-- Published: Thursday, 5 January 2017 | Print | Disqus

Trump’s Twitter Age Could See Gold Rise 13% In 2017

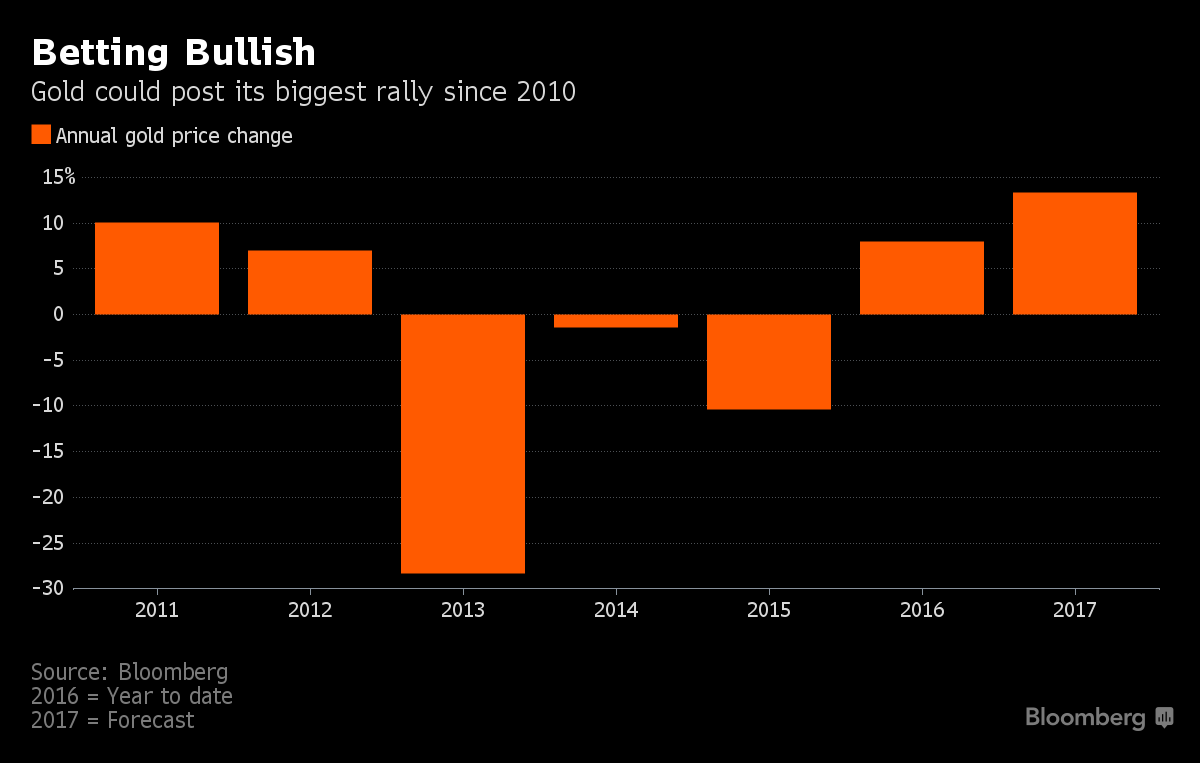

Gold price seen jumping 13% in 2017 after 9% gain in 2016, Bloomberg analyst survey shows

140-character missives by President-elect means new paradigm

“140 characters of unfiltered Trump is likely to create tensions with America’s largest trading partners…”

Bloomberg Intelligence poll shows 42 percent of respondents predict gold will be the best-performing metal in 2017

Two Bloomberg respondents including GoldCore say gold to reach $1,600/oz

“Markets that are already shaken by the fallout from Brexit, the coming elections in Europe and indeed the increasing specter of cyber warfare could again see a safe-haven bid…”

Gold is not “irrational” today – politicians, policy markers and markets are

Gold that can inspect and take delivery of easily a vital hedge against massive irrationality in world of 2017

From Bloomberg:

“The Donald J. Trump era is marking a new age for gold as an investor safe haven.

While the precious metal has always been hoarded in times of trouble, a bevy of political and economic surprises in 2016 sparked a surge in buying that sent bullion to the first annual gain in four years. Prices may rally about 13 percent in 2017, according to a Bloomberg survey of 26 analysts.

Fueling the bullish outlook is the risk of chaos on multiple fronts: a possible trade war from America’s fraying relationship with China, the alleged Russian hack of U.S. political parties, the U.K.’s complicated exit from the European Union, and elections slated in France, Germany and the Netherlands that may see a rise of nationalist groups.

And then there are Trump’s frequent Twitter posts, in which the U.S. president-elect feuded with rivals and made declarations that unsettled allies even before he takes office Jan. 20.

“140 characters of unfiltered Trump is likely to create tensions with America’s largest trading partners,” Mark O’Byrne, a director at broker GoldCore Ltd, said by e-mail.

“Markets that are already shaken by the fallout from Brexit, the coming elections in Europe and indeed the increasing specter of cyber warfare could again see a safe-haven bid.”

Gold for immediate delivery is up 8.9 percent this year (2016) to $1,155.12 an ounce, halting a three-year slide. More than two thirds of the analysts and traders surveyed from Singapore to New York said they were bullish for 2017.

The median year-end forecast was $1,300, with the year’s peak seen at $1,350. Two, including O’Byrne, said the metal may reach $1,600.”

President elect Trump, Twitter and his tweets being a popular topic du jour, the Bloomberg article was syndicated and published very widely internationally and can be read in full on Bloomberg here Gold ‘Lures’ Investors Worried About Trade Wars and Trump Tweets and Bloomberg Quint here Trump’s Twitter Age Brings Chaos Risk Reviving Gold as Haven

KNOWLEDGE IS POWER

For your perusal, below are in order of downloads our most popular guides in 2016:

10 Important Points To Consider Before You Buy Gold

7 Real Risks To Your Gold Ownership

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Thank you and wishing you a healthy and fulfilling 2017

Gold and Silver Bullion – News and Commentary

Gold Rises to Four-Week High on Dollar Slump, Trump Haven Demand (Bloomberg.com)

Gold holds ground at more than 3-week high after FOMC minutes (MarketWatch.com)

Asian stocks start mixed amid strong economic data (MarketWatch.com)

Ex-Barclays trader pleads guilty to price-fixing (MarketWatch.com)

Bitcoin Hits All-Time High as Currency Controls Drive Fear (Bloomberg.com)

Gold ‘Lures’ Investors Worried About Trade Wars and Trump Tweets (Bloomberg.com)

It’s The “Most Volatile” Year For Political Risk Since World War II (ZeroHedge.com)

42 Years of Fractional Reserve Alchemy (GoldSeek.com)

‘Audit the Fed’ bill gets new push under Trump (TheHill.com)

Trump’s Budget Chief Liked Gold & Had Dim View of Dollar (Bloomberg.com)

Gold Prices (LBMA AM)

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

28 Dec: USD 1,139.75, GBP 931.29 & EUR 1,091.88 per ounce

23 Dec: USD 1,131.00, GBP 921.99 & EUR 1,082.25 per ounce

Silver Prices (LBMA)

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

29 Dec: USD 16.06, GBP 13.10 & EUR 15.36 per ounce

28 Dec: USD 15.85, GBP 12.96 & EUR 15.22 per ounce

23 Dec: USD 15.74, GBP 12.85 & EUR 15.06 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Thursday, 5 January 2017 | E-Mail | Print | Source: GoldSeek.com