-- Published: Sunday, 14 August 2016 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

As the precious metals prices surged this year, so did U.S. petroleum inventories. While rising gold and silver prices are a positive sign for the precious metals industry, the surging U.S. petroleum stocks are extremely negative. However, the prices of the metals and energy are currently not trading based on the fundamental values.

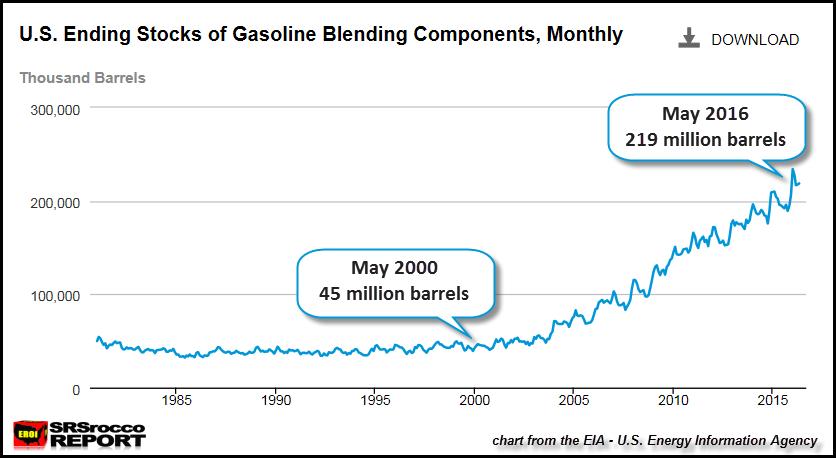

For example, the price of oil continues to rally on the back of rising U.S. and world petroleum stocks. This is especially true in the United States. Not only are total U.S. Gasoline stocks higher this May compared to the same period last year, they are up considerably over the past decade:

Total U.S. Gasoline (Blending) stocks hit a record high for the month of May, reaching 219 million barrels. Last year, total U.S. Gasoline stocks were 196 million barrels… 23 million barrels less. Now, if we go back to May 2000, total U.S. Gasoline stocks were five times less at 45 million barrels.

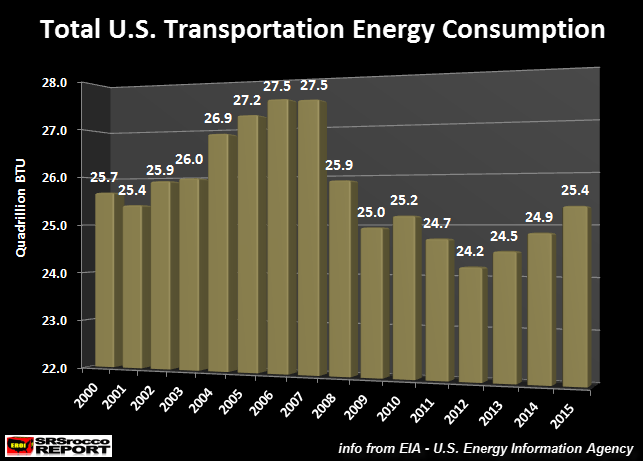

Of course, some folks would quickly reply that this is due to Americans driving more and consuming more gasoline. Well, that would be correct if it were true. Unfortunately, it isn’t. I went to the EIA – U.S. Energy Information Agency and looked at total U.S. Transportation Energy consumption going back until 1950. The chart below only provides data since 2000. However, we can see a troubling sign here:

The U.S. Transportation fuel consumption is shown as Quadrillion BTU’s. That’s a lot of energy. For example, total U.S. energy consumption in 2015 was 97.5 Quad BTU’s. The Petroleum percentage of U.S. Transportation consumption of 25.4 Quad BTU’s represented 26% of total energy consumption by the country.

Regardless, as we can see from the chart above, total U.S. transportation energy consumption was actually higher in 2000 (25.7 Quad BTU’s) than it was in 2015 (25.4 Quad BTU’s). Furthermore, we can see that U.S. Transportation energy consumption peaked in 2006 & 2007 at 27.5 Quad BTU’s. Ever since the 2008 U.S. Investment Banking and Housing Market collapse, total transportation consumption has never surpassed its previous peak.

So, the important question needs to be asked… why are U.S. petroleum gasoline stocks continuing to rise to record levels??? Is it because the U.S. Energy Industry wants to make sure that Americans have plenty of extra fuel in storage if there is some BLACK SWAN EVENT? I hardly doubt it. These companies survive on making profits, not being altruistic.

Correct… it’s due to falling demand.

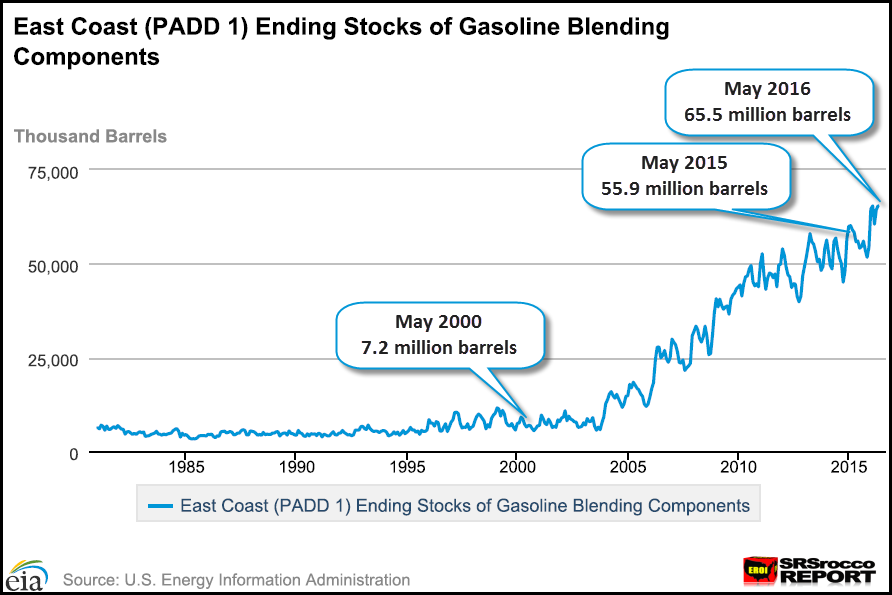

Again, total U.S. Gasoline stocks are 23 million barrels higher in May than they were during the same month last year. Moreover, the situation is even worse in the East Coast (PADD 1). Let’s look at the disaster taking place in the East Coast Gasoline inventories:

East Coast Gasoline stocks hit a new record for the month of May by surpassing 65 million barrels. This is up nearly 10 million barrels from the same month last year. While total U.S. Gasoline stocks are up 12% from last year, East Coast Gasoline stocks are up a whopping 17%.

In addition, East Coast Gasoline stocks are nine times higher than they were in 2000 (7.2 million barrels). This is almost double the rate for the entire country that experienced a five time increase (2000 = 45 million barrels/ 2016 = 219 million barrels) since 2000. This is why the price of gasoline is so much lower in the North East than it used to be in the past… and compared to many other regions of the country.

Do people actually think the price of oil will continue to rise as U.S. and Global petroleum stocks continue to increase??? I also listened to an interview where the analyst was explaining that the huge glut of gasoline stocks in the United States has forced refiners to switch to their “Winter Blend” several weeks early. The thinking by the refineries here is that the “Spring-Summer Blend” stocks of gasoline will start to decline as they switch to the winter blend. However, this is only a short term solution. The analyst in this interview warned, “What the hell is going to happen if gasoline consumption continues to weaken heading into the fall and winter?”

This will just make a bad situation even worse.

I will continue to put out updates on the U.S. petroleum stocks. I beleive they will continue to rise, especially in the fall and winter months. At some point, the fundamentals will kick in and we will see much lower oil and gasoline prices.

Unfortunately, this will be extremely BAD NEWS for the U.S. Energy Industry. Their balance sheets are already in lousy shape this year. If energy prices continue to decline, we are going to see serious problems in the U.S. Energy Sector.

As Energy Prices Continue To Decline, Watch The Opposite Take Place In The Precious Metals

I believe we are just beginning to see the epic move in the price (value) of the precious metals. As I stated in my article, THE COMING BREAKDOWN IN THE U.S. & GLOBAL MARKETS: What Most Analysts Miss, Stocks, Bonds and Real Estate values will plummet as U.S. and Global Oil production heads south due to the “Thermodynamic Collapse” of net energy.

Thus, the best assets to protect wealth in the future will be in physical gold and silver. I will be writing about this in more detail in future articles.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Sunday, 14 August 2016 | E-Mail | Print | Source: GoldSeek.com