While gold and silver had largely remained range-bound for the better part of the third quarter, lower support gave way as traders threw their gilded babies out with the bathwater as the tape was hit Tuesday morning with the hopes, fears and hype of higher rates.

The Hopes: as witnessed in the relief from the growing desperation in Europe that has seen European bank shares fall sharply with negative yields this year, led by Germany’s embattled Deutsche Bank, who’s market value has roughly been cut in half since January.

Stoking hope, was a report out of Bloomberg (see Here) Tuesday morning citing confidential ECB officials, that an “informal consensus has built among policy makers in the past month that asset buying will have to be tapered once a decision is taken to end the program.” And although they “didn’t exclude that QE could still be extended past the current end-date of March 2017 at the full pace of 80 billion euros a month”, the report elicited a taper-tantrumesque reaction in the government bond markets – as well as bank shares, with yields and bank stocks rising on both sides of the Atlantic.

The Fears: as in David Byrne’s, “My god what have we done?!” realization, that although low yields were welcomed by central banks to prop-up economic growth and stave off potential deflation, they’re not so good for bank profits and defined pension plans over the long run, as it inherently squeezes profitability and hence could eventually put the broader financial system at risk through substantially weaker banks.

Although fear of inflation was the tack he chose, Richmond Fed President Jeffrey Lacker’s closing remarks from his speech early Tuesday morning (see Here) made the favorable policy parallel to the Fed’s severe actions in 1994 that doubled the Fed funds rate from 3 to 6 percent over just one year. Notwithstanding the apparent absurdity of the comparison with today’s economic backdrop, the speech set the tone for the morning session and correlated with the sharp range break lower in precious metals and bid in the US dollar.

The Hype: Simply put, you know there’s serious confusion and divide within the Fed, and hence – the market, when a Fed president cites 1994 as a model policy blueprint and gives Greenspan credit for the preemptive action that “laid the foundation for the price stability we’ve enjoyed over the last 20-plus years”.

Ignoring the massive market dislocation that rolled the dice of systemic risk and took down among other investors – Orange County California, someone should remind Lacker that Greenspan’s aggressive preemption in 1994 also inverted the yield curve and took US economic growth from 5.6 percent per year to just 1.4 percent – in just three quarters.

If it wasn’t for luck and the nascent technology boom that was just getting started, his actions would have undoubtedly precipitated a deep recession and an immediate unwinding of tighter monetary policy, that would have destroyed the Fed's credibility in the market going forward. And although the Fed at that time had room to drive rates on both sides of the road, with US economic growth currently at 1.4 percent, the inevitable and likely severe contraction brought on by a similar tightening regime, would find the Fed out of road overnight and back to more unconventional policy measures that have already lost considerable efficacy and support within the market.

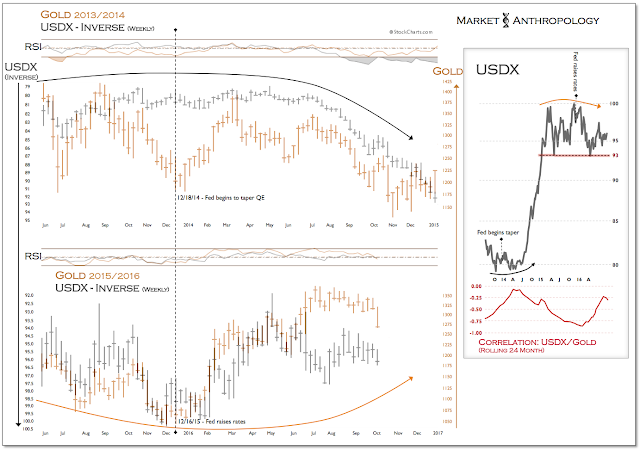

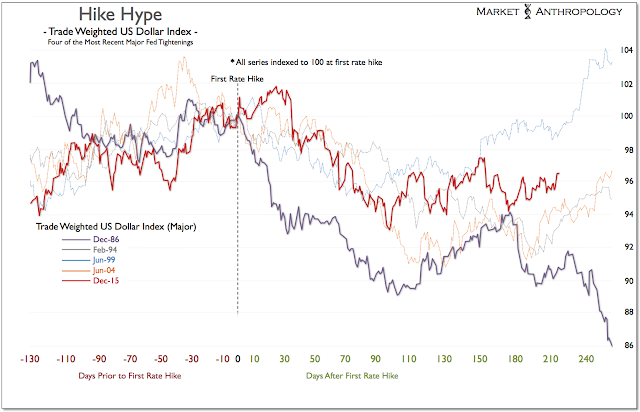

The Opportunity: With the range break lower this week, gold and silver are now trading back to levels from late June in another market environment significantly discounting the impact of higher rates. While a modest 25 basis point hike is not out of the question this December – and one we suspect is now being fully priced into the sector, it has paid to buy the dip in precious metals over the past year, as market participants become over zealous on the prospect of higher rates and ignore the real motivation of a weaker dollar and lower real yields.

The reality is that these misplaced expectations are eventually walked back, as market forces and the economic data largely prevent the Fed from enacting more conventional tightening regimes, let alone a severe outlier period like 1994. From our perspective, it would behoove Lacker to follow the median trend of the Fed's own dot-plot projections, that despite moving in the right direction over the past year, still have considerable room to fall in line with more realistic expectations within the long-term yield cycle.As we've described in previous notes, this expectation gap ties directly into the performance of the US dollar that peaked with the Fed's dot-plot projections last year, and which we strongly suspect will again be hit on the downside with the realization that this isn't Kansas – or 1994 anymore.