TRUMP MAY HAVE "PRICKED" THE GLOBAL BOND BUBBLE

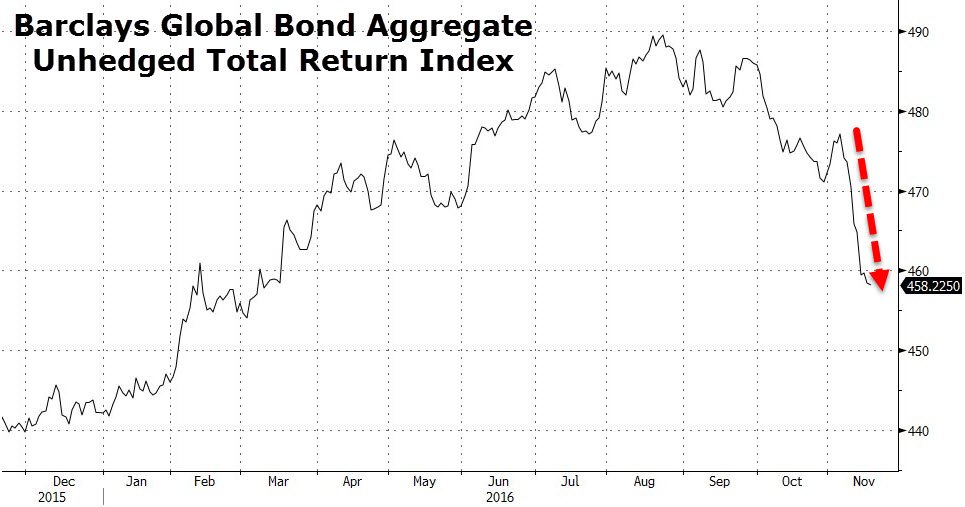

Trump called during the campaign for a $1 trillion infrastructure package, $5 trillion in tax cuts, increases in military spending and the repeal ObamaCare, which could cost more than $350 billion over 10 years. At the same time, the president-elect has promised “not to touch” Social Security or make cuts to Medicare. The moment Trump was elected the markets immediately reacted to this potential massive fiscal injection. Bond values plummeted as yields spiked.

Over $1T in global leveraged capital evaporated almost instantaneously.

TRUMP'S THREAT OF PROTECTIONISM & POTENTIAL RETALIATORY TARIFFS

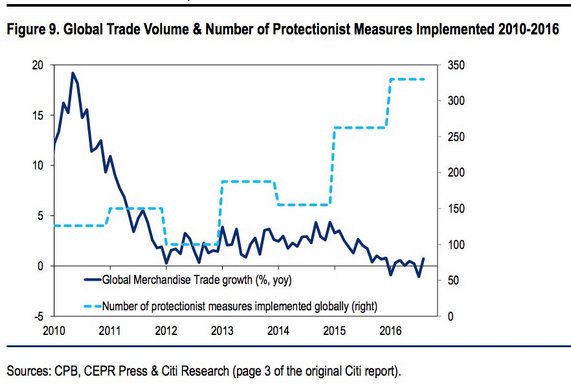

Less precise than the inflation expectations being "baked in"was the pricing in of a potentially slower global economy due to Trump's threat to renegotiate existing US trade agreements. His campaign rhetoric signals the likelihood of protectionism, tariffs and trade wars. None of this is particularly encouraging for growth projections especially with already slowing global trade volumes and for further increasing protectionist measures on-top of those already implemented.

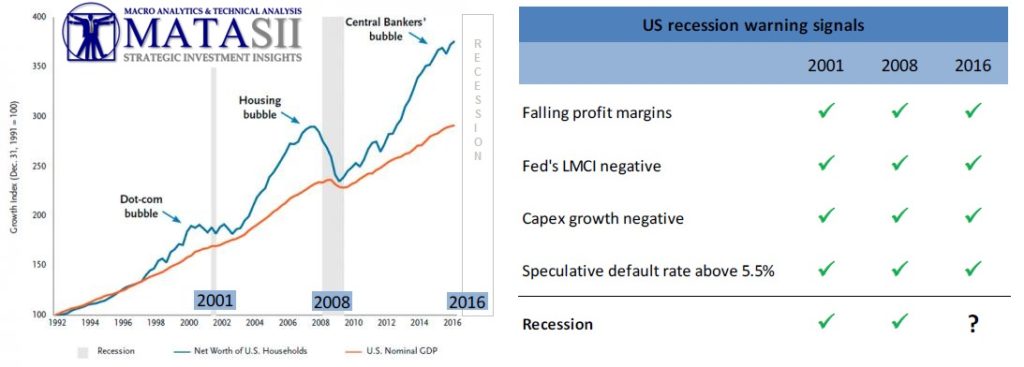

BRINK OF RECESSION

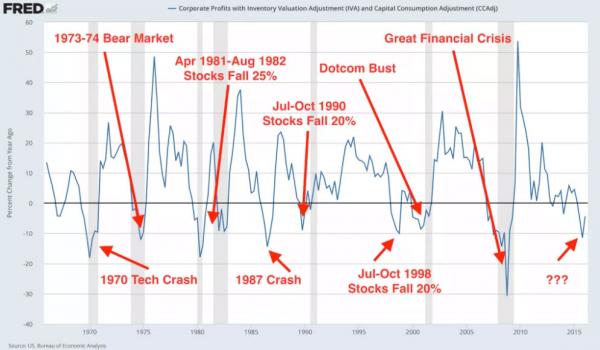

Trump's "pro-growth" policies may play well to the electorate and to future economic expectations, but in the short term the realities are such that they he may very well have pushed the US over the brink of a potential pending US Recession!

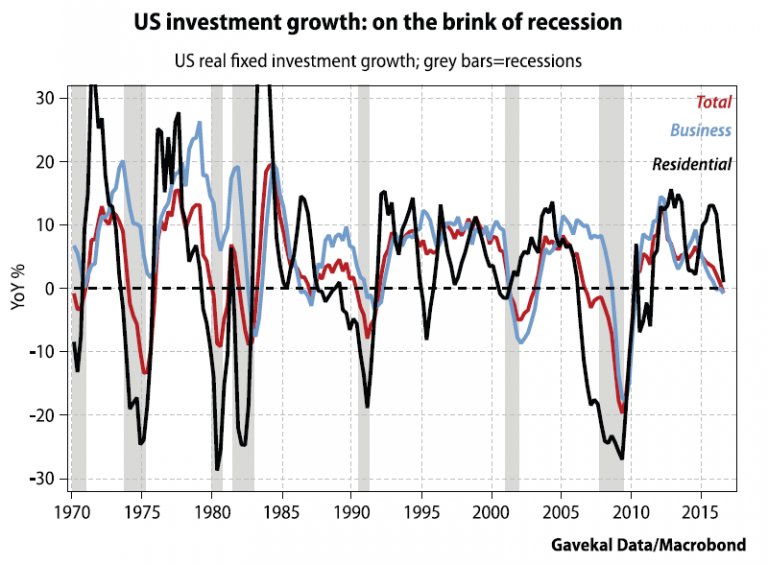

US INVESTMENT GROWTH APPEARS NOW AT THE TIPPING POINT

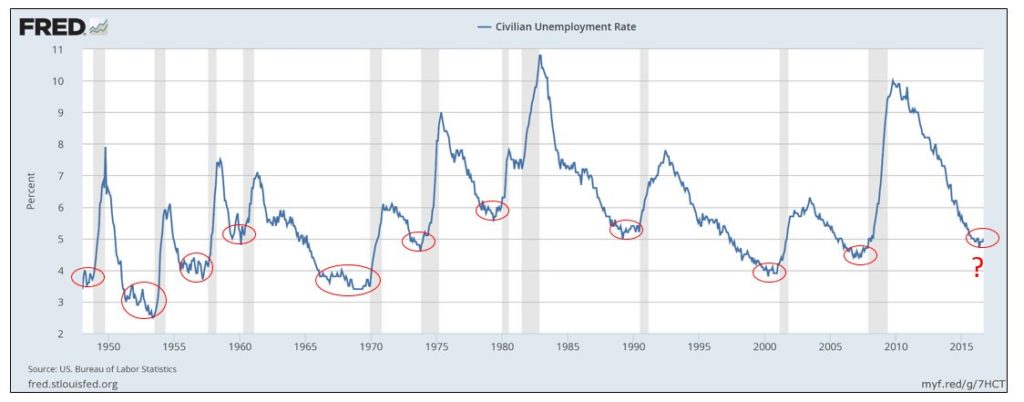

THIS LEVEL OF CIVILIAN EMPLOYMENT RATE HAS ALWAYS BEEN A PRECURSOR TO A RECESSION

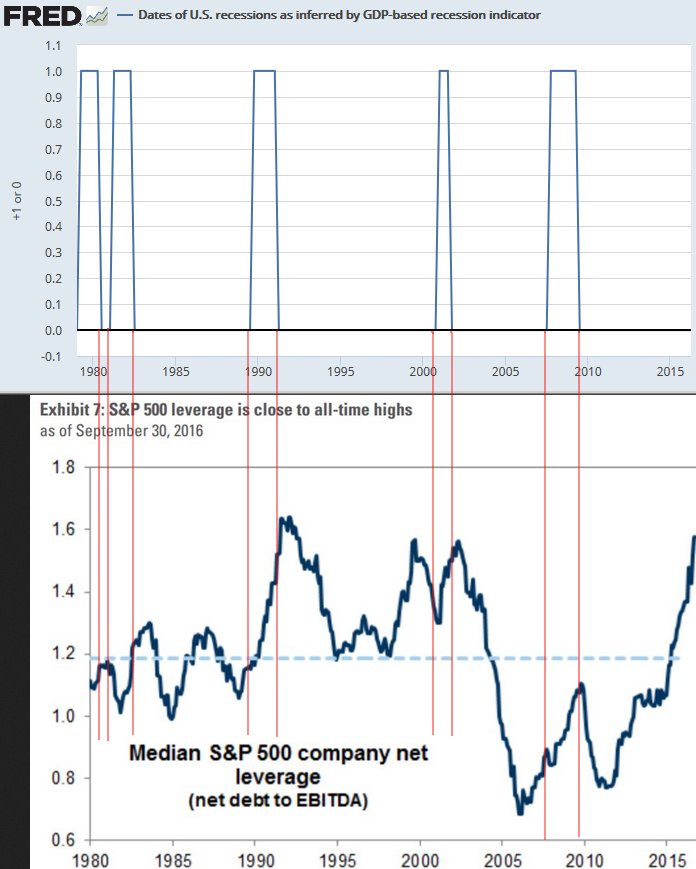

LEVERAGE CORRELATION TELLS THE STORY

WE ARE DUE FOR A CYCLICAL US RECESSION

What could be different with this recession?

- First, it is going to be truly global – essentially all Emerging Markets would experience a recession (for them it would be far worse than 1998 though).

- Second, the Developed World Central banks are out of traditional ammunition (zero to negative rates everywhere).

- Third, the debt levels and excess leverage in use today are unprecedented within the public sector, corporate private sector and overall households,

The list goes on!

Expect it to get ugly in 2017 after the election honeymoon wears off (and that honeymoon already seems pretty rocky)!

https://matasii.com/