-- Published: Tuesday, 13 December 2016 | Print | Disqus

Evidence of traders rigging the silver marketCourt documents detail private chats between bank tradersLawsuit alleges widespread rigging of precious metal market“Avalanche can be triggered by a pebble if u get the timing right” – UBS trader “If we are correct and do it together, we screw other people hard” – UBS trader

Since 2003, we have believed and written about how the silver and gold markets are manipulated and “fixed” by banks. Even then there was circumstantial evidence to suggest this was the case.

Now we have definitive proof and the smoking gun that the “silver market mafia” in the form of leading bullion banks – such as Deutsche Bank, UBS and HSBC – were coordinating the manipulation of the price of silver and suppressing prices as alleged by the Gold Anti Trust Action Commitee (GATA).

While this is a joke to the young, naive, greedy and overpaid traders, it is important to remember that this is not a victimless crime. These traders were allowed to this by the banks they work for, thereby defrauding retail silver investors and bullion buyers around the world.

From Bloomberg:

A cache of documents from Deutsche Bank AG include what a group of silver investors claim is a “smoking gun”: private electronic chats showing traders from numerous banks conspiring to rig prices from 2007 to 2013, according to a court filing in New York last week.

The bank provided the documents to the investors after settling a lawsuit accusing it of rigging markets in precious-metals. As part of the accord in April, the bank paid $38 million and turned over more than 350,000 pages of documents and 75 audio tapes. The investors now want to use the chats to win permission from a judge to file a new complaint against other banks.

The traders aren’t named in the chats now in court filings; instead, they are identified by their bank, such as UBS Trader A. The chats have not been edited for spelling or grammar:

In Chats, Silver ‘Mafia’ Traders Flexed Muscle, Drew Blades

UBS and Deutsche Bank silver traders agreed to follow the “11 o’clock” rule where they would short silver at 11 a.m., timing their trades with a countdown sequence, according to court papers.

See ‘3, 2, 1, Boom’ – Silver-Fixing Allegations in a Dozen Chats & Bloomberg Silver fixing video

Hopefully business and finance journalists will now spend more time looking at this story and take the lead in exposing such fraud and indeed help prevent it from happening again.

It is hoped that the acquiescence of central banks in tolerating such manipulation and the possible collusion in manipulating the gold market as alleged and indeed documented by GATA here will now be considered with a fresh pair of eyes and an open mind.

Silver Fixing Transcripts (Excerpts)

The important point to remember here is that this involves the smallest of retail bullion buyers and investors being ripped off and defrauded by the largest players in the market – massive banks with massive liquidity provided to them by central banks.

It is also important to remember that this creates an opportunity as the suppression of gold and silver prices in recent years means that gold and silver remain undervalued – especially versus the assets that banks and central banks favour – property, stocks and especially bonds.

Manipulation is an opportunity for investors as it allows them to accumulate gold and silver at artificially depressed prices. The history of gold market rigging and manipulation is of short term success followed by ultimate failure and then much higher prices. This was seen after the failure of the “London Gold Pool” in the late 1960s and gold’s massive bull market in the 1970s.

The gold and silver beach balls have been pushed near the bottom of the ‘precious metals pool.’ The lower they are pushed in the short term, the higher it will surge in the medium and long term.

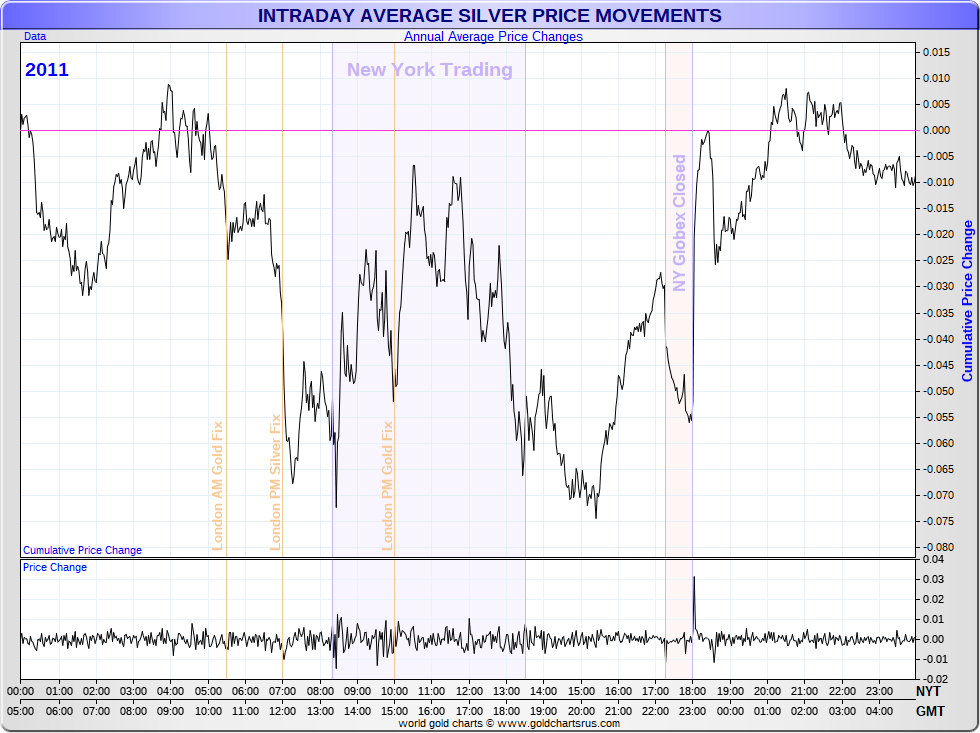

Nick Laird of goldchartsrus.com has done an excellent job of exposing the nature of silver price suppression by juxtaposing the silver traders chats with the price of silver in a great silver chart which has a magnifying glass icon to view chat transcripts related to silver price action and market manipulation here.

Gold and Silver Bullion – News and Commentary

Gold holds gains as dollar slips ahead of Fed meeting (IndiaTimes.com)

Gold futures log first gain in 3 sessions (MarketWatch.com)

Gold drifts ahead of US FOMC meeting (BullionDesk.com)

Gold suffering second-worst quarter in 18 years (CNBC.com)

November budget deficit $137 billion – U.S. Treasury (MarketWatch.com)

Silver Fixing Allegations in a Dozen Chats – ‘3, 2, 1, Boom’ (Bloomberg.com)

QE “Addiction” – “There’s no non-messy way out of this…” (WSJ.com)

2007 All Over Again – Stock Valuations Enter “Crash” Territory (DollarCollapse.com)

War in Cash in India Destroys Sales, Jobs & Economy (ZeroHedge.com)

Venezuelans Rush to Stash Cash Before Biggest Bill Is Voided (Bloomberg.com)

Gold Prices (LBMA AM)

13 Dec: USD 1,157.35, GBP 911.18 & EUR 1,090.80 per ounce

12 Dec: USD 1,154.40, GBP 916.82 & EUR 1,089.41 per ounce

09 Dec: USD 1,168.90, GBP 927.64 & EUR 1,100.75 per ounce

08 Dec: USD 1,174.75, GBP 925.47 & EUR 1,088.64 per ounce

07 Dec: USD 1,171.25, GBP 929.62 & EUR 1,092.19 per ounce

06 Dec: USD 1,171.15, GBP 918.18 & EUR 1,086.94 per ounce

05 Dec: USD 1,164.90, GBP 915.84 & EUR 1,095.36 per ounce

Silver Prices (LBMA)

13 Dec: USD 17.01, GBP 13.39 & EUR 16.04 per ounce

12 Dec: USD 16.86, GBP 13.34 & EUR 15.90 per ounce

09 Dec: USD 16.95, GBP 13.45 & EUR 16.03 per ounce

08 Dec: USD 17.13, GBP 13.50 & EUR 15.88 per ounce

07 Dec: USD 16.77, GBP 13.32 & EUR 15.64 per ounce

06 Dec: USD 16.79, GBP 13.17 & EUR 15.63 per ounce

05 Dec: USD 16.62, GBP 13.05 & EUR 15.54 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Tuesday, 13 December 2016 | E-Mail | Print | Source: GoldSeek.com