In the early decades of the 19th century, a new cultural and philosophical movement emerged that embodies all that makes America great. Led chiefly by Ralph Waldo Emerson and Henry David Thoreau, American transcendentalism praises the purity of the individual and stresses the importance of self-reliance.

“The great man is he who in the midst of the crowd keeps with perfect sweetness the independence of solitude,” Emerson wrote.

I recognized these uniquely American values early on when I made the move from Canada to Texas. Individualism, non-linear thinking, a rebellious streak—without them, the U.S. might not have been the birthplace of world-changing innovations such as the locomotive, automobile, airplane and microprocessor.

Today we have these same values to thank for the creation of Facebook, Amazon, Google and other tech giants, without which we can hardly imagine our lives now.

They’ve also helped make many people fabulously wealthy. Of the 400 Americans on Forbes’ wealthiest list, about two thirds can be labeled as self-made, including Jan Koum, a Ukrainian immigrant raised on food stamps who became an overnight billionaire when he sold his instant messaging app, WhatsApp, to Facebook in 2014.

Other countries have little choice but to emulate America’s economic and cultural biosphere that allows such innovations to flourish. In an effort to become a leader in autonomous driving, Germany-based Volkswagen is currently in the process of recruiting as many as 1,000 experts in artificial intelligence, virtual reality and big data—many of whom hail from Silicon Valley and other American tech hubs. According to Volkswagen Chief Information Officer Dr. Martin Hoffman, research teams in Berlin and Munich “work the Silicon Valley way. We have brought the Valley to Volkswagen… with over 20 experts from San Francisco and Boulder, Colorado.”

![]()

|

As I’ve pointed out many times before, the reason Silicon Valley must be imported from the U.S.—instead of built in-house—is largely because the European Union’s crushing regulations and policies of envy stand in the way of ingenuity and entrepreneurship. Their best brains, therefore, end up in the U.S., the land of opportunity.

“If anybody believes Europeans will create a better business environment than Americans, they’re completely dreaming,” Mark Tluszvz, CEO of a Luxembourg-based venture capitalist firm, told the Financial Times in 2015. “We don’t have this in our culture."

It’s essential we don’t lose it in our culture, either. Many U.S. lawmakers and bureaucrats, however, seem intent on significantly weakening our ability to innovate and stay competitive. The more rules and layers of regulations that businesses must contend with, the more the U.S. will resemble Brussels.

We can’t allow that to happen.

“Any fool can make a rule, and every fool will mind it,” Thoreau sagely wrote nearly 200 years ago.

Although “fool” might not be the word I would use, it must be recognized that the U.S. became the innovative powerhouse it is today not because of rules but because of the values of individualism espoused by the transcendentalists all those years ago.

Trump Pushing Back on New Rules

I’m convinced this is one of the key reasons why U.S. voters elected Donald Trump, despite his rough edges. Trump has pledged to streamline or altogether eliminate many financial regulations that have stymied the creation of capital over the years, from Dodd-Frank Wall Street Reform to the Sarbanes-Oxley Act (SOX). We add can to this list the Department of Labor’s (DOL) new Fiduciary Rule.

Signed by President George W. Bush, SOX seeks to prevent massive corporate fraud such as we saw from Enron and WorldCom in the early 2000s. Although a noble mission, SOX has had the unintended consequence of barring small to medium public companies from getting ahead. It’s also prevented retail investors from getting in on the ground floor. Because the requisite internal control procedures are so costly and cumbersome—necessitating additional compliance and accounting positions, not to mention hundreds of hours spent on compliance-driven tasks—smaller firms are inevitably at a disadvantage.

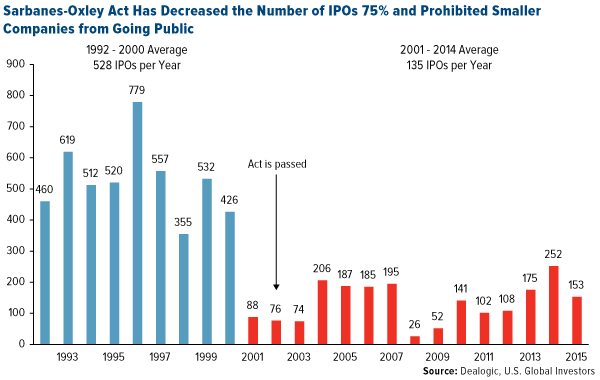

As a result, many small to mid-sized companies are delaying going public, or avoiding it altogether, to escape the regulatory burden. Before SOX, there were an average 528 IPOs a year. Since it was enacted, that number has fallen to 135, a decline of nearly 75 percent.

As for Dodd-Frank, signed by President Barack Obama, market experts ranging from Warren Buffett to Alan Greenspan support its repeal, with Buffett saying the legislation “has taken away the Federal Reserve’s ability to act in a crisis.” Many banks have done away with free checking, giving lower-income customers fewer and fewer banking options.

Joining the chorus in calling for deregulation is billionaire CEO of Koch Industries, Charles Koch. Speaking to ABC’s “This Week” back in April, he called our political and economic system rigged “in favor of [multibillion-dollar] companies like ours,” and criticized “corporate welfare that benefits established companies and makes it difficult for somebody to get started.”

Protecting the Little Guy?

These rulings, among others, have been detrimental to the formation of capital, especially for the little guy, whom they purport to be protecting. But it doesn’t exactly help or protect the little guy if his investment, banking and business options are dramatically limited. See this chart I shared with you back in July, which shows how retail investors have been locked out of participating in the best-performing asset classes.

Or consider the DOL’s new Fiduciary Rule. When it goes into effect in April 2017, it will inevitably limit the number of investment products available to retail investors. The ruling states that all retirement planners, advisors and broker-dealers must now “act in the best interests of clients” and charge only “reasonable” fees. This all sounds fine, but what’s naturally going to happen is financial professionals—in an effort to remain compliant with the rule—will recommend only the least expensive products, regardless of whether they’re a good fit. Many mutual funds—which might be better performing but have higher expenses than other investment vehicles—will fall off of brokerage firms’ platforms.

It would be like the DOL telling consumers they can only shop at Walmart and buy their coffee from Dunkin’ Donuts because anything more expensive—Target or Starbucks, say—is “riskier,” even though they’re of higher quality.

This type of anti-capitalist mindset is expected in the EU, not the U.S. Trump’s win certainly puts a target on the DOL’s Fiduciary Rule, which he has pledged to repeal, but like Sarbanes-Oxley and Dodd-Frank, we’ll have to wait and see.

And Yet, Business Owners Are Optimistic

Whether Trump can succeed at reversing some of these rules remains to be seen. If you remember, Obama failed to roll back—and, in fact, he extended—Bush-era legislation he strongly campaigned against, such as the Patriot Act and Bush tax cuts. The same might very well happen under Trump. Even Carl Icahn—whom Trump named as his special advisor on deregulation—has commented that Dodd-Frank is needed.

But Trump is a pragmatist, as Obama himself described him. “He is coming into this office with fewer set-hard-and-fast policy prescriptions than other presidents,” Obama said.

Indeed, Trump isn’t guided by ideology from the religious right, as Bush was, or the socialist left, as Obama was. Remember, he long identified himself as a Democrat and has supported Democratic candidates (including Hillary Clinton). So I think that, after 16 years of Bush and Obama, the pendulum is finally swinging back to the center. The question is: Can Trump make it work?

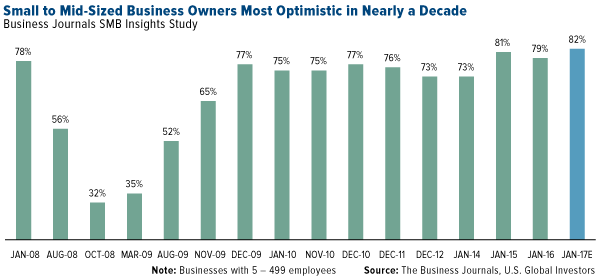

Many small to mid-sized business owners seem to believe he can. In a Business Journals survey taken the day after the election, 82 percent of businesses said they felt confident their prospects would improve over the next 12 months. That’s the highest reading in nearly a decade.

How Markets Are Betting

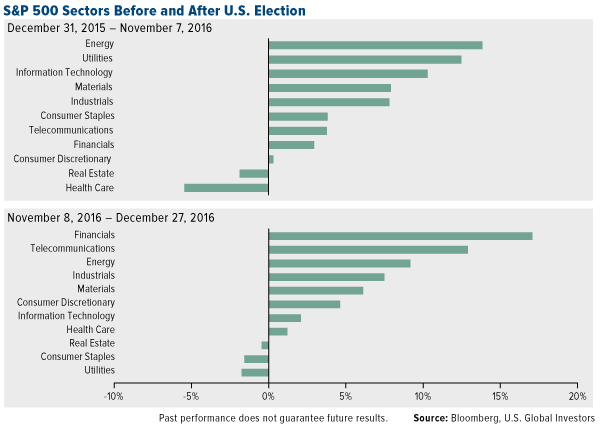

As I’ve pointed out before, investors seem to be betting that, despite the uphill battle ahead, Trump can deliver on financial deregulation. Below, the chart shows sector performance before Trump’s election compared with performance since the election. As you can see, financials jumped seven places to become the top-performing sector. What’s more, health care turned positive, suggesting investors are confident Trump and the Republican-controlled Congress can dismantle Obamacare.

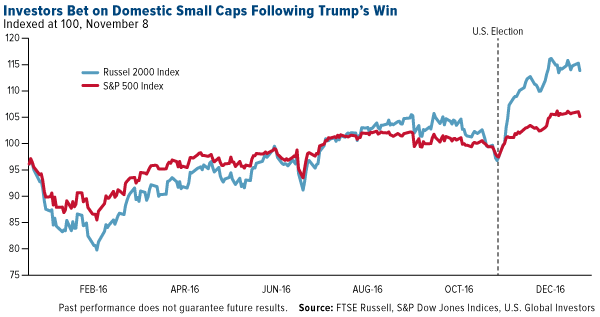

Small-cap stocks, as measured by the Russell 2000 Index, are also way up on bets that Trump’s protectionist policies will benefit domestics with limited exposure to foreign markets, more so than multinational blue-chip stocks.

It might be too soon to tell, but I expect these trends to carry on into 2017.

Rising Rates Ahead in 2017

With economic conditions and expectations improving, especially since the election, it’s very likely the Federal Reserve will continue to tighten throughout 2017. Rate hikes will be limited, but 3 percent mortgage rates are probably a thing of the past.

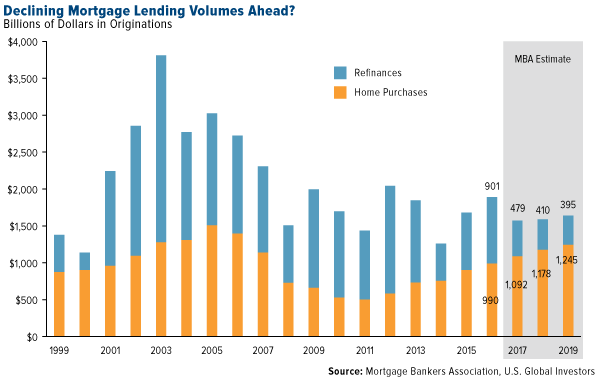

Lenders are already slashing their refinance-volume expectations for 2017 and beyond, according to a mortgage lender sentiment survey conducted in December by Fannie Mae.

In addition, Kroll Bond Rating Agency (KBRA) believes we’ve likely seen peak lending: “While 2016 has been an excellent year for the U.S. mortgage industry, with almost $2 trillion in new loan originations, we believe that this year is also likely to be the peak in terms of lending volumes for years to come.”

As I’ve pointed out several times before, when interest rates are on the rise, short-term municipal bonds are the place to be, since they’re less sensitive to rate increases than longer-term bonds, whose maturities are further out.

I want to wish all of my loyal readers, investors and shareholders a most Happy New Year! As we begin a new American chapter in 2017, complete with a new series of challenges both big and small, remember to hold fast to H.O.P.E.—Have Only Positive Expectations!

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 9/30/2016.