amount includes an approximate 68 mt build (2.2 Moz) in the Comex Gold Inventories. As we can see, the mainstream investor Gold ETF & Fund demand has driven flows in the first half of 2016 to 96% of the record 645 mt set in 2009.

And this was on the back of a lousy 15% correction in the broader markets in the first quarter of the year. What happens as the BREXIT contagion continues to spread pushing the broader stock markets lower?

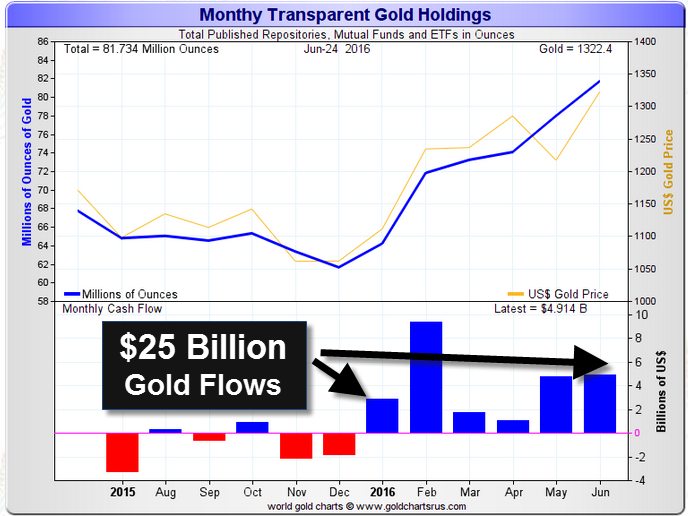

Again, according to the data at Sharelynx.com, an approximate $25 billion of mainstream funds went into Gold ETF’s, Funds and Exchanges in the first half of the year:

While this is most certainly a large surge of mainstream investor demand in Gold ETF’s & Funds, it’s still only a fraction of the overall market. Matter-a-fact, the top 400 World’s Richest people lost $127 billion on Friday after the BREXIT vote to leave the European Union.

Now, what’s even more interesting than that tidbit, is that a ONE DAY loss of $127 billion by the wealthiest people could have purchased ALL of the Global Gold & Silver ETFs and Funds in the entire world.

Currently, all the Gold ETF’s & Funds are valued at $108 billion while the Silver ETF’s & Funds represent a mere $16 billion. Thus, all the Global Gold-Silver ETF’s & Funds equal $124 billion. Basically, the richest of the rich lost more in one day than the entire Gold & Silver ETF and Fund Market.

The British citizens voting to leave the European Union is the straw that finally breaks the CAMEL’s BACK. It doesn’t matter if the politicians force England to stay in the EU, because the MINDSET of the public has been changed. It’s just a matter of time before the inertia grows to a level that finally overwhelms the establishment.

I got a kick out of Zerohedge’s article today, President Of The European Parliament: “It Is Not The EU Philosophy That The Crowd Can Decide Its Fate”. This is the epitome of FASCIST 101, where an UNELECTED Parliament can decide the fate of the British or any other European country.

We are experiencing the same thing in the United States as Donald Trump goes against the DEMO-PUBLICAN Establishment Cronies.

At some point in time, the DEBT & LEVERAGE in the system will take down the markets in a serious way, quite quickly. If you are the 99% of Americans who believe, “You need to stay in your 401K for the long-term”, you can’t blame Wall Street when you lose it all as you had plenty of chances to WAKE UP.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Tuesday, 28 June 2016 | E-Mail | Print | Source: GoldSeek.com