-- Published: Wednesday, 27 July 2016 | Print | Disqus

By Frank Holmes

In 1974, the American economist Arthur Laffer, then a professor at the University of Chicago, was having dinner with his friend Jude Wanniski, an associate editor of the Wall Street Journal. They were joined by Donald Rumsfeld and Dick Cheney, both of whom worked at the time in the Gerald Ford administration. The topic at hand was President Ford’s Whip Inflation Now, or WIN, initiative, which included proposed tax increases.

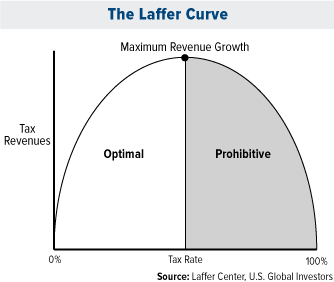

According to Wanniski’s version of the story, which he recounted years later in a WSJ article, Art grabbed a napkin and sketched out what Wanniski dubbed “the Laffer curve.” Put simply, the Laffer curve illustrates what happens when the government raises taxes too much—theoretically, it ends up bringing in less revenue than before the tax hike. Why? Taxpayers feel less incentivized to work if everything they earn is handed over to the government. Small businesses can no longer compete. The flow of capital is squeezed, and business growth slows to a trickle.

The Laffer curve says that tax revenue at both 0 percent and 100 percent is the same: zero. But somewhere in between those two values is the “optimal” tax rate, one that maximizes both government revenue as well as employment, productivity and output. (In the chart above, it looks as if 50 percent is the ideal rate, but the peak could fall anywhere. In fact, it varies year-to-year.)

Art is known today for being the architect of President Reagan’s supply-side economics policies, which emphasize free trade, spending restraint, fewer regulations and low taxes. According to the Laffer Center, these policies “contributed to the longest boom in United States history.” More wealth was created between 1982 and 2007 than in the previous 200 years, when adjusted for inflation.

These are policies that apply overseas as well. Part of why the U.K. voted to leave the European Union last month was to escape punitive taxes and regulations—indirect taxes—imposed by unelected officials in Brussels. British voters recognize the fact that policies of envy have stifled growth and innovation.

Romania Slashes Taxes, Speedy Growth Ensues

Another country that “gets it” is Romania, the mountainous, Central European nation and home to roughly 20 million people. After years of tepid growth, Romania’s government moved to revise its tax code. At the end of last year, it reduced the value added tax (VAT) rate from 24 percent to 20 percent, lowered the income withholding tax rate, nixed a controversial “special construction” tax, simplified deductibles and exempted certain dividends from corporate income tax.

The changes have worked much faster than expected.

In the first quarter, Romania grew 4.3 percent year-over-year, beating the 3.9 percent analysts had expected, and up 1.6 percent from the fourth quarter of 2015. This places the country among the fastest growing EU economies, with the European Commission now expecting it to be the second fastest growing country in the 28-member bloc, behind only Ireland.

click to enlarge

What’s more, investment bank Wood & Company sees country GDP growing 5.1 percent this year and 5.8 in 2017. Much of this growth, Wood writes, will be driven not just by tax cuts but also low borrowing costs, restructured balance sheets and loose fiscal policy. Private consumption is healthy and investor confidence is up.

The country is also getting back to work. Romania’s unemployment rate in May fell to 6.6 percent, compared to 10.1 percent on average for eurozone countries. Its youth unemployment rate, while worrisome at 21 percent, still significantly trails levels found in several other EU countries, including Italy (36.9 percent), Spain (43.9 percent) and Greece (47.4 percent).

A Tailwind for Romania’s Tech Industry

This is good news for Romania’s economy as a whole, specifically Bucharest’s important information technology sector, which has grown tremendously in recent years. In the first quarter, IT contributed 6.1 percent to the country’s GDP and is expected to exceed 10 percent this year or next. For years, Romania has promoted itself as a place to find reasonably priced software development by coders who speak English. Today, many of the world’s top tech companies, including Adobe, Microsoft, IBM, Intel and Oracle, operate in Bucharest, where consumer prices are dramatically lower than in London. (Rent is 84 percent cheaper in the Romanian capital than in the U.K. capital.)

In a previous post, I asked the question: Where’s Europe’s answer to Silicon Valley? Romania is the likeliest answer.

I’ve also been asking for months how Europe can jumpstart its economy, and again, Romania might very well have the answer. It all comes back to the Laffer curve. Since the financial crisis, we’ve relied too heavily on monetary policy to accelerate growth. But quantitative easing, helicopter money and negative rates have done all they can. Meanwhile, punitive taxes and burdensome regulation continue to hinder growth. It’s time we follow Romania’s lead and shift our focus to reforming our fiscal policies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of June 30, 2016.

| Digg This Article

-- Published: Wednesday, 27 July 2016 | E-Mail | Print | Source: GoldSeek.com