-- Published: Monday, 18 July 2016 | Print | Disqus

Financial Market Strategists are advising their clients to “buy gold on dips”.

“Gold has seen four major bull markets since 1970: this is another one,” Benjamin Wong, foreign exchange strategist at the Singapore-based bank’s Chief Investment Office, said in an e-mail. “The market has yet to deal with the political uncertainty going into the Nov. 8 presidential election.”

Fears surrounding Brexit saw gold rally to the recent highs of $1,375. However, as the uncertainty created in the wake of the “Leave” vote wanes, global equity markets have rallied, helped in no small part by surprisingly strong employment numbers from the U.S.

However, some feel that the gold market retracement is only temporary and that,“the market has yet to deal with the political uncertainty going into the Nov. 8 presidential election.”

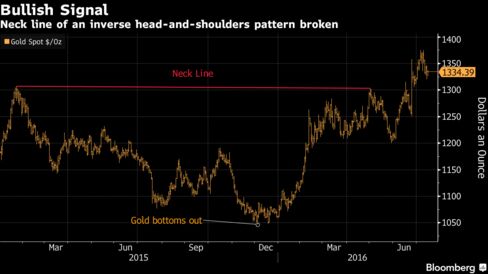

Wong is advising clients that any dips to $1,296 to $1,300 would be opportunities to accumulate. The next rebound may top resistance at about $1,380 and move prices toward $1,437 to $1,455, he believes. “Longer term, if the full force of the inverse head-and-shoulders pattern is applied, there remains scope for $1,525.”

You can read the full article here

Gold and Silver Bullion – News and Prices

Gold falls as safe haven appeal wanes after failed Turkey coup (Reuters)

Turkish Military coup fails and Hundreds are arrested as Erdogan vows revenge (Daily Mail)

Hedge Funds Finally Say No to Gold as U.S. Shares Smoke Records (Bloomberg)

Gold imports fall for the fifth month in 2016, exports grow after 18 months (IBTimes)

Citigroup’s Willem Buiter Says ‘Would Hold Gold’ (Theepochtimes)

‘Big Mother’ investors from mainland China buy big as yuan falls and global economy shudders (scmp)

The Worst Gold Bear Is Now The Most Convinced Bull (Zerohedge)

Gold Prices (LBMA AM)

18 July: USD 1,326.15, EUR 1,200.298 & GBP 1,000.050 per ounce

15 July: USD 1,330.50, EUR 1,194.789 & GBP 994.150 per ounce

14 July: USD 1,325.705, EUR 1,192.99 & GBP 1,001.96 per ounce

13 July: USD 1,340.25, EUR 1,211.45 & GBP 1,009.74 per ounce

12 July: USD 1,352.85, EUR 1,217.84 & GBP 1,029.11 per ounce

11 July: USD 1,358.25, EUR 1,231.66 & GBP 1,059.95 per ounce

08 July: USD 1,356.10, EUR 1,224.83 & GBP 1,047.45 per ounce

Silver Prices (LBMA)

18 July: USD 19.72, EUR 17.83 & GBP 14.89 per ounce

15 July: USD 20.14, EUR 18.08 & GBP 15.06 per ounce

14 July: USD 20.25, EUR 18.23 & GBP 15.15 per ounce

13 July: USD 20.29, EUR 18.31 & GBP 15.25 per ounce

12 July: USD 20.35, EUR 18.35 & GBP 15.47 per ounce

11 July: USD 20.47, EUR 18.53 & GBP 15.78 per ounce

08 July: USD 19.72, EUR 17.82 & GBP 15.20 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Monday, 18 July 2016 | E-Mail | Print | Source: GoldSeek.com