-- Published: Tuesday, 30 August 2016 | Print | Disqus

By Frank Holmes

We’ve finally reached late August, meaning your Facebook newsfeed is probably brimming with children and teenagers sporting brand new sneakers and backpacks in preparation for their first day of school. Maybe one or two of your young ones are heading back this week or next. If so, I wish them all the best this year, and I hope you enjoy and cherish watching them grow.

It’s also around this time that hundreds of thousands of 18-year-olds will be attending their very first day of college or university. This cohort, born mostly in 1998, is among the youngest of millennials, the generation born between 1980 and 2000. According to Census Bureau data, millennials are now the most populous adult segment in U.S. history, 83.1 million strong as of last summer. (By comparison, baby boomers number 75.4 million.)

This is why I find it so crucial to keep up with the trends, lifestyles and spending habits of this important group (not least of all because my own two sons belong to it). Any investment manager would be wise to do the same. Millennials are often characterized as entitled, lazy and disengaged, but many of these perceptions fail to stand up to scrutiny when we consider what they’ve already achieved in the information technology space. If you regularly use Facebook, Airbnb, Uber, Pinterest, Dropbox or any number of other popular apps valued in the tens of billions, you benefit from the work and imagination of entrepreneurs who came of age sometime during George W. Bush’s eight-year presidency.

There’s no getting around it: Millennials are our future leaders, innovators, consumers and investors. By 2020—a mere four years from now—they will make up an estimated 50 percent of the global workforce. What’s more, they’re expected to control between $19 trillion and $24 trillion on a global scale, according to consulting firm Deloitte.

Twenty-four trillion dollars. Let that sink in for a moment.

The First Digital Natives

One of the best ways to get a clear sense of the world this group has come of age in, I’ve found, is the Beloit College Mindset List. Every August since 1998, Beloit College has put together a list of cultural touchstones that helped shape and influence the current incoming class of college freshmen.

Last year, I was fascinated to learn that the class of 2019 has always depended on Google to answer their questions, always treated Wi-Fi as an entitlement, always known marijuana as a legal therapeutic substance in a growing number of states.

This year’s list for the class of 2020 is no less eye opening. Below, I’ve selected several points that illustrate millennials’ close relationship with digital technology.

- There has always been a digital swap meet called eBay.

- They have never had to watch or listen to programs at a scheduled time.

- If you want to reach them, you’d better send a text—emails are oft ignored.

- Books have always been read to you on audible.com.

- Bluetooth has always been keeping us wireless and synchronized.

- Airline tickets have always been purchased online.

Taken together, these observations shed some light on the expectations millennials have of their brands and services—expectations such as convenience, immediacy, transparency and a strong sense of community. It doesn’t matter how iconic or longstanding a brand is. If it fails to deliver on these expectations, 83 million millennials will antiquate it. (Remember Blockbuster?) Word of mouth is as important as ever, but the scope has vastly been broadened since their parents and grandparents’ time, from a handful of neighbors and acquaintances to a digital sea of millions.

Social Responsibility Matters

More so than past generations, millennials are mindful of ethical business practices and base many of their spending and investment decisions on those practices.

A recent study conducted by marketing tech firm Adroit Digital found that 38 percent of millennial consumers will drop a brand for another if it’s alleged to be doing “bad business”—consciously polluting a river, for example, or mistreating workers.

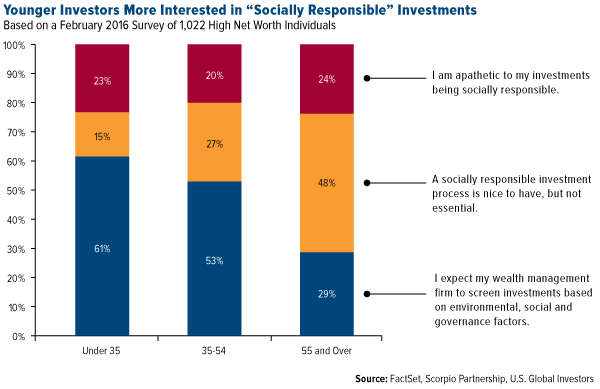

That social awareness translates to the investment side, even among wealthy investors. A vast majority of younger high-net worth individuals (HNWIs), defined as those controlling wealth greater than $10 million, expect their money managers to “screen investments based on environmental, social and governance factors,” according to FactSet. Sixty-one percent of millennials see these factors as essential, more than double the rate of their 55-and-older peers.

click to enlarge

Proceeding with Caution

The 2008-2009 financial crisis had a huge, lasting impact on young investors, who might have seen the value of their parents’ 401(k)s and portfolios cut nearly in half. As a result, many twenty and thirtysomethings tend to be a bit more cautious and conservative with their finances than Mom and Dad.

Consider this: In December 2015, UBS surveyed 2,638 affluent investors, including 584 millennials, on their investment attitudes. As a group, millennials maintained a larger cash holding than older generations (41 percent on average, compared to Generation X’s 28 percent and baby boomers’ 20 percent) and were unsatisfied with how their portfolios were positioned. Only 15 percent claimed they were “very happy,” compared to 32 percent of Generation X and 50 percent of baby boomers.

This could partially explain why millennials also have a much greater propensity to rent instead of commit to buying—which, in turn, helps explain the meteoric rise of “sharing economy” pioneers such as Uber (now worth more than Ford and GM) and Airbnb (worth more than Hyatt and Wyndham Worldwide).

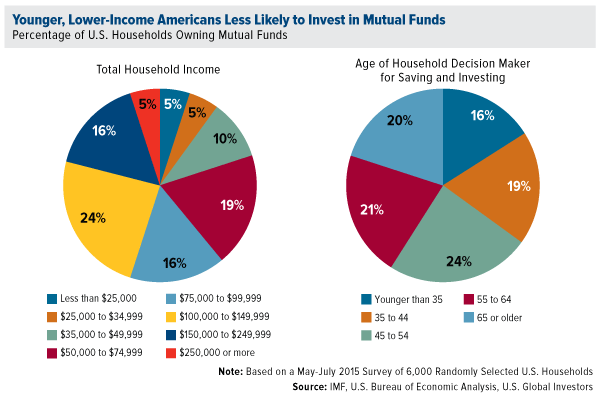

Meanwhile, younger and lower-income Americans are less likely than their older peers to participate in investments such as mutual funds.

click to enlarge

This is worrisome, especially since they themselves are skeptical of Social Security’s longevity. According to the Transamerica Center for Retirement Studies (TCRS), as many as 80 percent of millennials fear Social Security will no longer be around by the time they retire.

Fortunately, we have a solution.

Dollar-Cost Averaging

For many cautious millennials, taking a more long-term, disciplined approach to investing makes sense. This can be achieved through dollar-cost averaging, an investment technique that lets you invest a fixed amount in a specific investment at regular, automatic intervals—often just $100 per month.

Think of it like dipping your foot into a lake inch-by-inch, instead of taking a running leap off a 20-foot cliff.

That’s the case with our popular ABC Investment Plan, which allows investors to fund their financial goals more affordably. Of course, no investment plan can guarantee a profit or protection against a loss in a declining market, and you should evaluate your financial ability to continue in such a program in view of the possibility that you might have to redeem shares in periods of rising and declining share prices.

But for younger investors who might feel hesitant to make the plunge all at once, the ABC Investment Plan is an option worth considering.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more of U.S. Global Investors Funds as of 6/30/2016: Ford Motor Co., Wyndham Worldwide Corp.

| Digg This Article

-- Published: Tuesday, 30 August 2016 | E-Mail | Print | Source: GoldSeek.com