-- Published: Sunday, 11 December 2016 | Print | Disqus

By Michael J. Kosares

Market expectations could be based on false assumption

“Looking ahead, Credit Suisse argues against the view of many pundits that U.S. President-elect Donald Trump’s fiscal policies are likely to hurt gold. The market has factored in an expectation that a mix of U.S. tax cuts, deregulation and infrastructure spending will boost the economy, pushing up real interest rates and strengthening the U.S. dollar. ‘We counter that trade protectionism and anti-immigration policies are negative for growth and positive for inflation,' Credit Suisse said." – SMN News/Kitco

Since election day, the markets have reacted as if the Trump administration were likely to be a re-run of the Reagan years. "Stocks and the dollar," reported Bloomberg recently, "have risen since the Nov. 8 presidential election on hopes that Trump’s advocacy of big tax cuts, increased defense spending and deregulation will usher in another period of prosperity. The coming change will be a 'profound president-led ideological shift' akin to Reagan’s, according to Bridgewater Associates founder Ray Dalio. Trump’s advisers and the billionaire himself have embraced the comparison."

Though there are profound similarities between the two philosophically in terms of tax, defense and deregulation policy, the economic conditions Trump will face are the polar opposite of what Ronald Reagan faced in 1981. Investors, as a result, could be basing investment decisions on a false assumption.

When Reagan took office the United States was just coming off a disastrous encounter with runaway inflation. If inflation was going to be tamed, the interest rate would have to be pushed to a level higher than the inflation rate, something then-Fed Chairman Paul Volcker in fact accomplished. It killed inflation, restored dollar strength and touched off a long-term stock market rally.

This time around, the United States is coming off a brush with a disinflationary crisis that still threatens to tumble into full-scale deflation. Different medicine is required. In fact, there have already been rumblings that the Fed will be very careful to keep the interest rate under the inflation rate for the foreseeable future. The goal is to ignite inflation – an outcome that by definition would undermine the purchasing power of the dollar.

How the markets will perform under such circumstances remains to be seen, but already some analysts are predicting a return to a 1970s-style stagflation – an environment that produced a bear market in stocks and bonds and a bull market in precious metals, quite the opposite of what markets are signaling at this point in time. (The bond market, thus far, stands alone among primary investment markets as reacting according to the historical script.)

Two different worlds – Reagan’s and Trump’s – and the incongruity of market expectations when measured against the historical record is telling. Eventually the financial markets will come down from the present euphoria and begin to consider what the odds-on economic reality will look like for 2017 and thereafter. Credit Suisse may be on to something.

Click to enlarge

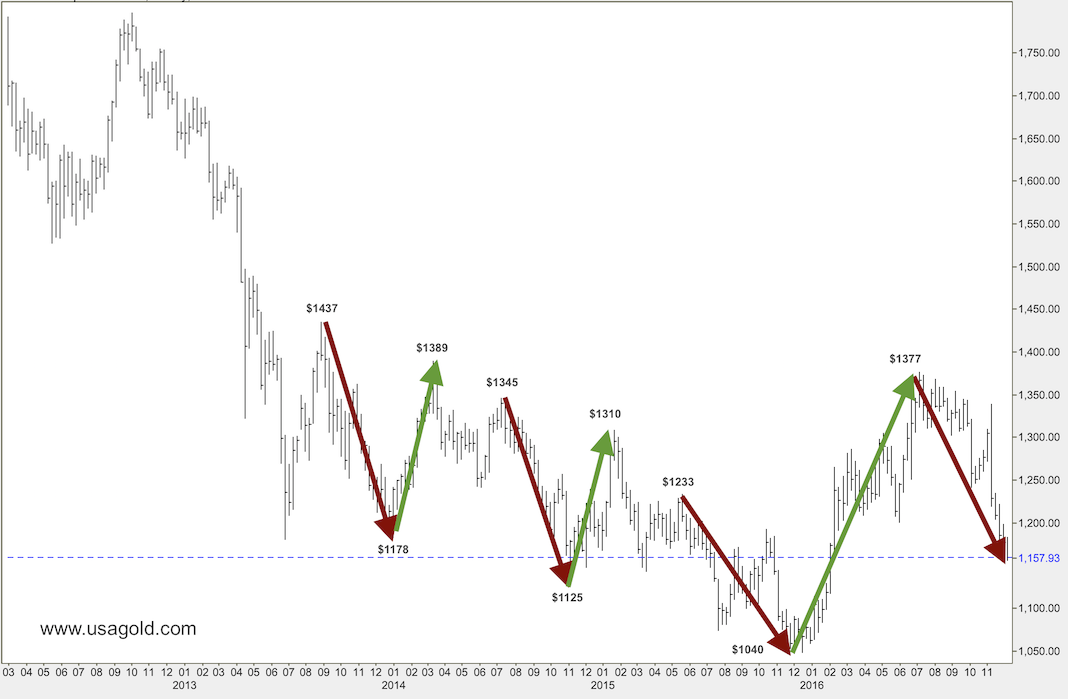

Since gold hit its post-2008 peak in 2011 and corrected, it has fallen into a pattern of declines in the second half of the year followed by recoveries during the first half of the succeeding year. The second half lows range from $1050/oz to $1150/oz, and the second half highs range from $1300/oz to $1450/oz. In each instance, the lows were posted in December. This does not necessarily mean that gold will react in the first half of 2017 as it has the previous three years, but the pattern is worth noting. In addition, the recovery tops fall in line with the Swiss bank's price prediction featured at the top of the page.

–––––––––––––––––––––––––––––––––––––––––––––––––

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of News & Views, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer - Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the the accuracy, timeliness or completeness of the information found here.

| Digg This Article

-- Published: Sunday, 11 December 2016 | E-Mail | Print | Source: GoldSeek.com