There is critical information in the first 45 seconds of the Donald Trump campaign video below. Now the election is over, and this nonpartisan analysis is not about campaigns, politics or who should have been elected - but some absolutely fundamental changes that could be on the way.

https://www.youtube.com/watch?v=vST61W4bGm8

The video was Trump's closing argument for his election, and was released on November 6th.

I count seven times in the first 45 seconds where Trump appears to running against the Federal Reserve as much as he was running against Hillary Clinton. There are three clips of vast sums of money. There are two panning shots of Federal Reserve symbols. There are two shots of Janet Yellen, with one of those being of her with other international central bankers.

Now, as long time readers may have noticed, I generally keep politics out of my writings, and haven't been saying anything about the election. While I have strong opinions, I don't see my role as being a political editorialist, we've all been surrounded by enough of that 24/7 throughout this election cycle.

But, helping people understand this strange new financial world of ours is my goal. And whether you are Republican, Democratic, independent, or have never even been to the United States, a soon-to-be new president quite explicitly identifying the Federal Reserve as a major source of the problems facing the United States could have extraordinary financial and monetary implications for all of us, around the world.

Artificial Stability & Its Price

As I have been writing about for some years now, our current very low yield markets are based upon record-setting levels of central banking interventions. Withdraw the interventions - and the apparent stability is subject to almost instant collapse (whether that would be a good or bad thing is another matter).

I won't repeat it, but a much more extensive analysis of the dilemma faced by the government when it comes to stability - and the very high price for investors and savers - is linked here.

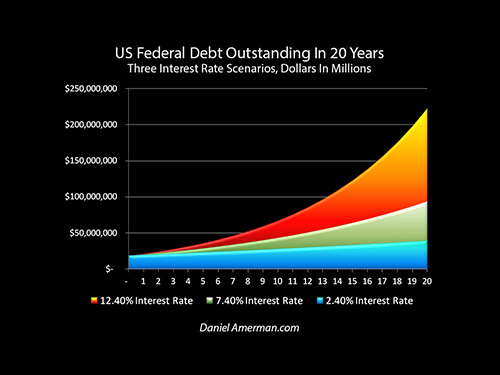

There is also the issue that if the Federal Reserve loses control and interest rates return to more historically normal levels, this would lead to an extraordinary increase in annual deficits that would send the national debt soaring upwards and out of control (absent major tax increases). But if rates don't rise, then saver wealth could decrease by as much as 95% compared to historical norms, which creates an extraordinary conflict of interest between the government and savers, as analyzed here.

All It Takes Is One Election

There is another point that I have been making repeatedly in recent years, which is that while central banks can seem almost all-powerful for years at a time as they force stability and low yields onto markets - they are defenseless against one kind of risk. That risk is politics in general - and elections risk in particular.

As analyzed here in 2015, elections are an existential risk to both the Euro and the European Central Bank - because election risks could collapse the stability of the system at any time. As I wrote at the time:

"What is worth remembering is that politics is the "dog" and central banks and financial institutions are the "tail". Now for periods of time it may indeed appear that the tail is wagging the dog.

But, ultimately it's always the dog that wags the tail, and it is the central banks and banking systems who exist at the sufferance of whomever holds the raw political power.

Anyone who loses track of the underlying basics of the situation may find themselves facing the biggest financial surprise of their lifetimes, and perhaps much sooner than they expect."

On November 8th, 2016, a large dog in the United States did stand up and give itself a good shake, much like another large dog did in Great Britain earlier this year, as analyzed here. And the financial surprises could still just be getting started in each case on a global basis, particularly when the two are taken together and in combination with future elections in Europe.

Did Trump Mean What He Said?

Another factor that I think everyone can agree on is that the Donald takes things - personally. He seems to believe in striking back - personally. And he has made clear that he holds Janet Yellen personally responsible for using the Fed's very low interest rate policies to try to deny him the election, as one of the ways in which he said the election was rigged against him.

Keeping all those factors in mind, it is well worth going back and playing the first 45 seconds of the Trump campaign ad again, and perhaps several times. In Trump's closing argument - in what is in his mind the very center of his pitch to get elected - which person (aside from Hillary Clinton) and what institution are responsible for causing millions of people to suffer in America and must (implicitly) be dealt with in order to "Make America Great Again"?

Now, running on promises, and doing something quite differently after being elected is the political norm, so Trump won't necessarily attempt anything.

Indeed, that seems to be the current discussion among the media and the groups in power that are still trying to come to grips with what was for them the shocking results of the election. They were dead wrong in their "expert" consensus that Trump could never win the nomination. They were dead wrong in their reflection chamber consensus among themselves, even as of the very evening of the election, that Trump could never actually win the election. Until he did.

And now a new sort of consensus seems to be trying to coalesce around the idea that Trump either can't or won't do what he said he was going to do. The message is being tried out that there are too many limits in terms of laws and institutions, and the need for Congress to participate.

And maybe that will turn out to be true. Maybe Trump will spend his attention and political power on Obamacare and immigration changes, and Yellen will quietly serve out her term until February of 2018. Maybe Trump talked big in general, but he ends up being consumed by the realities of the system, and is able to make only incremental changes.

With the Republican establishment having lost the primaries, and the Democratic establishment having lost the general election, many of those on the inside are very hopeful that this will turn out to be the case.

But there is another alternative, and that is that Trump genuinely did mean exactly what he said. It could be that when the President-elect looks at himself in the mirror in the morning, he does see himself as an agent of decisive change. Which means that it is possible that he has every intention of using the full powers of the Presidency to bring about decisive changes in general - and changes at the Fed and monetary policy in particular.

If that is what works out to be true, then there are three dots to be connected, and possibly very soon.

1. Since the financial crisis of 2008, we have lived in a financial and economic world that is quite different from what came before. Prices and yields in all major investment categories - stocks, bonds, precious metals and real estate - are all dominated by central banking and governmental interventions.

2. Even as I have tried to educate people on how these markets work in ways that are very different from traditional markets, I have also been pointing out that there is a central vulnerability of this artificial stability - a vulnerability that the central banks and markets refuse to even take into consideration. The Fed and other central banks aren't actually the source of power, and they can lose their power at any time as the result of elections.

3.There was an election, and if the new president actually meant what he said and does intend to act as a decisive agent of change - then every aspect of money and investments is in play on the most fundamental of levels. They are subject to change in ways that may have little to do with the paths of the last eight years, and may indeed turn upside the assumptions that have been driving prices and yields. This is true of stocks, bonds, mortgages, index funds, retirement accounts, savings and everything else.

If Trump does do anything, he may be very, very careful about how he does it. Trump does know about debt and interest rates. He likely knows full well the potential carnage if the domestic - or international - markets decide the Fed may no longer have their back. And he has explicitly stated that nations as deeply in debt as the United States need to have low interest rates.

But then again, he may not need to do anything. All that has to happen is for enough major investors to think that he may do something, and that gets them spooked, and consequences occur.

So what happens next?

I don't know. I've been thinking about that a lot as I digest the election results. I'll be thinking about it a lot more over the weeks to come and will have more to share.

But, I wanted you to have this information and to have it today. The monetary and investment world as we have known it over the last eight years may now be very much in play, and the old assumptions may not work for much longer. And if and when things start to work in an entirely different way - that change could happen very quickly, with little or no notice.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

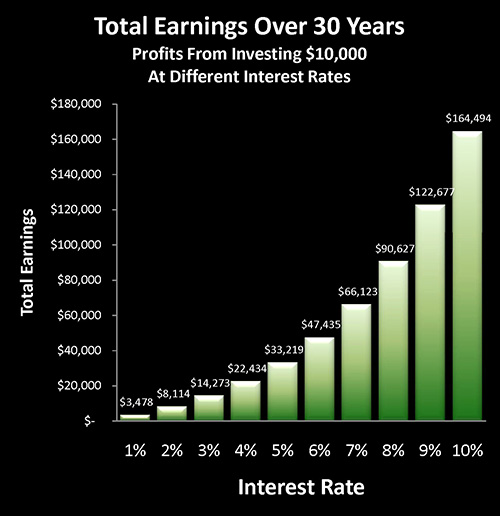

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day. A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

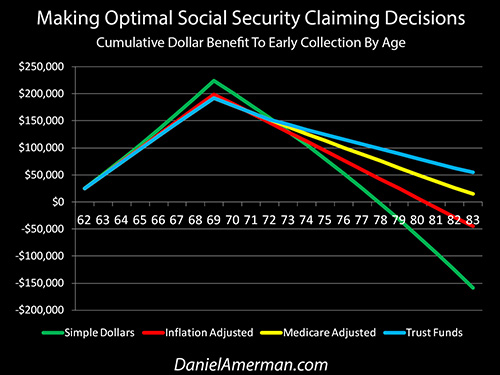

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.