-- Published: Thursday, 30 June 2016 | Print | Disqus

By: Daniel R. Amerman, CFA

With the victory of the "Leave" camp in the June 23rd referendum in the United Kingdom, the world finds itself on the edge of a financial precipice.

Crucially - we are not over the edge, not yet. But it is right in front of us.

This is far more serious than anything that we have seen since 2008. And if we go over that edge then something potentially much worse than 2008 is in front of us. Which is exactly why Alan Greenspan is saying this is the worst financial situation of his lifetime, and why George Soros is now predicting that the disintegration of the EU and the euro is "practically irreversible".

There are those who would tell you that Brexit was a shocking and unpredictable development that defies all reason and logic, and for which no one could be prepared. This is self-serving and likely self-reassuring talk for the political and media elite, but it is profoundly mistaken.

The most dangerous part of Brexit was that something like it was so completely predictable, and remains predictable in other nations, as are the potential and much worse consequences.

While it is true that the specifics of a referendum in the UK on the day of June 23rd, 2016 was not predictable far in advance, in broader terms, this risk has been coming at us like a freight train. It has been in plain sight for years now, as well as the potentially dire consequences. Everyone should have been prepared, and those in power should have been making some quite difference choices.

To show the plain dots that were there to be connected the entire time, I offer the two article excerpts below - in which those dots were identified and connected, as I did my best to explain the clearly visible danger. One I wrote in April of the 2015, and the other was in May of 2014.

The April of 2015 article excerpt (full article link here) is below. The "All It Takes Is One Election" section describes the concepts driving what would happen in June of 2016 in detail.

The Existential Danger To The Euro Is Elections

There is a respectable chance that the euro will collapse sometime in the next several years, with implications for employment, economic growth and investment markets on a global basis. And the biggest threat is not directly money, debt, a potentially rapidly approaching Greek default, or a failure of central banking policies but is instead something much simpler.

The risk is elections. That is, the near term existential threat to the euro and indeed the global financial system is when voters don't do what the status quo politicians, the media and bankers want them to do.

...

There is an assumption that the world will follow a political path that fits with the narrative described by the current dominant media/political/financial power structure.

Which is that in Europe, essentially the center will always hold because the alternatives can't be even contemplated.

However, as we've been seeing in real time, events seem to be moving in the other direction. As covered here, there has been a polarization in European politics and a rapid rise in the power of both the far left and the far right at the expense of the center.

The current crisis in Greece is an example of but one side of the issue. All it took was one political election of a far-left party in one smallish nation and it was straight to a crisis for the eurozone. Which could lead to something that was supposed to be impossible which was a Greek exit from the euro, or Grexit.

Now, picture what happens if the National Front in France wins an election, or joins a coalition government, or if another of the "far-right" parties does that in another country. And we have a far-left party in Greece (or Spain) demanding effective debt forgiveness, lest the euro be destroyed. And across the table, needing to be part of any consensus decision is the leader of a newly installed far-right government, who was elected on the basis of both leaving the euro and stopping the flood of immigrants.

How does that scenario play out for the grand experiment that is the euro? The far right and far left won about 40% of the vote between them in the May 2014 EU parliament elections, and that was before the elections in Greece, or the rise of ISIS and sharp increase in terrorist attacks, or the recent surge in North African immigrant boats crossing the Mediterranean. All it takes is a further movement of 11% and the center is lost, along with those widespread assumptions about the future.

All It Takes Is One Election

The single most important take away from the current Greek crisis is not the immediate effects of this crisis, nor is it the effectiveness of the financial defense mechanisms that may in fact be able to contain any damage in the near future.

What really matters is that the "powers that be" have been powerless to stop it.

Obama, Kerry, Merkel, Hollande and Cameron had no ability to change the results of the election in Greece.

Just as Yellen and Draghi also lacked that power.

Just as the New York Times and Washington Post lacked that power.

Just as Goldman Sachs, JP Morgan and Morgan Stanley also all lacked that power, as did the International Monetary Fund, and the World Bank.

We have this enormously powerful collection of financial institutions, governments, media and international organizations, all of whom were powerless to stop what triggered the current crisis. Which was simply a nation holding elections, and appropriately enough in this case, whatever else you may agree or disagree with, this did occur in the cradle of democracy.

And what that tells us is two things:

1) the defense of the financial stability of the eurozone is and always has been based on political consensus; and

2) Greece proves that this political consensus is an assumption that can't actually be controlled.

It is a proven wildcard that can bring the whole house of cards down.

Now again, we don't know if Greece will do it. Nor do we know what will happen in Spain. Or what will happen in France or other nations.

But what is plain to see is that there is a continuous and ongoing risk over the coming years. For what needs to be recognized is that the current dominant power structure can win the next 10 relevant elections, where the status quo is at risk but is preserved and it won't necessarily matter in the end.

Because all it potentially takes is one key election.

Let's say the status quo manages to win every election between now and December of 2015 or June of 2017 and then one party in one nation, be they of the right or the left that was supposed to never get elected does get elected.

Right there, at that very point, regardless of how many previous elections the status quo had survived, everything we think we know about the euro could be turned upside down. With ripple effects that would quickly travel around the world and affect every other nation who is a trading partner with Europe which we all are.

And once that happens, because the defenses of this experimental currency as well as the global financial system are based on political consensus, a severe crisis could develop very quickly indeed.

What is worth remembering is that politics is the "dog" and central banks and financial institutions are the "tail". Now for periods of time it may indeed appear that the tail is wagging the dog.

But, ultimately it's always the dog that wags the tail, and it is the central banks and banking systems who exist at the sufferance of whomever holds the raw political power.

Anyone who loses track of the underlying basics of the situation may find themselves facing the biggest financial surprise of their lifetimes, and perhaps much sooner than they expect.

(article excerpt end)

Fourteen months later, in June of 2016 - that "biggest financial surprise of their lifetimes" did indeed occur for many people.

However, the train had been oncoming since well before 2015, as identified in the article below from May of 2014 (full article linked here). The "Deadliest Risk" section is particularly applicable for today.

Euroskeptic Victories Raises Global Risk Of Return To 2012 Crisis

In one of the most stunning political developments in recent decades, the group of political parties that are being collectively called "Euroskeptics" won more votes than any other individual party in several major European nations in the May elections for the EU Parliament.

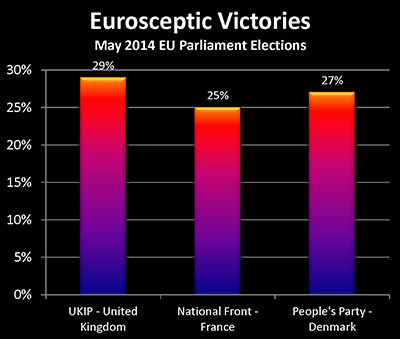

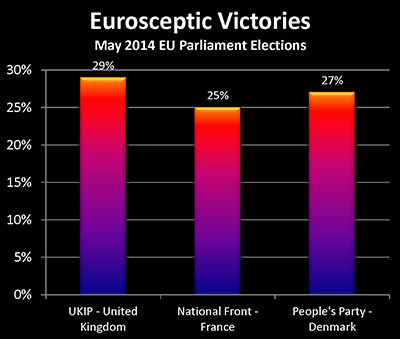

In the UK, Nigel Farage's UK Independence Party, which advocates immediate withdrawal from the European Union, led all other political parties by winning 29% of the vote. In France, Marine Le Pen's anti-euro and anti-immigration National Front party, with their slogan of "France for the French", also received the highest percentage with 25% of the votes. In Denmark, the anti-EU and anti-immigration People's Party received the most votes as well, with 27% of the total.

...

We still have a world of "too-big-to-fail" financial institutions that are interlocked in a massive web of counterparty risk and other exposures, facing the possibility on a daily basis that some combination of counterparty risk, contagion risk and liquidity risk could bring down the whole system, as explained here absent the power of central banks to prevent that from happening.

However, as I've been writing about for some years now, the dysfunctional fundamentals do not translate to some sort of collapse being inevitable. Far from it.

Rather, central banks and governments working in combination have extraordinary powers which can be used to force artificial stability on the system. Creating dollars by the trillions out of nothingness in the form of quantitative easing is one tool, even while changing the very laws and rules as needed to maintain that stability is another tool.

But the caveat with this type of crisis containment is that while there is nothing inevitable about severe financial crises or monetary collapse, there remains a certain kind of risk that could blow the whole system apart in virtually no time at all.

The Deadliest Risk

What is the most dangerous form of risk for dysfunctional economies and financial systems that are being held together through artificial governmental and central bank interventions?

It is exactly what we are seeing in Europe.

Given that money is ultimately political in nature, and it is politics that are holding the system together right now, the deadliest form of risk to this artificial stability is political risk.

(underlines added in June, 2016)

And what we are seeing in Europe may be the best example of this risk that we've seen since the European financial crisis of 2012.

29% of the voters in the UK voted in favor of a party that wants to leave the EU.

25% of the electorate in France just voted in favor of a party that would exit the euro and drastically change the political landscape of Europe.

These fundamental political changes have the potential of slashing the power of the EU and the ECB to maintain artificial economic stability.

And if they do lose control, then the crisis of 2012 could be right back upon us in no time at all, as suddenly the daily headlines become filled again with the potential unraveling of the Spanish and Italian financial and economic systems.

And if the Eurozone were to go down in terms of financial stability, an effective tsunami would flash across the Atlantic Ocean in a matter of hours.

(article excerpt end)

The Costs Of Containment & The Crucial Caveat

The underlined section from 2014 above is of particular importance, because it is unusual, but I believe it to be the only useful framework when it comes to how to prepare for the future.

I've never been a gloom and doomer, but I also left the mainstream decades ago, because some of our current issues have been building for decades.

Instead, as my long term readers know, I have been explaining financial repression, inflation taxes, quantitative easing, deliberately distorted inflation measures, very low interest rates and all the other tools that governments and central banks use to "keep the lid on". These are the financial defense measures, and they are powerful tools that have been highly dysfunctional for individual investors in terms of after-tax and after-inflation returns.

Heavily indebted governments control annual deficits by collapsing the creation of future saver wealth and retiree standards of living, as explored here.

Hidden inflation taxes are used to radically increase real tax rates and revenues in a manner few people understand, as explored here.

Saver wealth is systematically taken by governments and used to control or slow down the growth of national debts in a process of financial repression over a matter of decades, in a manner that history shows that voters simply do not understand, as explored here.

These are extraordinarily powerful tools. Indeed, I don't see how it possible to understand our current situation, or what we've experienced since 2008, without understanding the tools that are used to maintain artificial stability while redistributing wealth from the general population to governments and the financial industry.

But central banks are not all powerful.

Which is why I've always had that caveat, of political risk being what can blow apart those defenses, and make the seemingly awesome powers of the central banks evaporate into the nothingness. And in recent years, I have repeatedly identified what I felt was the single greatest risk to global financial stability, which was election risks in Europe.

My caveat just became reality, and it came from the source identified.

Correlated Risk & The Precipice

We do indeed stand on the edge of a precipice. Crucially - we are not over the edge, not yet. But it is right in front of us.

This is far more serious than anything that we have seen since 2008. And if we go over that edge then something potentially much worse than 2008 is in front of us. Which is exactly why Alan Greenspan is saying this is the worst financial situation of his lifetime, and why George Soros is now predicting that the disintegration of the EU and the euro is "practically irreversible".

Brexit is pure correlated risk, aka systemic risk, just by itself. If it spreads to break off even one member of the European Monetary Union, such as France or the Netherlands, then it is likely game over for the euro. Which means that by far the greatest correlated risk (or systemic risk) of our lifetimes, hits the whole world at the same time.

Simultaneously, there is a collapse in the firewalls. The European Union is a deeply dysfunctional collection of nations, with many no growth economies, heavily indebted governments, aging populations, and very high structural youth unemployment, that is also struggling with immigration and terrorism crises, even as fast growing political schisms arise from those pressures, with some nations moving left and others moving right.

What currently holds the EU together is fantastic monetary actions by the European Central Bank, including negative interest rates and the more or less direct monetization of government and corporate debt. But if the euro implodes, or even loses sufficient credibility - then in a flash, the ECB goes from wielding financial superpowers to having no powers at all. And with no ability to contain the underlying fundamental problems, they rise to the surface simultaneously along with the evaporation of the purchasing power of the euro.

What is different about what is happening right now, and what is so deadly dangerous, is that what creates the risk simultaneously destroys the ability to contain the risk.

With almost any other kind of major risk, what is set into motion is a battle between natural market forces seeking rational valuations, and the forces of financial containment seeking to maintain artificial prices and stability. While people don't usually think about it in those terms, the forces of financial containment did ultimately win the battle in 2008 (albeit at a high cost for savers that continues to this day), and every other major battle since then, including the near default of the US government and the repeated near defaults of Greece.

If the ECB is taken down simultaneously with the euro, then at that point we have stepped over the edge, and are in the precipice,

Because, if that happens, then the battle never even starts, but it is straight to game over. Now, the United States, Japan, the IMF, Germany, likely the UK and France and others, and maybe China too, will of course try to rapidly construct a new structure to contain the damage. But the primary firewall having entirely failed on the front end, makes that much more difficult to pull off.

The animations in the video below show how this works in graphic form. We had a systemic crisis before in 2008, it was contained by the firewalls. As explored in the video, most of those firewalls probably can't be used again, or at least there are big issues with doing so. If Brexit leads to the destruction of the euro, then as illustrated, we have systemic risk that instantly collapses the firewalls.

The Coming Battle

Part II of this article includes 1) an animated video exploring correlated risks, firewalls, and the collapse of firewalls; 2) the coming attempts to negate Brexit; and 3) why the possible negation of Brexit, or potential containment of this crisis, still leaves the world exposed to the next round of European elections risks.

Continue Reading The Article

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: dan@danielamerman.com

This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Thursday, 30 June 2016 | E-Mail | Print | Source: GoldSeek.com