-- Published: Friday, 7 October 2016 | Print | Disqus

Sterling gold surged 5% in less than a minute overnight in Asia with prices rising from £994/oz to £1,043.40/oz as sterling had a massive “flash crash.” Sterling plummeted in the second biggest fall in its history – only slightly less than the collapse after the Brexit vote.

Despite gold’s peculiar, sharp fall in dollar terms on Tuesday and 4.1% loss for the week, sterling gold is another 1.7% higher this week – from £1,010/oz to £1,027/oz – again showing gold’s importance in hedging against currency devaluation.

Gold in Sterling – 24 Hours

The latest sterling crash heightened concerns about the vulnerability of the British pound due both to “Hard Brexit” concerns and the outlook for the debt laden UK economy.

The pound collapsed about 10 percent from levels around $1.2600 to $1.1378 “in a matter of seconds” according to Reuters. The pound recovered most of the falls and most analysts said it was due either to a “fat finger” trade or more likely the automated algorithmic computer trades that now dominate the increasingly casino like, global foreign exchange market.

Thomson Reuters, which owns the Reuters foreign exchange brokerage platform RTSL, said a particular trade had been canceled and that the low for sterling was revised to $1.1491 – still a near 10% fall versus the dollar and the weakest level for sterling since 1985.

Gold in Sterling – 1 Week

The fall coincided with comments by François Hollande reported by the Financial Times that European leaders should take a “firm” negotiating stance with the UK on Brexit.

The pound’s pounding added to pressure on UK government gilts, pushing 10-year bond yields 10 basis points higher to 0.978 percent, their highest since the days after Britain voted to leave the European Union on June 23. UK 10 year gilts have been sold off aggressively this week with the yield rising from 0.733% to 0.978% at 0935 British Standard Time (BST) this morning. 10 Year gilts have risen from 0.518% to near 1% today.

UK Govt Bonds 10 Year Note Yield (Bloomberg)

UK Govt Bonds 10 Year Note Yield (Bloomberg)

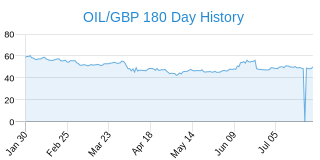

Oil in sterling terms has surged in recent months and is up nearly 50% in just six months – from £27.70 per barrel to over £40 per barrel today. Inflation is set to surge in the coming months. Consumer inflation has remained low but the price of food, energy and other goods is likely to surge in the coming months. The plummeting pound will put upward pressure on the consumer price index (CPI) in medium term as producers face higher input costs. Already import prices in the UK are rising sharply as raw materials become more expensive.

Import prices were 7% higher in September than in August 2015 – due to the tumble in the pound following the Brexit vote.

Market participants discounted the possibility that the massive sell off was due to a very large institutional seller – hedge fund, bank, sovereign wealth fund or central bank – placing one massive sell trade. In an age of financial warfare, currency wars and very elevated geo-political tension between western powers and China and particularly Russia, this is a possibility. Indeed, James Rickards, author of ‘Currency Wars’ and the ‘The New Case for Gold’ warned “British Readers” of Bill Bonner’s Daily Reckoning in an email just yesterday of “a 350,000-Point Shock To The Currency Markets:”

British reader, you are uniquely positioned to potentially profit from what could be one of the biggest shocks to the currency markets we’ve seen since Brexit…

It’s a move that could – if it plays out as I expect – be as huge as 350,000-points.

That’s not a mistake or a typo… we’re looking here at a fundamental change… an audacious attack… the likes of which we haven’t seen since the height of the cold war in the 60s.

Gold dealers in the UK have reported a surge in account openings and a sharp increase in gold sales. We saw quite a sharp increase in demand after the price fall in Tuesday and that has continued this week. Investors see value in gold at these lower levels and this latest spike in sales is due to concerns about Deutsche Bank and other European banks and the outlook for sterling and the UK economy due to the increased possibility of a “Hard Brexit’.

Over the long term, gold has performed well for UK buyers and protected them from the risks manifest in recent years. Over 10 years, gold in GBP terms is up more than threefold or by 222% from £317/oz to £1,023/oz. An average annual performance of over 13% per annum.

Sterling silver is now 50% higher year to date – from £9.39/oz to £14.03/oz – and acting as a near perfect hedge against the rise in oil prices.

Sterling gold is now 43% higher year to date – from £716/oz to £1,026/oz – and protecting UK investors and savers from the devaluation of sterling – see Sterling Gold Rises 1.3% as Sterling Slumps On ‘Hard Brexit’ Concerns, Up 36% YTD

Inflation is beginning to raise its ugly head, while economic growth remains weak. There is a whiff of stagflation in the air …

Gold and Silver Bullion – News and Commentary

Sterling recoups some losses after near 10 percent plunge; stocks slip (Reuters)

Gold heads for 4% fall for week in USD, flat in GBP (Reuters)

Goldman Sees ‘Buying Opportunity’ If Gold’s Slump Gets Worse (Bloomberg)

Physical gold demand will limit price decline: Goldman Sachs (CNBC)

Gold price dip to spur physical buying – WGC (Bulliondesk)

Gold Price Drop Likely To Spur Demand – WGC (Gold.org)

Major Victory For Gold And Silver Traders, Manipulation Lawsuit Against Gold-Fixing Banks Ordered To Proceed (Zerohedge)

Central banks suppress gold to help China accumulate – Rickards (Daily Reckoning)

Former Soros Associate Says Fed Responsible For Gold & Silver Smash (King World News)

Gold and Silver Smash Down (Future Money Trends)

Gold Prices (LBMA AM)

07Oct: USD 1,255.00, GBP 1,012.91 & EUR 1,127.62 per ounce

06Oct: USD 1,265.50, GBP 994.30 & EUR 1,131.23 per ounce

05Oct: USD 1,274.00, GBP 1,001.11 & EUR 1,134.37 per ounce

04Oct: USD 1,309.15, GBP 1,026.90 & EUR 1,172.21 per ounce

03Oct: USD 1,318.65, GBP 1,023.40 & EUR 1,173.99 per ounce

30Sep: USD 1,327.90, GBP 1,025.01 & EUR 1,187.67 per ounce

29Sep: USD 1,320.85, GBP 1,016.92 & EUR 1,177.14 per ounce

Silver Prices (LBMA)

07Oct: USD 17.33, GBP 14.01 & EUR 15.55 per ounce

06Oct: USD 17.76, GBP 13.98 & EUR 15.88 per ounce

05Oct: USD 17.80, GBP 13.99 & EUR 15.86 per ounce

04Oct: USD 18.74, GBP 14.68 & EUR 16.78 per ounce

03Oct: USD 19.18, GBP 14.89 & EUR 17.07 per ounce

30Sep: USD 19.35, GBP 14.92 & EUR 17.33 per ounce

29Sep: USD 19.01, GBP 14.61 & EUR 16.95 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Friday, 7 October 2016 | E-Mail | Print | Source: GoldSeek.com