-- Published: Sunday, 11 September 2016 | Print | Disqus

By Gary Tanashian

The opening segment of this week’s Notes From the Rabbit Hole (NFTRH 412) was intended to be a quick blurb but went on to become a five page exercise. It is shared publicly not so much because it is hard core analysis (which the rest of the report took care of), but because after a week like last week I think being a little wordy can be for the better.

I had a difficult week last week; a couple things had gone wrong and my schedule was just ridiculous. On Wednesday I was feeling pretty stressed out and wondering why I just can’t seem to catch a break. Then I looked up and saw a man with two hooks for hands walk by. It was almost as if he were sent into my view to straighten me out.

Another source of perspective is a more obvious one. Today being September 11, I would venture that we all remember where we were and what we were doing on that day in 2001. I was working at my company. It was a normal morning and then it seemed like the world just stopped, except for the jet fighters that were putting a lock down to the sky above us. It seemed like the world then magically came together for a few days… fast forward to today’s divisive, sad and hateful political theater.

The stock market? A piece of cake, when you’ve got your head on straight. What I see after taking a look at sentiment, is that while we could get a bounce, something probably started on Friday and I don’t think it will be finished until it tests the 2100 area on the S&P 500 or possibly, the 200 day moving average (currently 2057).

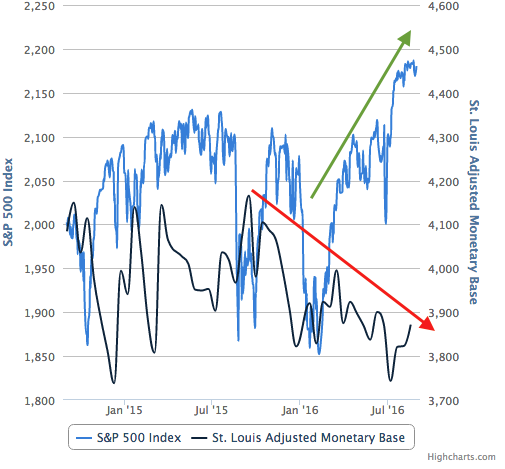

The other consideration is that when we began the ‘Breadth Thrust’ theme (thanks again to subscriber ‘LN’) we noted it would have a shelf life, and that this is likely a terminal thing. Was Friday the beginning of the termination? That would not be proven until major support is taken out. We are entering a tricky period where Fed jawbones are set on full frontal confusion mode, the market is getting emotional and Yellen’s got that “tool box” which, as noted last week, may be used to try to sustain the stock market’s upward float (ref. the money supply/stock market graphs from NFTRH 411).

The gold sector is taking the correction it needs to take for new investment opportunity. I know I don’t sound like a team player in the gold “community” and that is because the bear market taught me the depths to which some gold bugs would sink in order to keep the herd invested or at least interested, as if this were the only asset class in the world. As the bull market took hold in 2016 many gold experts continued on as if there had never been an intervening, wealth destroying 4 year period from 2012 through 2015.

You know them by the dogma, by a singular obsession with gold stocks or simply by the lame titles to analysis articles like ‘Got Gold?’ (I mean come on man, that stupid milk commercial is at least a couple decades old). But after calling the last in a long line of bottoms, the pompom brigade is finally right. It’s a bull market. That is a fact, when using the 20% figure that someone once decided defines a bull market.

Now the question is, what kind of a bull market is it, a short cyclical one or the next leg of a long secular one? I lean toward option #2 but regardless, it is time to patiently gauge buying opportunities with a combination of key technical levels and gold bug sentiment analysis at the ready. The sector’s fundamentals are helped by the fact that the stock market is also having problems.

As for the rest of the macro markets, global stocks – which had been a mix of bullish and bearish countries and economic zones – suffered no real damage last week. EM and Asia got clobbered on Friday, Canada eased within its bull trend and Europe pulled back. But the status was not altered. Not all markets were bullish to begin with, but those that were are still on trend and those that weren’t did not suffer short-term trend damage. One other thing that held firm last week was inflation expectations, by two of our gauges.

I thought it was very curious that on a day when everything (precious metals, commodities and stocks) got hammered inflation protected T bonds broke out vs. nominal T bonds and the Canadian ‘inflationary speculation’ barometer continued to be firm.

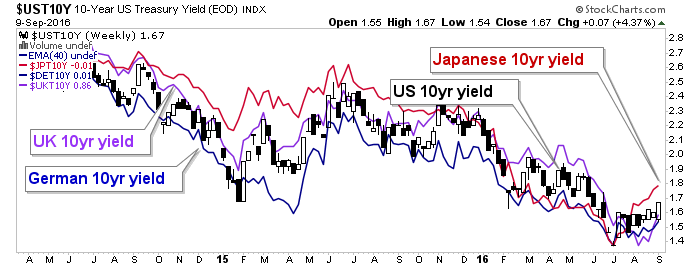

What’s more, long-term interest rates surged across the globe.

Aside from having implications on the prospective Japanese Banks trade we noted last week (we’ll update it in the NFTRH+ Notes segment), one wonders if this is a sign of rejection toward policy makers as inflation expectations bump up. Again, why, with the big downside in most financial markets on Friday are yields going up? Put another way, why did not supposedly venerable US Treasury bonds get a risk ‘off’ bid?

Well, look at the sneaky 10 year US yield creeping out of its 2016 downtrend.

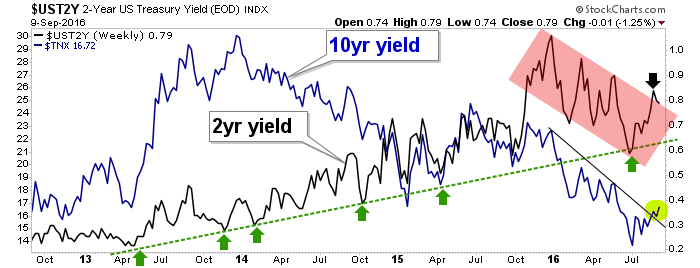

Brainwashed gold bugs go running for cover! People are going to tell you that yields are rising, which will support the US dollar and croak gold. But if this is the beginning of a trend, where short-term bonds are stronger than long-term bonds (i.e. long-term yields are stronger than short-term yields) then that could signify the engagement of a major holdout in the fundamental case for gold and gold mining.

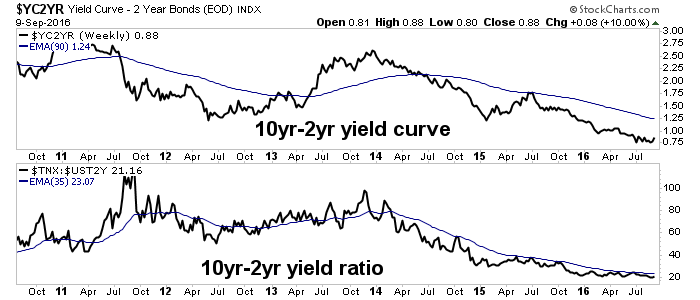

Of course, we are talking about the yield curve which, as you can see, is still down trending but bumped up last week.

As we move forward, scouting buying opportunities (for investment) in the gold sector, it will be important to have an iron clad fundamental backdrop in place. Assuming our inter-market gold ratio charts remain intact, a rising yield curve would be most welcome.

By the weight of the evidence so far, it looks like the curve could rise due to inflationary pressure (ref. TIP-TLT) as opposed to the other reason it could rise, which is deflationary pressure and a rush to the liquidity of short-term Treasury bonds.

This is not a time for overly simple market analysis. It is a time for rolling up our sleeves and getting our hands dirty every single week because we have got tigers by the tail (wounded animals known as the Federal Reserve and its global cohorts, with the potential for a bond market rebellion on their hands).

Before we get too heavy on a theme of gold sector (and potentially later on, commodity and certain global and US market) buying opportunities we need to manage what is going on in the here and now. In particular, we need to interpret what is going on in bonds, which are the tools – the macro magic tricks used by policy makers since 2008 have involved bonds in one way, shape or form after all – in the tool boxes like the one that Janet Yellen referenced at Jackson Hole.

The stock market likely has lower to go and I am in no hurry to try to support it with my capital. It will either hold major support or fail into a serious bear phase.

In the gold sector, reliable opportunities come when the media declare the gold trade dead, people who hate the concept of a non-income paying asset tout their views and the gold bugs themselves get emotional… all the while fundamentals are engaging. The last great opportunity was Q4 of 2008. We can look for an echo of that, at least.

We then moved on to the usual format covering technicals, macro fundamentals, sentiment and indicators across all major market segments. In all, 31 additional pages comprise the balance of NFTRH 412, which helped me immensely in gaining insight across several markets with respect to what happened last week and what is likely to happen going forward.

NFTRH.com and Biiwii.com

| Digg This Article

-- Published: Sunday, 11 September 2016 | E-Mail | Print | Source: GoldSeek.com