-- Published: Thursday, 21 July 2016 | Print | Disqus

By Frank Holmes

U.S. municipal bonds have had a spectacular first half of the year. As of July 1, they returned 6.2 percent on a tax-adjusted basis, compared to the 2.7 percent for the S&P 500 Index, placing them among the top performers of 2016 so far. Last month was munis’ best June performance since 2000, according to Bloomberg, spurred largely by negative bond yields around the globe and investor uncertainty following the Brexit referendum in the U.K.

Inflows have been robust. Between January and May of this year, more than $27.2 billion in new cash flowed into muni bond mutual funds, according to the Investment Company Institute (ICI). That’s a huge step up from the $8.4 billion during the same period last year.

For the week ended July 13, muni mutual funds saw a spectacular $1.2 billion in net new cash, up from the previous week’s $738 million and above the four-week moving average of $1.1 billion. This extends muni bonds’ multi-month-long streak in net inflows—already one of the longest in U.S. history—proving that in a world of low government bond yields and macroeconomic uncertainty, munis continue to be sought as a “safe haven” for their relatively low volatility, modest gains and, of course, tax-free income.

click to enlarge

Even yield-starved foreign investors, who aren’t eligible to take advantage of the tax benefits, are seeking shelter in American munis. As I’ve mentioned before, about $10 trillion worth of global government debt now carries historically low or negative yields.

click to enlarge

For some investors, the worry now is that the muni tax exemption might soon be capped or eliminated altogether, which would drastically reduce the security’s appeal.

The thing is, I don’t see this happening. Here’s why.

More than 100 Years of Tax-Free Income

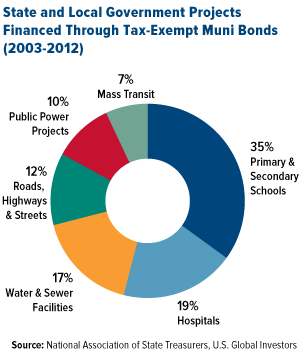

First, a little historical background. Municipal bonds were first written into the tax code a little over 100 years ago, in 1913. Since then, they’ve helped finance countless essential public works projects—everything from schools to hospitals, roads to bridges, airports to seaports, sewers to water treatment plants. More than three quarters of all national infrastructure needs have been built and maintained using muni bonds, which investors have been attracted to for their tax-free income.

Today, over 57 percent of muni investors are over the age of 65, many of whom live on fixed incomes, according to IRS data.

On more than one occasion, President Barack Obama has proposed capping the tax benefit, on the grounds that too much of the $30 billion or so a year in foregone federal taxes ends up in wealthy investors’ pockets. Indeed, a recent study shows that between 1989 and 2013, municipal bond ownership has increasingly concentrated among the nation’s wealthiest households.

Think this is purely part of a socialist agenda? On the contrary, there’s been bipartisan support for the idea. Republicans as prominent as former House Speaker John Boehner and Kevin Brady, chairman of the House Ways and Means Committee, have floated capping muni income.

But with only six months remaining before Obama vacates the White House, a cap is highly unlikely to happen.

It’s equally as unlikely that the next occupant would be in favor of lifting the exemption.

Trump and Hillary, United in Infrastructure Spending

Both presidential nominee Donald Trump and Hillary Clinton, who is set to receive the Democratic nomination next week, are strong advocates of infrastructure spending. This might be the only thing the two candidates have in common with each other, as CLSA analyst Christopher Wood pointed out recently in his “GREED & fear” newsletter. Trump has promised a “trillion dollar rebuilding program,” while Clinton has proposed a five-year, $275 billion infrastructure restoration package.

This is certainly good news for our roads, bridges, schools and other public works, many of which are in sore need of a spit shine.

It’s also good for muni investors.

Ending or reducing the tax benefit is ill-conceived, and I think Trump and Clinton both know that. It would jeopardize hundreds of billions of dollars each year in new debt financing, and would push more construction and labor costs onto local taxpayers.

So leaving all else aside, I’m confident that no matter who wins the election in November, the tax exemption is safe.

By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This article may include certain “forward-looking statements” including statements relating to revenues, expenses, and expectations regarding market conditions. These statements involve certain risks and uncertainties. There can be no assurance that such statements will prove accurate and actual results and future events could differ materially from those anticipated in such statements.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

| Digg This Article

-- Published: Thursday, 21 July 2016 | E-Mail | Print | Source: GoldSeek.com