-- Published: Thursday, 8 December 2016 | Print | Disqus

By John Mauldin

When Charles Gave, paterfamilias of Gavekal, chooses to express displeasure over an economic trend, an asset class, or what have you, he does not exactly mince words. If you happen to be in the room when he does so, he can sound like the Voice of God Himself, declaring from on high. And with his longish flowing white hair, he actually looks like central casting setting over to play the part.

Today Charles is exercised about Italy. He first reminds us that when Italy adopted the euro in 1999, he had argued that Italy would change from being an economy with a high probability of many currency devaluations to one with the certain probability of eventual bankruptcy. Now, he says, the fateful moment is not far off.

He gives us a couple of before-and-after charts: before March 1999 and from March 1999 to the present, in which he compares Italian and German industrial production and the performance of their respective stock markets. He notes that from 1979 to 1998, Italian industrial production outpaced Germany’s by more than 10%, and Italian equities outperformed German equivalents by 16%. That’s after taking into account the devaluations. Northern Italy is actually a production powerhouse, or was…

Then came the euro. Since 1999 Italian stocks have underperformed German stock by 65%, and since 2003 Italian factory output has lagged Germany’s by 40%. Thus, summarizes Charles, in this short essay,

The diagnosis is simply that Italy has become woefully uncompetitive, and as a result, is not solvent. This much is clear from the perilous state of its banking system, which is always the outcome when banks lend to firms that have been rendered uncompetitive by some reckless central banker….

This has to be the most well-telegraphed, and now inevitable, national bankruptcy that I have seen in my 45-year career.

Which is exactly what I have been saying for years in my books and Thoughts from the Frontline. It is getting ready to happen, and when it does it will affect all of Europe and then the entire world.

The timing for all such things is difficult. It is possible that the Germans blink and the ECB allows Italy one more opportunity to kick the can down the road – and drive up their debt-to-GDP to well over 150% at the same time. From the point of view of the bureaucrats in power, putting the problem off for another few years is a good thing because maybe they won’t be around at that point and somebody else can deal with it and take the blame.

Winter finally decided to show up in Dallas. It will actually get below freezing either tonight or tomorrow night. And I will be flying into winter weather in DC and New York this weekend. I am doing something that for me is extremely unusual. I really hate early mornings and especially hate to get on early flights. But I have to be in DC, so I am taking a 6 AM flight Friday morning. I have so many friends (like Dennis Gartman or Olivier Garret) who can sit down in a plane seat and immediately go to sleep. It doesn’t work that way for me, no matter how often I try.

But a last-minute opportunity came up to spend some time with Dr. Woody Brock on Thursday night at a small gathering, and that is something I just simply can’t pass up. There is too much to talk about, and I have so many questions. Woody may be wrong from time to time, but he is seldom in doubt. And the rest of the table, which is one of those I can’t talk about, is pretty impressive, too. I get invited from time to time to provide comic relief.

Then I will see other good friends flying in from around the country for a quiet, fun dinner and conversations along the lines of what the heck do you do with assets in markets like these? That will also be a topic for this weekend’s letter. Until then, you have a great week, and I will be writing from DC.

Your wondering how bad Italy will get analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Putting the Boot into Italy

By Charles Gave

December 6, 2016

Matteo Renzi has joined a long line of Italian prime ministers who failed to “reform” their country. This is another way of saying that he could not wave a magic wand and make Italy competitive with Germany. The grim reality is that no Italian leader stood a chance of changing their country once the fateful decision was made to peg its currency to Germany’s. At the time of the euro’s launch in 1999, I argued that the risk profile of Italy would change from being an economy where there was a high probability of many currency devaluations to the certain probability of eventual bankruptcy. Sadly, that moment is not so far away.

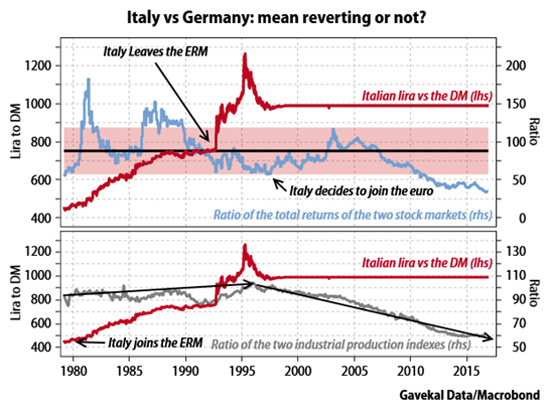

The chart below tells the story of Italy’s recent economic history in two parts, namely, (i) March 1979 to March 1999, and (ii) March 1999 to the present. Italy joined the Exchange Rate Mechanism in 1979 at 443 lira per deutschemark, yet by 1990 frequent devaluations meant that rate had slid to about 750 lira. By the early 1990s, the Bundesbank was overseeing a newly unified German monetary system and in order to fight inflation it had driven real interest rates to 7%. By September 1992 the stresses on the system caused the UK, Sweden and Italy to exit the ERM, which meant another huge currency devaluation, pushing the lira as low as 1250 against the deutschemark, but delivering a huge tourist boom to boot.

Still, from 1979 to 1998 Italian industrial production outpaced that of Germany by more than 10%, while Italian equities outperformed German equivalents by 16% (this indicates that Italian firms were earning a higher return on invested capital than those in Germany).

Then came the euro. By 2003 it was clear that Italy was uncompetitive and subsequently, Italian equities have underperformed German equities by -65%, reversing the previous half century’s pattern when Italian equities outperformed on a total return basis. Similarly, since 2003 Italian factory output has lagged Germany’s by 40%.

The diagnosis is simply that Italy has become woefully uncompetitive, and as a result, is not solvent. This much is clear from the perilous state of its banking system, which is always the outcome when banks lend to firms that have been rendered uncompetitive by some reckless central banker. Short of imposing Greek-style slavery on Italy, there is not much hope of solving the problem, but I rather doubt that the Italian electorate will be as patient as its neighbours across the Ionian sea.

As such, the relationship between Italy and Germany is radically different from that in the 1945-99 era when a natural return toward equilibrium was achieved through exchange rates adjustments. The only possibility on the current trajectory is that the Italian and German economies keep diverging, which is why a “normal” resolution cannot be achieved.

Hence, an Italian sovereign default of some variety is now a near certainty. While a central bank can address a liquidity problem, it cannot fix a solvency issue, especially one as large as Italy’s. The only remedial action that can now be taken is to throw good money after bad, which is exactly what I expect Mario Draghi to do, especially as he played such a key facilitators’ role in getting Italy into the euro system in the first place. Such actions – possibly to be announced on Thursday at the European Central Bank’s policy setting meeting – can of course merely postpone the day of reckoning, but will solve absolutely nothing.

The rational approach for investors is to shun Italian financial assets such as bank equities or government bonds until such time as exchange rates are once again market determined prices. This has to be the most well-telegraphed, and now inevitable, national bankruptcy that I have seen in my 45-year career. There is no reason to be dragged under the steam roller as there are many other markets and assets to play in.

| Digg This Article

-- Published: Thursday, 8 December 2016 | E-Mail | Print | Source: GoldSeek.com