-- Published: Sunday, 28 August 2016 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The situation Americans face in the future will be nothing like anything they have experienced in the past. While we have seen old footage and heard stories about the Great Depression (starting in 1929), we have no idea how bad things really were during the 1930’s.

At that time, approximately 25% of the American population were farmers. Thus, when things really got bad, folks in the cities could move out and stay with their families or relatives on the country farm. This is not an option for most Americans today as only 2% of the population are farmers and ranchers (source).

After WWII, Americans left the farms in large numbers for the allure of the great life in the cities and suburbs. For decades, living in the city or suburb offered Americans a much easier way of life as the United States had plenty of cheap energy and resources to tap into.

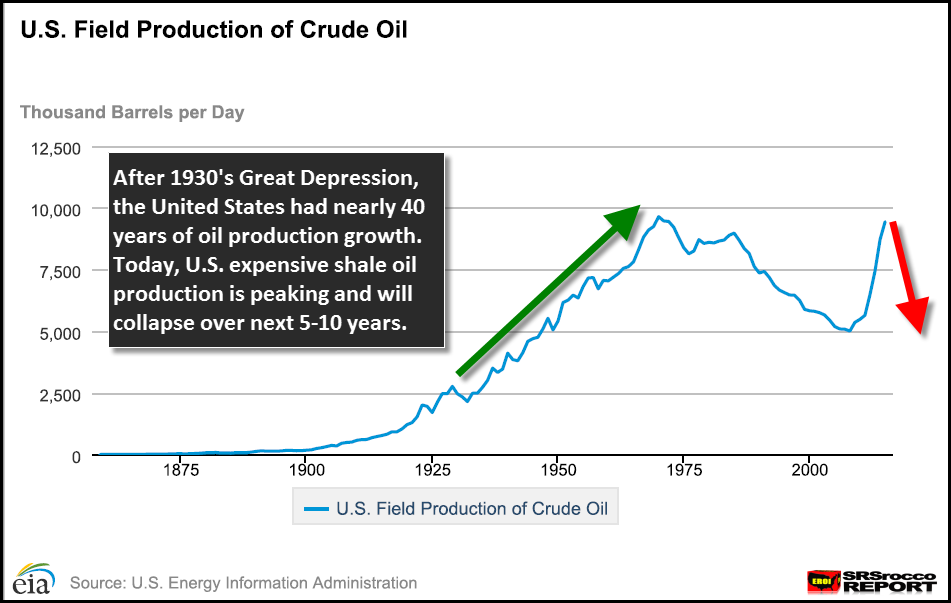

Matter-a-fact, after the 1930’s Great Depression, U.S. oil production continued to increase for nearly 40 years:

Even though U.S. oil production declined some years (1930-1970), overall growth steadily increased in a linear fashion. However, the recent surge in U.S. oil production (2007-2015), mainly due to the ramp up of expensive shale oil, moved up exponentially and will likely decline in the same fashion. This will have a profoundly negative impact on the U.S. economy and financial system.

Furthermore, the U.S. was able to pull itself out of the Great Depression due to the fact that it was just starting to tap into its huge reserves of cheap, high EROI (Energy Returned On Investment) oil supplies.

For example, the massive Lakeview Gusher in California (1910) had an estimated EROI of 35,000/1 (source):

Basically, for one barrel of energy equivalent consumed to drill the Lakeview Gusher, it provided 35,000 barrels of oil. Today, Shale Oil comes in at whopping 5/1 EROI and Oil Sands in Canada is about 4-5/1 EROI.

The EROI of U.S. Oil & Gas in 1930 was 100/1. This includes exploration and production. According to white paper, A New Long Term Assessment Of Energy Returned On Investment (EROI) For U.S. Oil & Gas Discovery and Production, the U.S. oil industry in 1919 was finding 1,200 barrels of oil for each barrel of oil equivalent energy it consumed in exploration. Today it has fallen to less than 5/1.

As the U.S. oil and gas EROI declined, especially after 1970, the United States continued to thrive due to the Petro Dollar system and the ability to import high EROI from the Middle East and other oil exporting nations. Unfortunately, this is not a situation that will continue for much longer as the massive debt in the system is unsustainable.

Comparing U.S. Debt 1929 vs Today

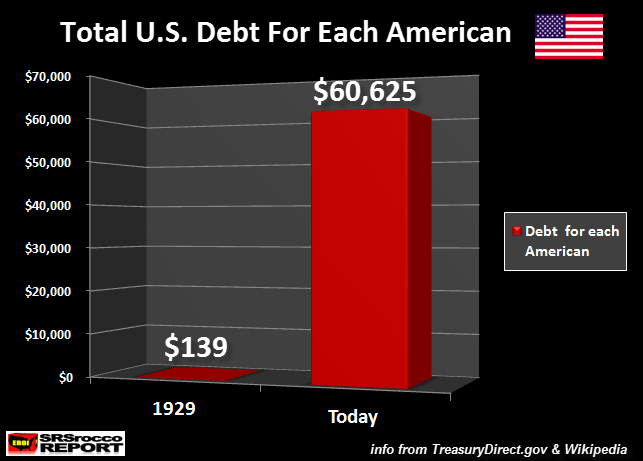

It’s quite interesting to see how much of a change has occurred since the Great Depression. While things were very bad for Americans in the 1930’s, the amount of U.S. public debt per person was very low versus today:

According to several sources, the U.S. population was 122 million in 1929 while total public debt was $16.9 billion. Thus, the average debt per American in 1929 was $139. Compare that to a population of 320 million and $19.4 trillion in debt at an average $60,625 per American today.

NOTE: A few readers suggested that I adjust for inflation in this example. So, if we take $139 in 1929 and adjusted for inflation today, it would be worth $3,288. So, the net difference would be nearly 20 times higher.

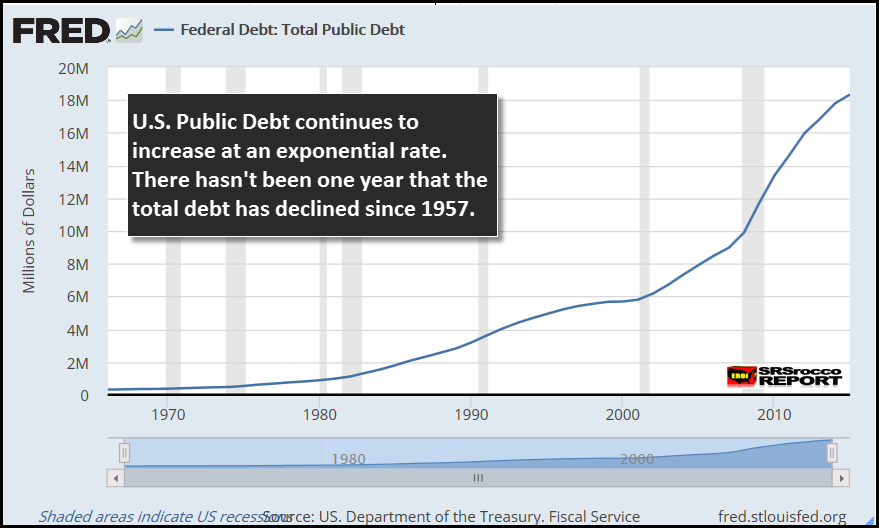

What is interesting about total U.S. debt is that after each World War, the total level of debt declined for several years. For example, after the end of World War I, total U.S. debt fell from $27.4 billion in 1919 to $16.1 billion in 1930 (source). This was also true after World War II when total U.S. debt fell from a high of $269 billion in 1946 to a low of $252.7 billion in 1949. Over the next several, as total U.S. debt continued to increase, there were a few years that experienced declines (1951, 1956 & 1957).

However, after 1957, there wasn’t a single year that total U.S. debt declined…. it continued to increase for 58 consecutive years:

I believe the reason total U.S. debt was able to decline after each World War and during a few years in the 1950’s, was due to the relatively high EROI of U.S. oil and gas. Moreover, as cheap domestic U.S. oil production peaked in 1970, oil imports had to increase to supply the ever-growing sprawl of the AMERICAN LEECH & SPEND SUBURBAN ECONOMY.

At the peak, the U.S. imported a staggering 14.1 million barrels a day of oil in 2005 (net imports). This accounted for nearly three-quarters of total U.S. oil consumption. Again, the Petro-Dollar system allowed the United States to exchange U.S. Treasuries (paper IOU’s) for oil.

As U.S. oil consumption declined after the 2008 Investment Banking and Housing collapse on top of increasing domestic shale oil production, net imports fell to a low of 4.1 million barrels a day in May 2015. However, according to the EIA – U.S. Energy Information Agency’s recent update (Aug 24th), net oil imports jumped to 6.6 million barrels a day (source).

So, now that U.S. oil production has declined 12% from its peak last year, imports are again on the rise. Unfortunately, many oil exporters in the future will likely not take U.S. Treasuries or Dollars for oil. This will cause serious trouble for Americans as U.S. oil production continues to collapse over the next 5-10 years.

While U.S. debt has exploded, so has the value of gold

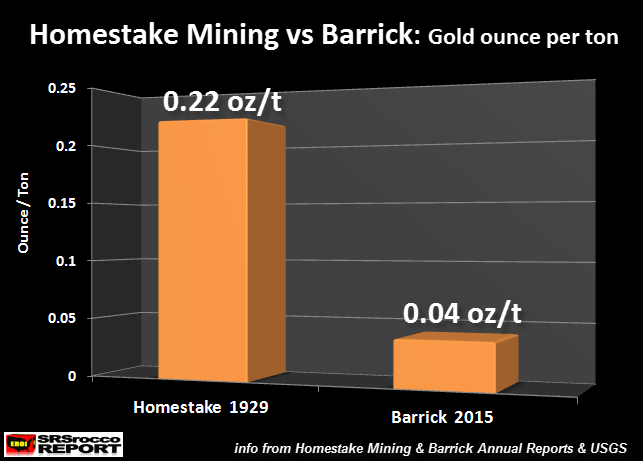

Homestake Mining 1929 vs Barrick Gold Today

If we compare the two largest mining companies in the U.S., we can see what a difference has taken place since 1929. I was able to obtain several older annual reports from Homestake Mining, which was the largest gold producer in the country during 1929.

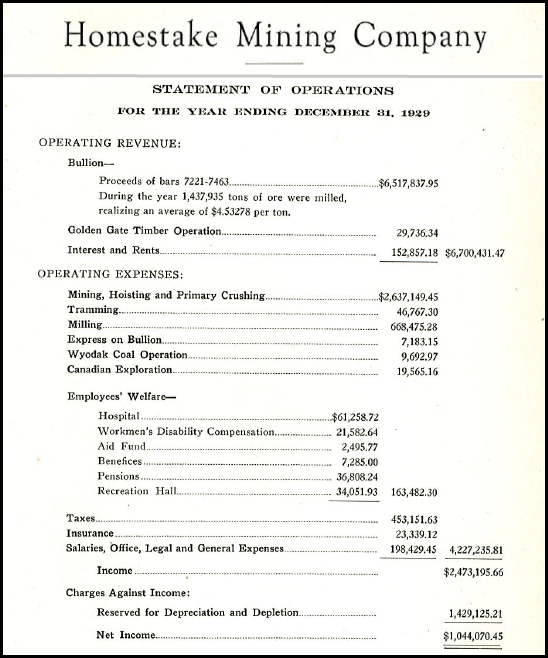

Here is a rare copy of Homestake Mining’s 1929 Annual Report:

According to the USGS 1929 Gold & Silver Annual Report, Homestake Mining produced 312,328 oz of gold in 1929. As we can see on the top of the annual report, Homestake Mining processed 1,437,935 tons of ore which resulted an average yield of 0.22 ounces per ton (oz/t).

Now, if we compare that to Barrick that produced 6.1 million oz of gold in 2015 while processing a staggering 139 million tons of ore, their average yield was a pathetic 0.04 oz/t:

When Homestake Mining was producing gold in 1929, it was extracting nearly enough gold per ton to make an 1/4 oz Gold Eagle (0.27 oz) versus Barrick in 2015 that wouldn’t have enough metal to make half of an 1/10 Gold Eagle (0.11 oz) (source).

Furthermore, Homestake Mining paid its shareholders a staggering $1.7 million in dividends on total revenues of $6.5 million that year. Thus, Homestake Mining’s dividends were 26% of total revenue in 1929 and each investor received a stunning $7 per share.

Now, let’s look how this compares to Barrick. Barrick paid a total of $160 million in dividends in 2015 on total revenues of $9 billion. Which means, Barrick’s dividends were less than 2% of total revenues while investors received a paltry 14 cents for each share.

What a difference aye? By the way, Homestake Mining only had a little more than 251,000 outstanding shares versus Barrick’s 1,165 million…. LOL. So, if an individual had 100 shares of Homestake Mining in 1929, they would have received $700 versus Barrick’s investors receiving $14. The math is certainly not good for modern gold mining investors.

If we compare the cost to mine gold at Homestake Mining 1929 vs. Barrick Gold Q2 2016, there is a significant difference. According to my adjusted income approach in calculating an estimated break-even for gold mining for each:

Homestake Mining 1929: = $17.33 oz (based on $20.63 spot in 1929)

Barrick Gold Q2 2016: = $1,152 oz (based on $1,259 spot in Q2 2016)

Even though Homestake Mining’s 1929 margin of a 16% profit was only twice as high as Barricks Q2 2016 margin of 8%, we can clearly see the real winners were the Homestake Mining shareholders who made 50 times more money in dividends than Barrick’s shareholders.

NOTE: The margins were simply calculated by taking the cost of production by the spot price in both examples.

As we can see, producing gold for its shareholders was a much better deal for Homestake Mining investors than for Barricks. Furthermore, a Dollar could buy a lot more gold in 1929 than it can today.

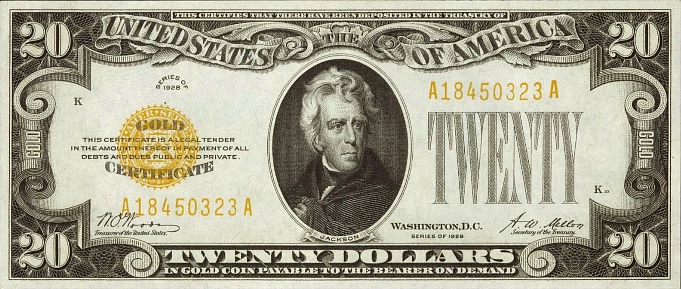

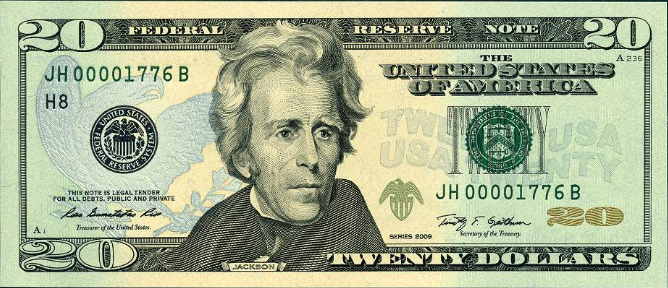

U.S. Gold Certificates 1929 vs Federal Reserve Notes Today

Prior to President Roosevelt confiscating gold in 1933, the U.S. Treasury issued Gold Certificates. Thus, any American could go into a bank prior to that period and turn in their paper Gold Certificate and demand actual gold. Today, if you tried to do that at any bank, they would bring everyone out from the back and laugh at you.

Below are two $20 bills. The top is a $20 Gold Certificate and the bottom is a $20 Federal Reserve Note:

The $20 Gold Certificate was printed in 1929, and the $20 Federal Reserve Note was printed 80 years later in 2009. Both are bills, but one was backed by real gold and the other is now backed by $19.4 trillion in U.S. Public Debt. That is why it’s called a “Note.”

We must remember, a “Note” is an obligation. When you take out a home mortgage or car loan, it can be also called a “Note.” So, all those Federal Reserve Notes we keep in our wallet or purse are debts or obligations we owe, rather than an asset such as a Gold Certificate that represents physical gold.

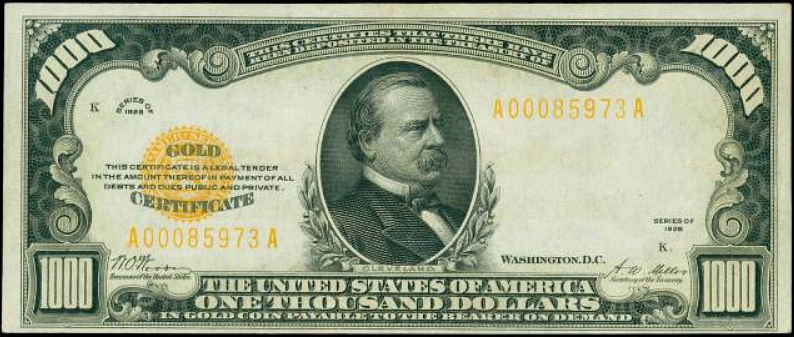

Here is another Gold Certificate printed in 1928:

This $1,000 Gold Certificate was rare and even rarer today. Of the 84,000 printed that year, there are only 200 available today to collectors (source). The value of this $1,000 bill today ranges from $4,000 to over $20,000 depending on the condition. So, not only did this $1,000 Gold Certificate represent a lot of value in gold at the time, it’s worth 40 to 200 times more today.

If an American took that $1,000 bill and went to the bank to demand gold bullion in 1929, he or she would receive (50) $20 gold coins. The amount of gold in a typical $20 St. Gaudens gold coin was 0.967 oz. (source). So, even though the spot price of gold in 1929 was $20.63, when we multiply it by 0.967, we end up with almost $20.

Regardless, that $1,000 Gold Certificate in 1929 would enable the holder to a nice bag full of 50 gold coins. The average cost of a new car in 1929 was $643 and a new median home price was $7,246. Today, $643 would only pay half of the taxes on a $25,000 car. Furthermore, $7,246 would be less than a third of one percent of a down payment for the typical $250,000 house today.

Lastly, $1,000 today in (10) $100 bills won’t even buy you one ounce of gold. All you could get today for $1,000 is 3/4 oz gold compared to 50 oz in 1929.

What a change in 85 years… aye?

Americans are in real trouble and I don’t continue to say that just to be pessimistic or negative. U.S. oil production is about to collapse while total U.S. public debt of $19.4 trillion turns out to be a staggering $60,625 for each American. There is no way this debt will ever be repaid.

Some investors and analysts believe there should be a “Debt Jubilee” or a wiping out of debt so we can start fresh. I would like to remind these “Einsteins” that wiping out debt also wipes out the supposed assets on the other side. When assets implode, so will the capital available to the market for future economic activity.

Anyhow, U.S. debt will implode due to the collapse of U.S. domestic oil production on top of falling oil imports in the future. This will create an event in history that will make the population understand the value of GOLD & SILVER once again.

While Americans have been suffering 45 years of Gold & Silver Monetary Amnesia, PRECIOUS METALS RELIGION will finally wake up the living dead. However, when this occurs, I would imagine most Americans will be caught by surprise as many will be wondering why their Banks are closed for an extended “Holiday” and their brokers are no longer taking their calls.

While I have tried to wake up family and friends about whats coming, I hate to say…

GOD HATH A SENSE OF HUMOR…..

Check back for new articles and updates at the SRSrocco Report

| Digg This Article

-- Published: Sunday, 28 August 2016 | E-Mail | Print | Source: GoldSeek.com