-- Published: Tuesday, 27 December 2016 | Print | Disqus

By: Thomas Furman

USDJPY Price Sustainable?

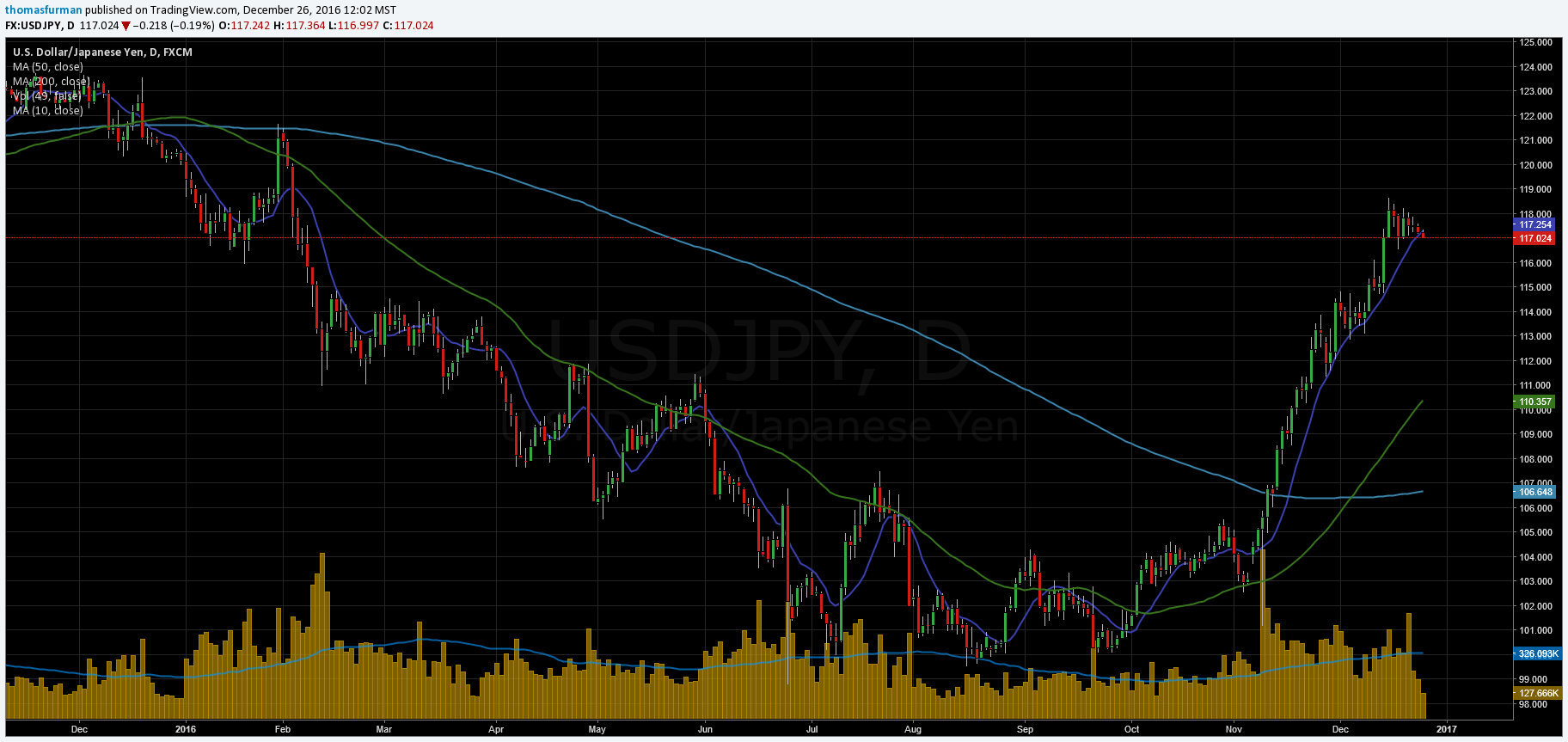

Has USDJPY price topped at 188.66 or is consolidating for another run higher? For that answer let’s take a look a recent price action. For a four to five day period since USDJPY peaked the price action seemed to suggest a pennant was forming (daily chart), which is definitely a bullish pattern in uptrends. However, I’ve been skeptical…a contrarian. The speed and trajectory of the USDJPY rocket suggest short covering fuel by foolish momentum exuberance once again; therefore price is more likely constructing a top, in the short-term at least, than another breakout as Longs cannot sustain the move higher.

Hit It Enough Times and It will Fall:

If you hit it enough times it will fall. That’s what appears to be playing out with the USDJPY pair. Take a look at the pattern as it stands today (12/26/2016) it has formed a falling right triangle, which is bearish. The 117.00 level is providing support, however, like a bouncing ball each bounce is weaker than the previous. So the pattern has quickly changed from bullish to bearish, which meets my expectation this unsustainable rise is coming to an end.

Another hint is how far price is above the 50 and 200 DMA, it’s quite elevated by anyone’s standard and should give the bulls a reason to pause. The loftiness is not likely to continue as the risk for a price drop increases significantly as price is pushed higher. For price to correct this gap it can happen in two ways, violently or consolidating. A violent correction could send price to the 200 DMA at around 106.60. If that were to happen I suspect it would overshoot to 106.00 where there is some support. If price manages to consolidate it will probably form a bull flag, which would be negated with a sustain fall below 114.70.

The Market has Rhythm:

USDJPY price did not stop its advance by chance. We need to look back to January 2016 for evidence. Note where price had support and resistance…the 117.00 – 118.00 area, which not by coincidence is the same area we saw support/resistance one year earlier in January 2015. So now we are here again at this price level. Will it break above? Not likely on its first try. We will have to wait and see how dedicated the bulls are.

Gold Price:

USDJPY is one of my favorite indicators for monitoring gold price action. USDJPY inversely follows gold price fairly well. To be complete the EURUSD is a great indicator as well. Some may argue better as it is weighted heavier in the DXY. My preference is the USDJPY.

When is come to the gold price over the next couple of weeks I contend we should see a move higher with the miners following but a bit muted in their advance. It would take a sustain move above $1200 to get miner speculators reinvigorated after the brutal smash-down of the last few months. But I do suspect a fairly sharp short-term rally in GDXJ, GDX, and individual large and mid-cap miners as shorts start to take profits. The longer would-be sellers hold on to their positions the higher price will go. To be honest I have no idea how high the next rally will take GDX and GDXJ price. There are some strong support-turned-resistance areas but these could just as easy be cut through or provide a wall of impenetrable resistance. Anyone pinpointing a specific price during the next bear market rally is guessing regardless of their data. In saying that I strongly suspect GDXJ and GDX price will reach $33.50 & 20.50 respectively where both will see the first major resistance area. If you’re holding you should consider selling if you are a short-term holder as my XAUUSD price target is $980.00 area in the medium term.

- Thomas Furman

You can read all of my contrarian post at http://contrarianperspective.contrarianperspective.com/

| Digg This Article

-- Published: Tuesday, 27 December 2016 | E-Mail | Print | Source: GoldSeek.com