-- Published: Tuesday, 20 December 2016 | Print | Disqus

By Bob Loukas

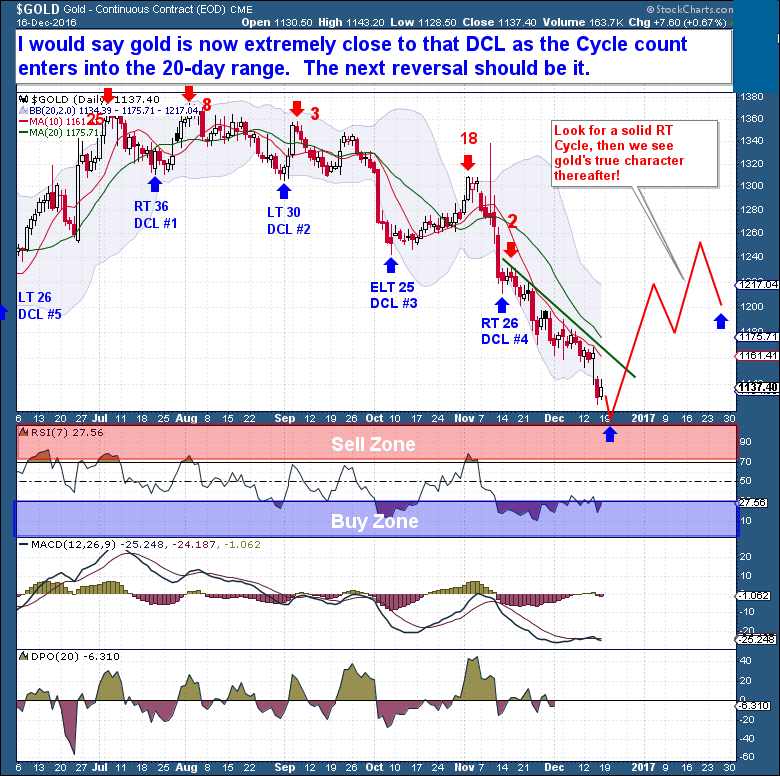

In last weekend’s report, we covered how the Daily Cycle count was stretching too far, so marking a Nov 15th Daily Cycle Low (DCL) made sense. Doing so means that another DC began on Nov 16, and that puts today’s date in the normal timing band for a new DCL. So with another DCL fast approaching, the capitulation decline we saw this week fits perfectly with expectations.

The large drops in Silver and the Miners are strong indications that the final capitulation for the current Daily and Investor Cycles is at hand.

(Keep in mind this is an except from a premium report published over the past weekend. Prices on charts reflect Friday’s close)

An outlook is not an absolute call, so until Gold bottoms we’ll be dealing in probabilities. I’m highlighting the most likely outcome to enable consideration of the risk/reward profiles on potential trades. So, while I expect that a major low in Gold is imminent, traders should still be cautious. I cannot stress enough that traders must be both realistic and patient as they consider possible market moves. And they need to understand that trading with a good probability of success does not guarantee that they will be correct.

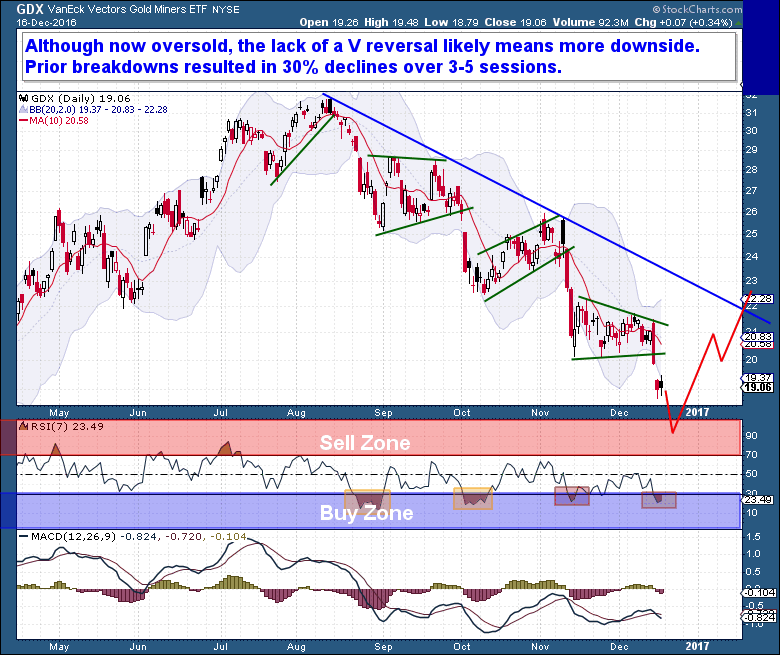

Turning to the Miners, the lack of a sharp “V” bounce after Thursday’s low suggests that more downside is ahead. The 20+ day triangle bear pattern cracked to the downside on Wednesday, and this type of decline typically runs for 3 to 5 sessions, so we should be close to the DCL/ICL. Another weak open next week should give way to a solid reversal higher.

But remember – the tail-end of any Cycle can be extremely dangerous. Too many traders fear missing the early part of the next rally and are burned by the declines that come with a final washout decline. The last week of any Cycle is typically the most volatile, and provides the largest price change, so I’d urge extreme caution with Gold.

That said, we covered the possibility of a final flush lower last week, and that’s what has come to pass. While we can never rule out further declines, I believe that the end of the coming week will see Gold moving higher in a new Investor Cycle!

https://thefinancialtap.com/

| Digg This Article

-- Published: Tuesday, 20 December 2016 | E-Mail | Print | Source: GoldSeek.com