-- Published: Sunday, 21 August 2016 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

While Jim Rickards explains many reasons why it is important to own gold, he leaves out the most important factor. Jim has become one of the more prominent names in the precious metals community due to his strong opinion on owning gold even though he worked on Wall Street (the anti-gold financial establishment) for 35 years.

Jim Rickards has written several best-selling books such as, Currency Wars, The Death Of Money and more recently, The New Case For Gold. Rickards is a big believer in owning gold to protect against the collapse of the highly leveraged derivatives based financial industry.

Rickards has gone on record in stating that his technical target for the price of gold posted in the article, Gold “Chart of the Decade” – Math Suggests $10,000 Per Ounce Says Rickards:

“I have a technical level for gold, it is $10,000 U.S. per ounce. That amount gets bigger over time because it’s a ratio of physical gold to printed money. The amount of physical gold doesn’t go up very much, but printed money goes up a lot, so the dollar target goes up more over time because of all the money printing.

$10,000 U.S. per ounce is the implied non-deflationary price for gold. If you have to go back to a gold standard, or anything like it to restore confidence, that is the number you must have to avoid deflation.

So $10,000 per ounce is mathematically derived and is not a guess.”

Rickards as well as legendary gold trader, Jim Sinclair both believe the value of gold will rise due to backing all the outstanding U.S. Dollars with physical gold. Thus, Rickards mathematical formula for arriving at that $10,000 per ounce figure is based upon the outstanding fiat currency in the system. Rickards believes for the U.S. Dollar to continue to function as a currency after the coming financial collapse, it will have to be backed by gold.

While I applaud Rickards for coming out against the anti-gold Wall Street financial establishment, he fails to mention the most important reason to own gold going forward. Furthermore, Rickards suggests a 10% ownership in gold as “INSURANCE” in the case of a financial and economic collapse.

Rickards explains about gold insurance in his article, Gold: The Ultimate Insurance:

If you have a 10% gold allocation, it’s like owning fire insurance. If the stock market goes to new all-time highs, and gold goes nowhere, that 10% allocation won’t hurt you. But if the markets collapse, which I do expect, and the price of gold skyrockets, that 10% allocation will increase by multiples. That profit will protect you against losses in the rest of your portfolio. So gold has that insurance function. And that can’t be downplayed.

As Rickards suggests, gold will act as insurance protecting your wealth during an economic and financial collapse. His rational here is that even if your portfolio suffers from huge declines during a stock market crash, the individual’s gold holdings will multiplying in value, offsetting loses in stocks and even bonds.

Before I get into the most important factor that Rickards fails to consider in owning gold, I’d like to mention that I respect the work he is doing. If only 2% more of investors in the world decided to allocate 10% of their portfolio to gold, the price of gold would skyrocket on that MOVE alone. So, by Rickards going out and publicly stating investors should own gold through interviews and his new book, The New Case For Gold, he’s providing excellent advice.

However, his recommendation for owning only 10% of one’s portfolio in gold is DRASTICALLY TOO LOW. This is where I differ from Rickards on gold and silver ownership.

Gold & Silver Will Explode In Value Well Beyond What Rickards Forecasts

As I have mentioned in several articles and interviews, the value of gold and silver will explode in value due to the permanent collapse of the U.S. and Global Markets. This goes well above and beyond anything that Rickards demonstrates in either his interviews or books.

According to Rickards, the next financial and economic collapse will be just another BIG BUMP in the road. Most precious metals analysts, Jim Rickards included, suggest the importance of owning gold to protect wealth during this next financial and economic calamity. Unfortunately, the most important factor they leave out is the “PERMANENT COLLAPSE DUE TO FALLING ENERGY PRODUCTION.”

I just had an interview with Doc and Eric Dubin at SilverDoctors on Thursday on this very subject. I believe that will be posted this weekend. I must say, I was a bit passionate about new energy information and why the U.S. and Global Markets are going to be in much more serious trouble than individuals realize.

That being said, the U.S. (world included) was able to pull itself out of the Great Depression of the 1930’s as well as other economic and financial shocks due to the GROWTH OF WORLD OIL PRODUCTION. This will no longer be the case going forward.

I wrote about this upcoming collapse which was detailed in my article, The Coming Breakdown Of U.S. & Global Markets Explained: What Most Analysts Miss:

The U.S. and world are heading toward an accelerated breakdown of their economic and financial markets. Unfortunately, the overwhelming majority of analysts fail to understand the root cause of this impending calamity. This is also true for the majority of precious metals analysts.

The reason for this upcoming systemic collapse of the U.S. and Global markets is quite simple when you understand the information and are able to CONNECT THE DOTS. While it has taken me years of research to be able to finally put it all together, new information really put it all into perspective.

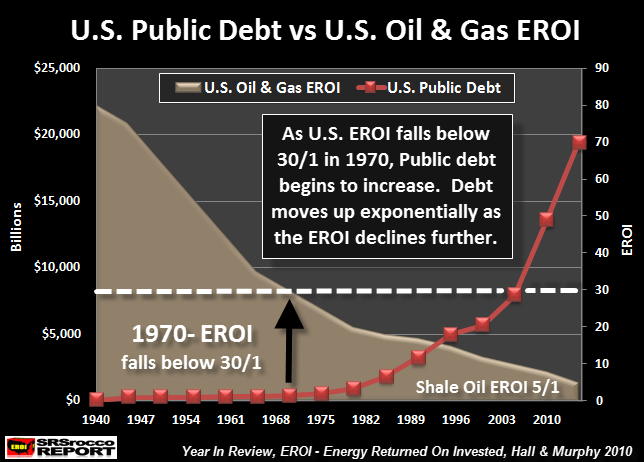

The reason I believe this collapse will be different than anything in the past is due to the Falling EROI- Energy Returned On Invested. This is shown in the following chart:

I don’t want to get into too many details here (as they were explained in the article linked above), however, the massive increase in U.S. public debt is directly tied to the falling EROI of U.S. oil and gas energy production. In 1970, the U.S. enjoyed an EROI of 30/1. Thus, we had 29 profitable barrels of oil for the energy cost of each barrel to maintain and grow our modern society. In addition, a high EROI allows oil companies to remain profitable and to continue future exploration.

Unfortunately, the EROI of U.S. Shale oil production is 5/1… thus, it only provides four profitable barrels. Nearly half of U.S. total oil production is from shale oil fields. Thus, the overall EROI of U.S. oil and gas energy production has fallen considerably and is now below the MINIMUM REQUIREMENT of 20/1 EROI to sustain our modern society (source found on linked article above).

This is why we are experiencing runaway Health Care, Education, Food and etc costs. We just don’t have enough profitable barrels of oil anymore to pay for it all. So, to try and continue business as usual, we add a lot more debt to the system as costs continue to increase.

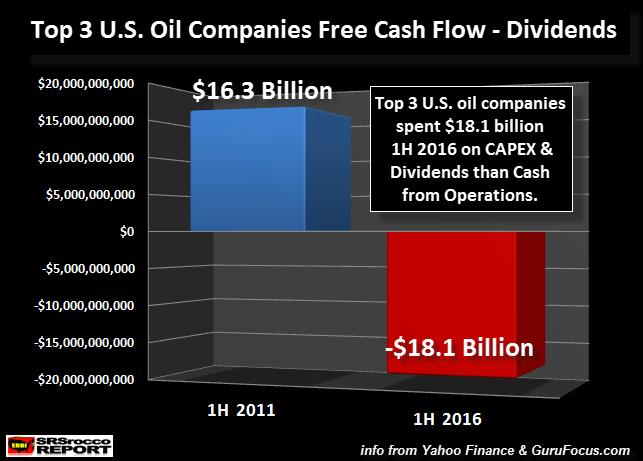

Sure, government and corporate corruption are partly to blame for rising costs, but overall, the falling EROI is destroying everything in its path. For example the major U.S. Oil companies are hemorrhaging under the low price of oil as they had to fork out an additional $18.1 billion 1H 2016 to cover their capital expenditures and dividends that they didn’t make from their operations:

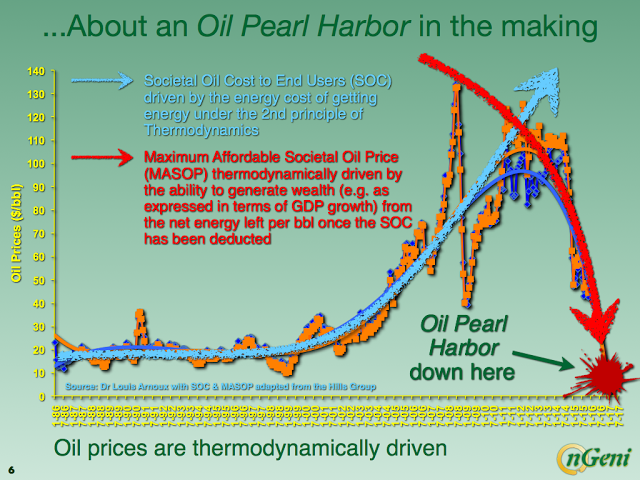

Some folks believe that when much higher oil prices arrive, the oil companies will tap into more expensive reserves and production will grow. While this is a NEAT IDEA, new information points to a “Thermodynamic Collapse” of oil due to the rapidly falling EROI:

This chart was put together by the work of the Hills Group (oil engineers and project managers) and Louis Arnoux. Instead of seeing much higher oil prices in the future, they forecast the price will head back much lower as the AVAILABLE NET ENERGY for society continues to decline. Basically, they believe the price will fall because the value of the oil will diminish. Even though someone might want to pay a higher price for energy, the society as a whole will be only able to afford a much lower price due to the collapse of NET OIL SUPPLIES to the economy.

This ENERGY FACTOR is not even spoken about by Jim Rickards. I imagine Rickards is a very smart guy and it would surprise me if he didn’t understand this information. If Rickards understood this energy information, it may not go over well to talk about this to the majority of investors who buy his books. I am not criticizing Rickards here, I just realize this topic is well beyond DOOM & GLOOM. It changes everything going forward.. and rather quickly.

Rickards states that investors should put 10% of their wealth in physical gold and keep the other 90% in the typical orthodox financial investments.

This is like saying: I AM GOING TO PLACE 10% OF MY MONEY ON THE GOOD BET and 90% ON THE LOUSY ONE.

I don’t understand that reasoning at all. We must remember, Stocks, Bonds, Real Estate and even Fine Art (which represent 90% of Rickards other allocation), are going to collapse in value during the Falling EROI Energy Supply scenario. Why in the living hell would you keep 90% in assets that are guaranteed to collapse in the future????

Let me clarify my position on this. I don’t recommend investors selling everything TODAY and buy physical gold and silver. That is not my intent. However, as time goes by, it will make more sense to get out of paper assets and into physical precious metals. Just as Rickard’s claims, the collapse will take place in the future. No one can give a date.

The difference between Rickards and my analysis is that Rickards focuses just on the financial system, leaving out the energy. The ENERGY is the most important part of the economy whether investors want to believe it or not. I gather Rickards believes we will continue to have infinite growth on a finite planet… so 10% is all you need in gold because stocks, bonds and real estate will come back even stronger than ever in the future.

THIS IS PURE FOLLY.

I will be writing more articles on this in the coming months. Also, Financial Industry expert Vic Patane and I will be doing another WELCOME TO THE CONVERSATION next week on how Brokerage Firms are now mentioning gold to their clients:

Charles Schwab just published a white paper on gold and gold investment vehicles. Stunning…well done…discussion of Gld, ETFs, futures, fees and rationale for investing in gold. Timing indicates investment community wants gold exposure. Wasn’t written in 2011 or when gold touched $1048, but now, why? And why no discussion now of owning physical gold in your pocket?

Because coins in your pocket mean taking currency out of the system…..we can’t have that…not even at Charles Schwab….buy GLD…….(spoiler alert, DONT!). More next week.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Sunday, 21 August 2016 | E-Mail | Print | Source: GoldSeek.com