-- Published: Tuesday, 25 October 2016 | Print | Disqus

By Frank Holmes

Last week I presented at the MoneyShow in Dallas, where sentiment toward gold was a bit muted compared to other recent conferences I’ve attended. The yellow metal has certainly taken a breather following its phenomenal first half of the year, but the drivers are still firmly in place for another rally: low to negative government bond yields; economic and geopolitical uncertainty; and a lack of faith in global monetary policy.

I want to thank my friend Kim Githler for hosting the MoneyShow. Every year since she founded the event in 1981, she’s captivated audiences with her intelligence, sharp wit and honesty.

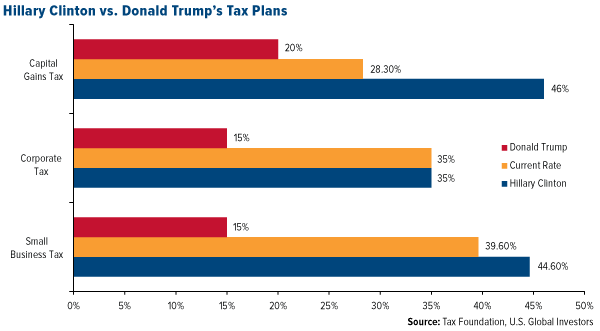

One of the highlights of the event was listening to American economist Art Laffer, whose “Laffer curve” shows that the government can actually bring in more revenue if tax rates are kept low. Art’s theory was used as the basis for President Ronald Reagan’s free-trade, low-tax policies. Later, Art actually supported Bill Clinton because he was willing to streamline taxes and regulations.

The same cannot, I’m afraid, be said of his wife Hillary, who plans to raise taxes at nearly every level.

click to enlarge

Although bad for your pocketbook and savings, the possibility of higher taxes is expected to increase interest in tax-free municipal bonds, especially among top earners. For over a year now, muni bond funds have seen positive weekly inflows, with $147 million going in during the week ended October 17. I expect this trend to continue as we head closer to the election, and beyond.

The Republicans at the event, meanwhile, were almost unanimously disappointed in their candidate Donald Trump. Many of the grievances had to do with his inability to stay on message. If he would simply stick to key issues such as public safety, immigration and minimizing taxes and regulations, he might have a clear shot at the presidency. Instead, he too easily walks into personal traps set by the media and the Clinton campaign.

Where’s the Retail Spending?

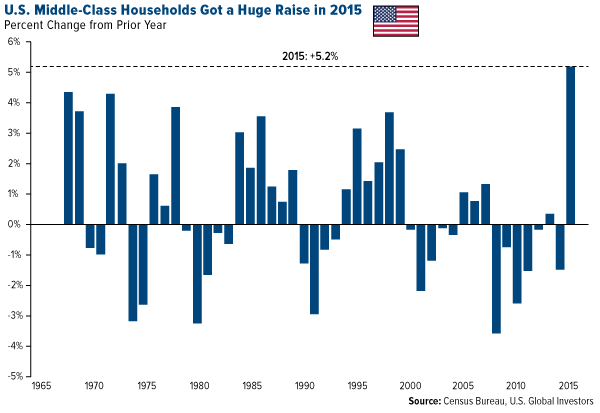

Maybe you haven’t heard yet, but you got a raise in 2015 without even realizing it. At least, that’s what the Census Bureau revealed last month. U.S. household income rose 5.2 percent, the fastest on record.

click to enlarge

This falls in line with other recent news that appears to show that the U.S. economy is humming once again, nearly a decade after the 2007-2008 financial crisis.

With unemployment at 5 percent, initial jobless claims fell to a four-decade low this month, while the labor-force participation rate—the share of working-age Americans who are working or actively seeking work—has finally begun to perk up. Also improving is the voluntary quits rate, which indicates workers now have enough confidence in the labor market to walk away from their current jobs and quickly find new ones.

As encouraging as this all is, I have to look at the consumer discretionary sector and wonder why we’re not seeing healthier consumption. (This is important, as spending accounts for roughly two-thirds of gross domestic product.) If more Americans have better-paying jobs, as the data seem to indicate, and they’re feeling good about parting with their money, why aren’t retail sales surging?

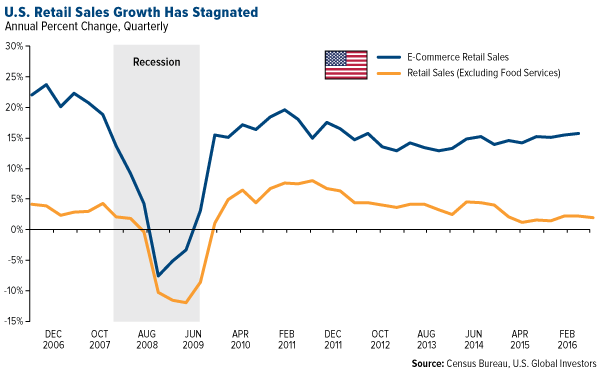

Instead, sales growth, excluding food services, has steadily been weakening. E-commerce sales growth looks strong, but the entire industry can’t be propped up by Amazon alone.

click to enlarge

Confirming this is Bank of America Merrill Lynch’s latest report on debit and credit card spending, which showed a “substantial slowdown” in retail sales, ex-autos, in September, according to Zero Hedge.

Despite the release of the iPhone 7 in September, BofAML didn’t see “a spike in electronic store sales akin to prior releases of Apple devices. It may be a reflection of the iPhone 7 or perhaps the trend in electronic store sales ex-iPhone is sluggish.”

The bank raises a couple of good points here. Apple’s latest smartphone was met with criticism stemming from its lack of a headphone jack, which might have dissuaded some consumers from upgrading.

And as many others have pointed out, it’s possible we’ve finally reached “iPhone fatigue.” Most everyone now owns a satisfactory smartphone—so long as it doesn’t explode—so consumers could simply be holding out for the next must-have gadget. Maybe they’ll find it in Facebook’s virtual reality Oculus Rift headset, but with its price tag still hovering above $800, it might take some time before consumers feel comfortable enough to buy it.

Automobiles and Housing Affected, Too

This goes far beyond smartphones. Big-ticket items such as automobiles and homes are also seeing sluggish, or even negative, growth. The S&P Global Ratings recently cut its automobile sales estimate for the year to 17.5 million from 17.8 million.

Facing inventory build-up, Ford Motor announced it would temporarily halt production at four of its factories both here in the U.S. and Mexico, Bloomberg reports. One of these factories, in Kansas City, builds the bestselling F-150 pickup.

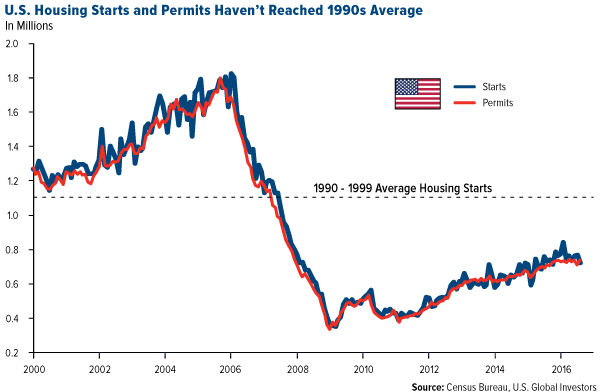

Meanwhile, the momentum of new housing starts and permits has also slowed, with starts falling in September for the second straight month. Despite improvement since the housing bubble, we still aren’t close to where we were pre-recession, let alone the 1990s average.

click to enlarge

The Slowest Recovery Since the Great Depression

Household income is up, unemployment is down—and yet sales are stagnant. It’s a paradox.

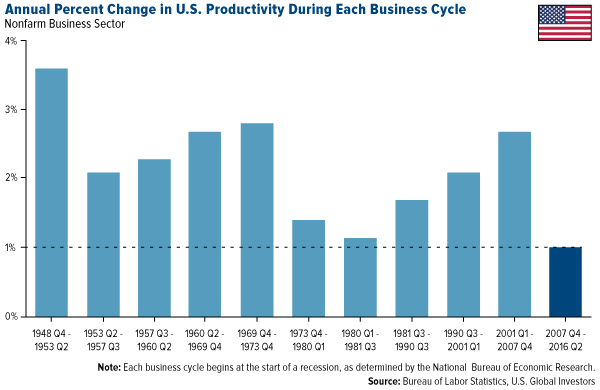

A paradox, that is, until we examine another economic indicator: labor productivity.

In simple terms, productivity means labor efficiency—producing more goods and services without working longer hours. And when productivity rises, it increases our standards of living.

Since the end of World War II, productivity rose pretty steadily. But growth has been near-anemic for close to a decade now and is currently running lower than it’s ever been.

Consider the following chart. Each bar represents a new business cycle following a recession. Crawling along at 1 percent annually, today’s productivity growth is weaker than the previous 10 cycles. In the September quarter, it actually fell 0.6 percent.

click to enlarge

The big question is: Why is this happening?

The answer depends on who or which economist you ask.

Possible factors that have been tossed around include the aging of the workforce, the strong dollar (which reduces the competitiveness of U.S. companies) and a slowdown in capital spending by businesses since the recession.

One of the leading theories, presented by economist Robert J. Gordon in his recent book “The Rise and Fall of American Growth,” argues that 19th and 20th-century innovations—air conditioning, indoor plumbing, the microwave, the automobile—were much more impactful on workers’ productivity than modern inventions such as the internet, cloud computing and smartphone apps. (Indeed, we’d probably all agree that these things often waste, instead of enhance, our time and energy.)

$740 Billion in New Compliance Costs

We can add to the list the growing mountain of regulations, a topic I’ve discussed many times before. According to the American Action Forum, there’s been, on average, one costly regulation—or “hidden” tax—implemented every day of the Obama administration. This has added about $740 billion and 194 million paperwork hours to the burden. Although designed with good intentions, these regulations, and the compliance costs associated with them, often stand in the way of efficiency.

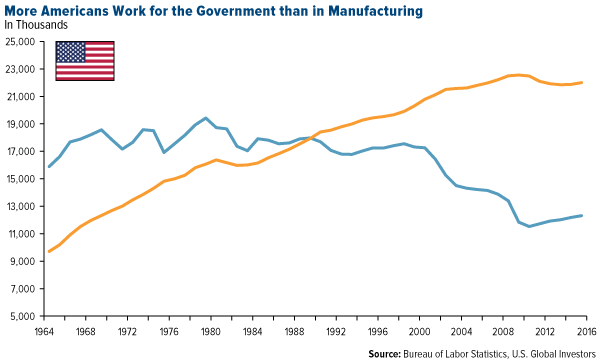

Also increasing are the number of government jobs, which aren’t exactly known to drive innovation. Although we’ve seen an uptick in new manufacturing positions during the last decade, jobs have over the long-run been on the decline.

click to enlarge

To get productivity back on track, and therefore consumer spending, the U.S. should strongly consider regulation reform.

http://www.usfunds.com/

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 6/30/2016: Ford Motor Co.

| Digg This Article

-- Published: Tuesday, 25 October 2016 | E-Mail | Print | Source: GoldSeek.com