-- Published: Friday, 23 December 2016 | Print | Disqus

Gold Mining Companies Are Running Out of Gold: Five Must See Charts

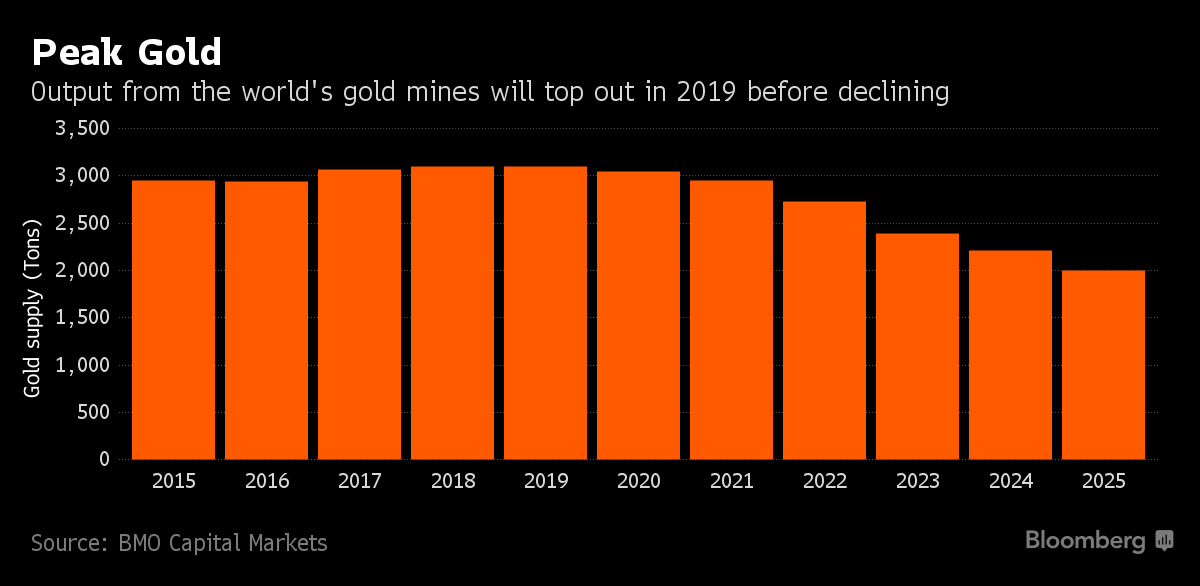

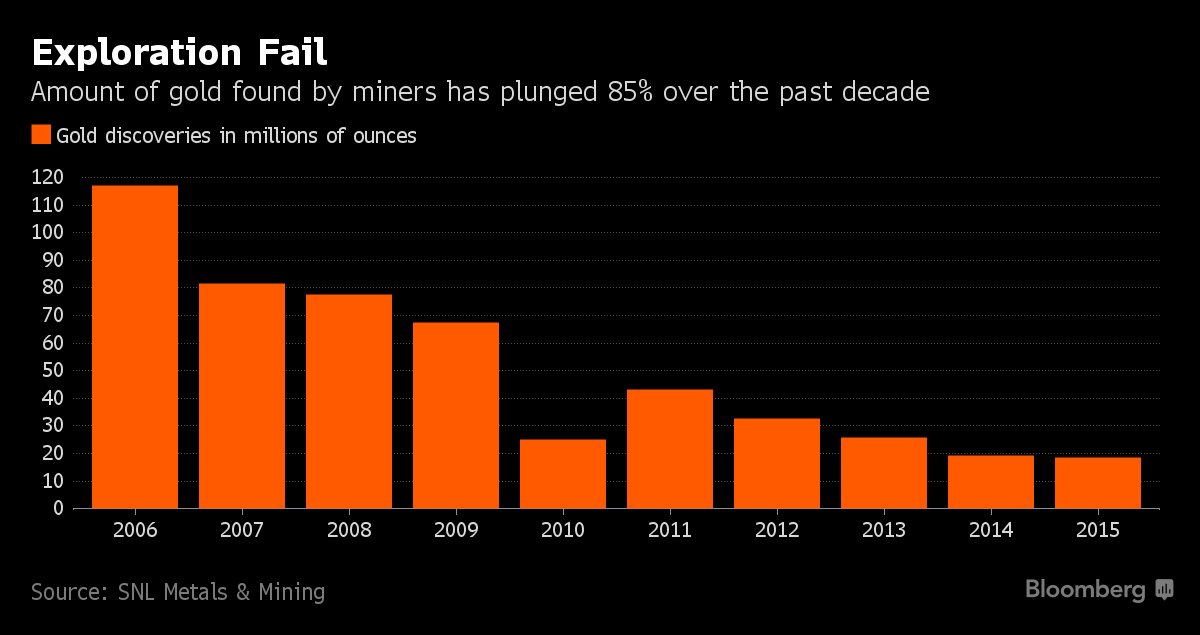

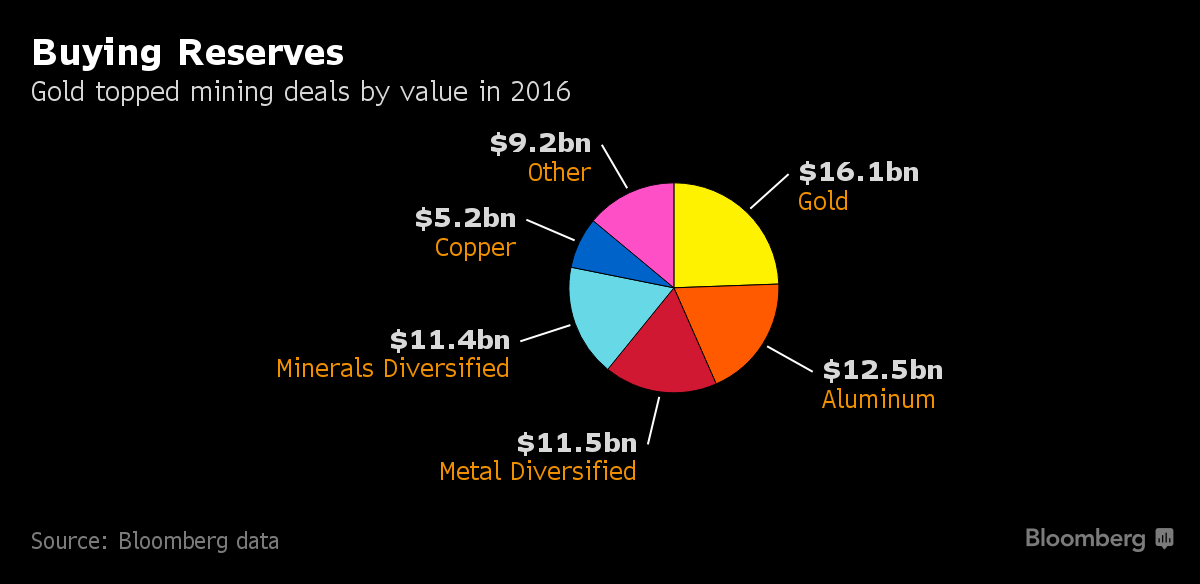

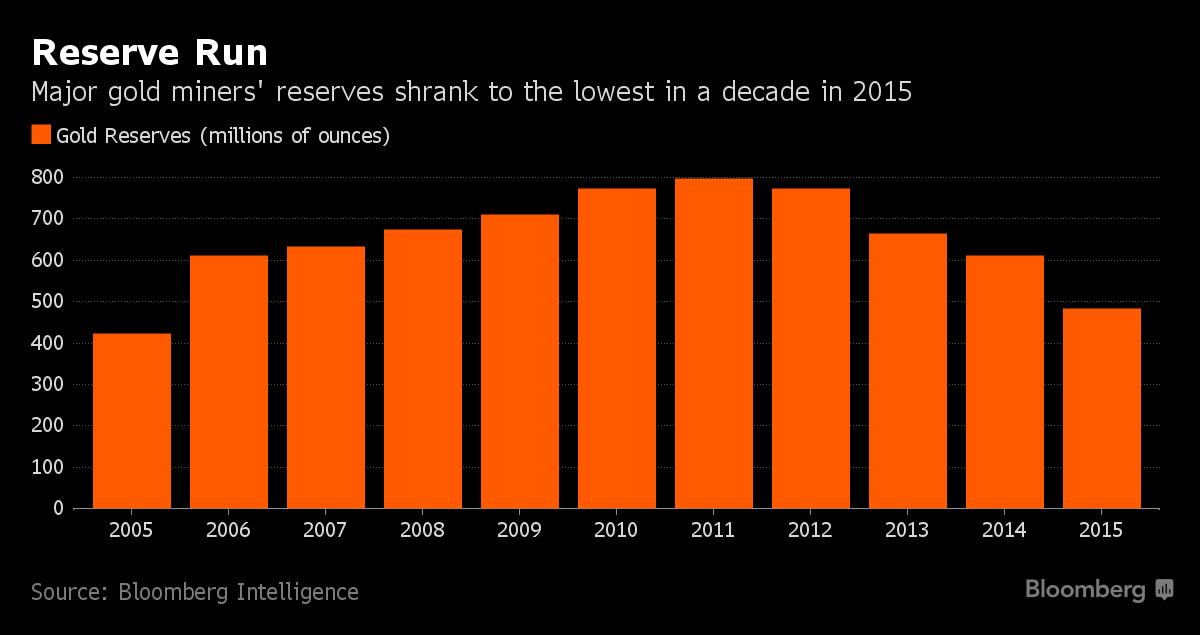

The reality of peak gold production has recently been acknowledged by Bloomberg and some of the financial media. Yet the mainstream, non specialist financial media has yet to cover this important topic with obvious ramifications for the gold market and the gold price in the medium and long term.

Peak gold production is happening globally which is very positive for gold and gold mining shares. Bloomberg have again covered this important fundamental factor in the market and have done so with an article and five must see gold charts:

“Gold’s had a roller-coaster year, surging as much as 30 percent before giving up the bulk of those gains. But one trend has been consistent: mining companies are finding it harder to dig up more of the precious metal.

The following charts show why, and what that means for the industry:”

We first covered the peak gold phenomenon back in 2007 and 2008 (see here) and have considered peak gold frequently over the years. ‘Peak Gold’ is happening which has important ramifications for the gold market and is a long term positive for the market which will support prices and should lead to higher prices.

Read full article on Bloomberg here

Gold and Silver Bullion – News and Commentary

Gold heading for 7th weekly loss on 2017 rate hike views (BusinessTimes.com)

Asian stocks slip ahead of holiday weekend (MarketWatch.com)

Gold prices ease as traders focus on rate hikes (Reuters.com)

Mortgage rates soar to 2 1/2-year high, Freddie Mac says (MarketWatch.com)

This Store Is Selling Gold-Plated Trump iPhones for $151,000 (Fortune.com)

Strongest Gold “Buy” Signal In 16 Years (TheDailyCoin.org)

China tries to talk dollar down, saying market is ‘too optimistic’ about Trump (SCMP.com)

Casey Warns “We’re Going To Have Financial Chaos… It’s A Dangerous Situation” (ZeroHedge.com)

As the year ends, we say farewell to yet another bank (MoneyWeek.com)

The unravelling of globalisation (MoneyWeek.com)

Gold Prices (LBMA AM)

23 Dec: USD 1,131.00, GBP 921.99 & EUR 1,082.25 per ounce

22 Dec: USD 1,130.55, GBP 916.20 & EUR 1,080.47 per ounce

21 Dec: USD 1,134.40, GBP 919.20 & EUR 1,091.07 per ounce

20 Dec: USD 1,132.75, GBP 915.94 & EUR 1,090.84 per ounce

19 Dec: USD 1,137.60, GBP 913.15 & EUR 1,089.14 per ounce

16 Dec: USD 1,134.85, GBP 911.17 & EUR 1,084.80 per ounce

15 Dec: USD 1,132.45, GBP 904.37 & EUR 1,080.70 per ounce

Silver Prices (LBMA)

23 Dec: USD 15.74, GBP 12.85 & EUR 15.06 per ounce

22 Dec: USD 15.77, GBP 12.78 & EUR 15.10 per ounce

21 Dec: USD 16.03, GBP 12.96 & EUR 15.40 per ounce

20 Dec: USD 15.80, GBP 12.80 & EUR 15.22 per ounce

19 Dec: USD 16.00, GBP 12.89 & EUR 15.34 per ounce

16 Dec: USD 16.05, GBP 12.91 & EUR 15.36 per ounce

15 Dec: USD 16.14, GBP 12.95 & EUR 15.51 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Friday, 23 December 2016 | E-Mail | Print | Source: GoldSeek.com