-- Published: Sunday, 10 July 2016 | Print | Disqus

By Jordan Roy-Byrne, CMT

Jason Zweig, who a year ago called Gold a “pet rock” is doubling down. He reiterates his belief, albeit a misguided one that Gold is a pet rock and justifies it with the usual anti gold bug propaganda. Unfortunately, Zweig along with many gold-bashers and ironically some gold bugs continue to either neglect Gold’s major fundamental driver or have no clue about it.

Roughly year ago, I wrote my first book, The Coming Renewal of Gold’s Secular Bull Market. Numerous readers and subscribers praised the book for being the best book ever written on the subject of Gold and gold investing. Unlike other present books on the subject my book is not typical gold-bug fluff with $10,000 price targets and such. Readers loved the book because it was based on objective facts that could be verified by real historical data and not opinion and ideology.

It is a fact that the trend is Gold is inversely correlated to real interest. In other words, negative real rates or declining real rates is what drives Gold higher. Conversely, when real interest rates rise (as they did from 2011 to 2015) Gold declines.

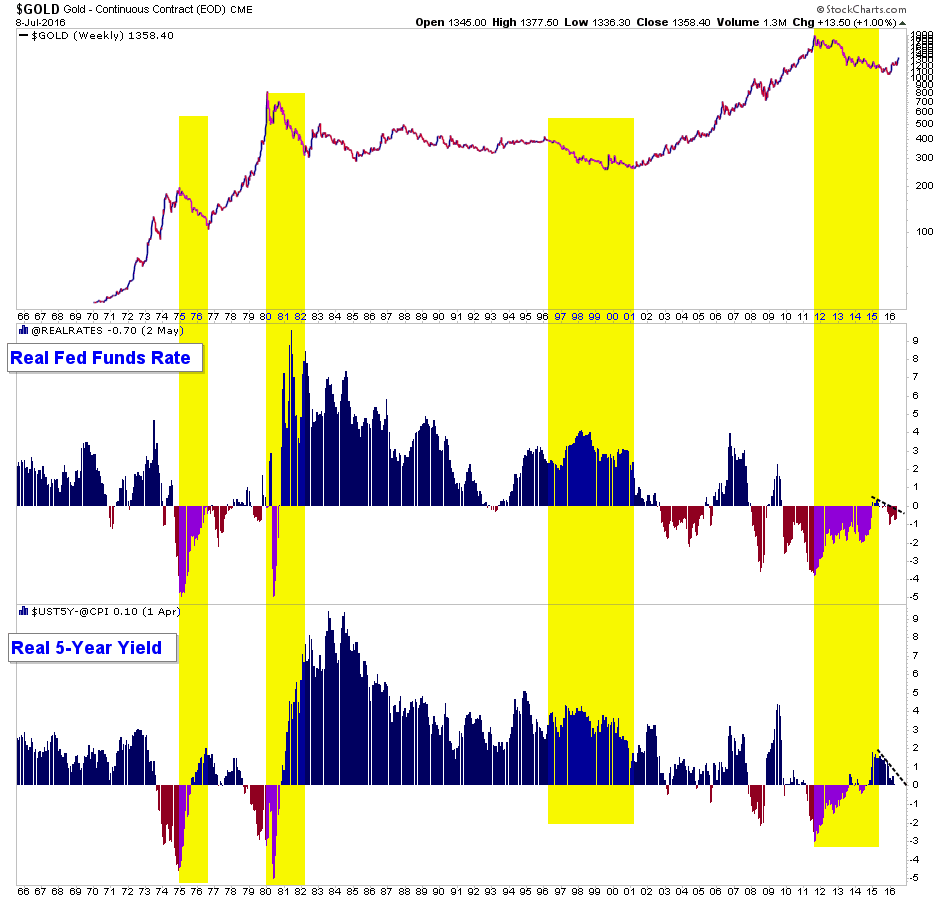

Take a look at the chart below in which we plot the real fed funds rate and real 5-year yield. Over the past year both have declined and gone negative. That explains the fundamental change driving the new bull market. (We also highlight the four bad bear markets in Gold during which real rates and real yields increased strongly and/or were strongly positive).

It makes perfect sense. Gold is money and an alternative currency. When short-term bonds, CD’s and savings accounts can earn a positive real return there is no need for Gold and alternative currencies. However, when real rates of return are negative or declining, Gold outperforms as it is now.

Zweig fails to mention anything about the importance of real rates and instead resorts to the typical anti-gold arguments. It is a poor inflation hedge. It is down 35% adjusted for inflation since 1980 (its absolute peak). It didn’t do well for part of 2008. Yada yada yada.

While he correctly notes that Gold is not an inflation hedge, his other arguments and facts are extremely disingenuous. Every gold hater typically picks 1980 as the start of every comparison (just as every gold bug picks 2000 as the start of their comparison). While I think 40-50 year comparisons aren’t that important, isn’t it interesting that Gold has actually outperformed the S&P 500 over the past 45 years! Did you know that Zweig?

Furthermore, he notes that Gold did not perform well during September 2008 and October 2008. Dude, from 2001 to 2011 that is literally the only time Gold had a major decline. That would be akin to a gold-bug pointing out the 20% decline in stocks during 1998.

Zweig concludes by arguing that investors are rushing into Gold because the chaos will only worsen and if Gold shoots higher from here it will only violate the precedents of the past.

By now, you know this is bullshit. Investors are rushing into Gold because the global trend in real rates and real yields is favorable for Gold. They can’t earn a positive real return on cash, CD’s and bonds. Moreover, these investors realize that the only palatable short term and long term solutions to the global debt crisis (which is constricting growth) are super bullish for Gold.

The bottom line is Gold is going much higher because the macro fundamentals are bullish and because historical valuation markers (which can be found in my book) easily justify Gold going to $3000-$5000/oz. Zweig and his ilk would be best advised to better educate themselves on Gold before writing another column. Ultimately, Gold’s secular bull market will end early next decade and stocks will then outperform for many years. But we are far, far away from that point. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Sunday, 10 July 2016 | E-Mail | Print | Source: GoldSeek.com