-- Published: Tuesday, 11 October 2016 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The news that flows from the Mainstream media continues to delude Americans from understanding the reality and disaster that is heading our way. A perfect example of this took place last week when a small oil company announced a new huge oil discovery in Alaska.

The headlines stated that Caelus Energy LLC found between 6-10 billion barrels of oil on the North Slope of Alaska. I imagine this new oil discovery did wonders in reviving the “hope” that the U.S. will still become energy independent.

However, rapidly falling oil production, due to high shale oil well decline rates, is putting a real kibosh on U.S. energy independence. U.S. oil production is already down one million barrels per day since its peak last year. Nevertheless, individuals who still believe that peak oil is rubbish are clinging to this new Alaska oil discovery as proof that technology will solve all our problems.

Unfortunately, common sense and logic will destroy this delusion once again. According to Forbes article, Alaska’s 10 Billion Oil Discovery: What You Need To Know, provides a few noteworthy points:

This oil will be significantly more challenging to access than the oil in recently discovered fields in Texas but less challenging to access than the oil in Shell’s recently abandoned project in Alaska’s Chukchi Sea in the Arctic.

….. The project would also include a new 150 mile pipeline to connect Smith Bay with the Trans-Alaskan Pipeline System in Prudhoe Bay. Even though Alaska’s pipeline regulations are considerably more friendly to energy companies than elsewhere in the U.S., it could still take between five and ten years before any oil is produced. And when it comes to opposition to pipelines and Arctic drilling, all possible delays are on the table.

The two important “Factors” to focus on here is the fact that this new oil discovery in Alaska will be “more challenging” to produce than new oil in Texas and that a new 150 mile oil pipeline would likely keep production from starting for 5-10 years.

The article stated that the production challenges and costs would be less than Shell’s now abandoned project in the Arctic Ocean. From what I have read, Shell would need something close to $120 or higher to make producing oil in the Arctic feasible. Well, with the current oil price less than half of that figure, producing oil in the Arctic is more a fantasy than reality.

Furthermore, the article also implied that Caelus Energy LLC production cost would likely be higher than producing this new oil in Texas. According to analysis by Art Berman, producing oil in the Permian field in Texas still loses money at $55-$60. Which means, to be profitable drilling oil in this “supposed’ new oil field in Alaska will need a price closer to $80-$100 a barrel.

This is the problem the Mainstream media and energy companies fail to consider. It doesn’t matter how much liquid oil is in the ground, if the cost is too high to extract it. Moreover, the rapidly falling EROI – Energy Returned On Investment is gutting the entire U.S. energy industry.

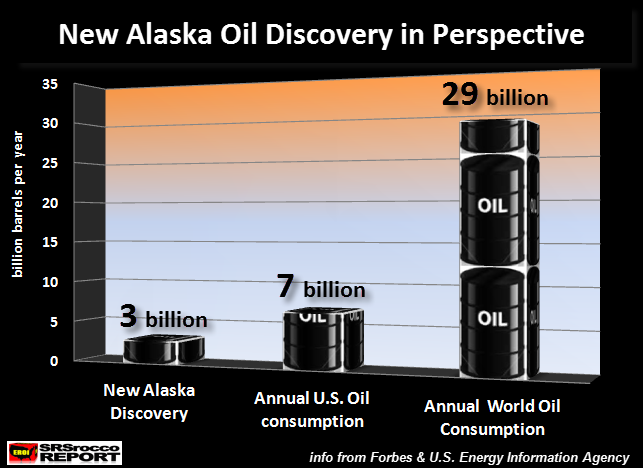

Regardless, the amount of oil the company claims they can ultimately recover in their new Alaskan discovery is about three billion barrels. While this may sound like a lot of oil, it’s peanuts when we compare it to total U.S. and world oil consumption:

If Caelus Energy LLC is actually able to extract the three billion barrels of oil in their Alaskan North Slope Smith Bay Field, it turns out to be less than half a year of U.S. oil consumption and about a month and half worth of annual global oil consumption.

So, even if this oil is extracted, it’s very little in the whole scheme of things.

Considering the higher challenges and cost to produce this Smith Bay Field oil, I doubt much if any of this oil will make it to market. Furthermore, the disintegration of the financial banking system continues in earnest as Deutsche Bank hemorrhages under the weight of massive derivative leverage.

I discussed this during my interview with James Howard Kunstler. You can assess my interview here at, KunslterCast 281- Chatting With Steve St. Angelo About Energy & Finance.

It was a pleasure chatting with James as I have been following his work for years. I first heard him in an interview with Art Bell on Coast-to-Coast-Am back in 2005. James has an excellent way in describing American’s “Delusions” and “Wishful thinking” in response to facing the negative ramifications of collapsing U.S. oil production.

While this new supposed Alaskan oil field discovery offers Americans hope that we will be able to continue business as usual, at most, it will only do so for six months. It seems as if hope is running a bit short on time nowadays.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Tuesday, 11 October 2016 | E-Mail | Print | Source: GoldSeek.com