-- Published: Thursday, 2 February 2017 | Print | Disqus

By Jordan Roy-Byrne, CMT, MFTA

Gold has underperformed both in nominal and real terms. Last week it formed a bearish reversal in nominal terms and against foreign currencies. However, the good news for bulls is the US Dollar Index lost support at 100, due to the Trump administration’s tough talk against Germany (and the Euro). Couple that with no movement from the Fed and the greenback should continue its decline, thereby juicing the current rebound in Gold and especially gold stocks.

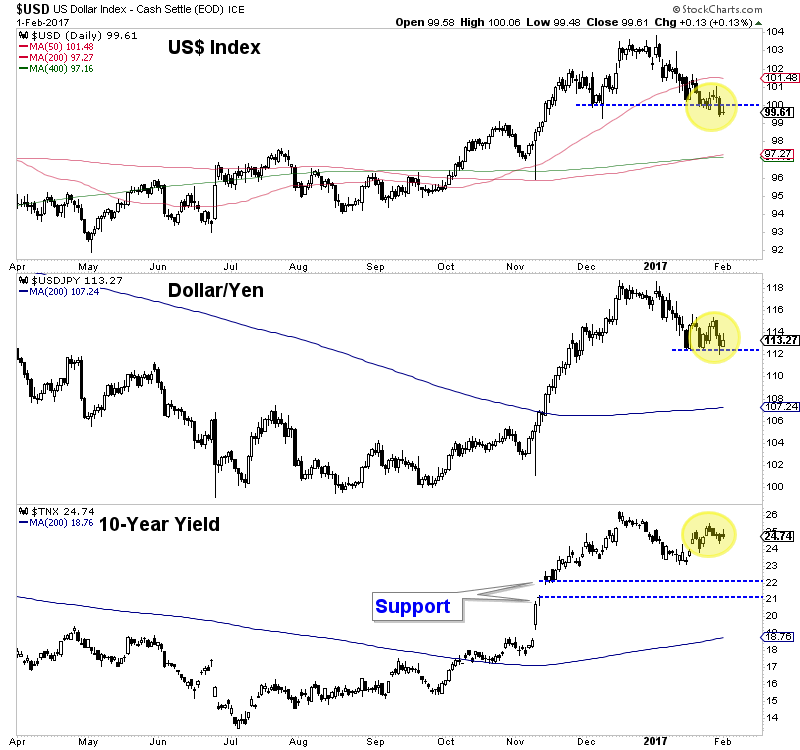

Take a look at the daily candle charts in the image below. We plot the US Dollar index, the Dollar/Yen cross and the 10-year Treasury yield. The US Dollar index has a potential measured downside target of 97 which happens to coincide with a confluence of moving average support. Dollar/Yen has not broken its corrective lows yet but if it does it would strengthen the odds the US Dollar index falls to 97. Meanwhile, the 10-year yield has some more room to fall if its correction were to continue. In short, lower levels on all these charts is short-term bullish for precious metals.

US$, US$/Yen, 10-Year Yield

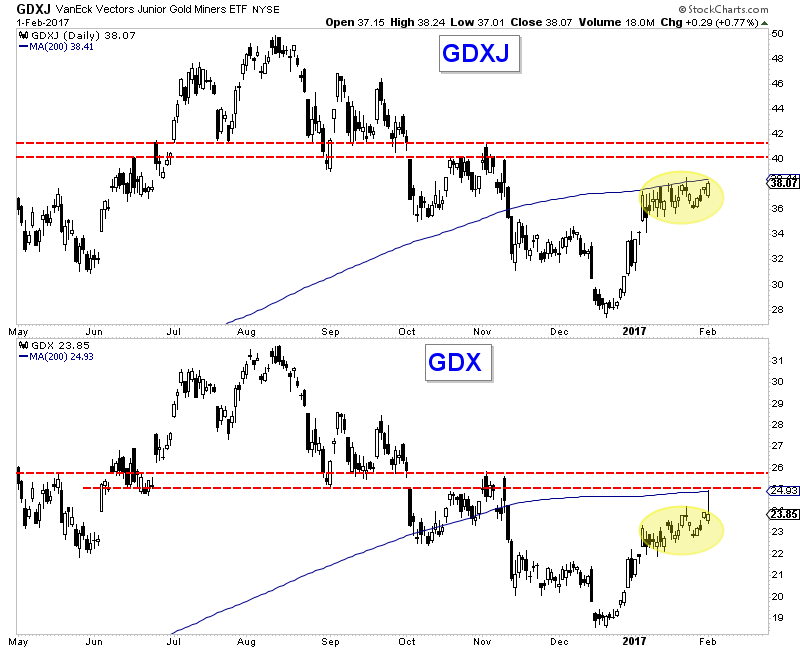

The daily candle chart below shows GDXJ and GDX. The 200-day moving average has held GDXJ but it has a great chance to continue its rally up to $40-$41. GDX could reach $25-$26.

GDXJ, GDX Daily Candles

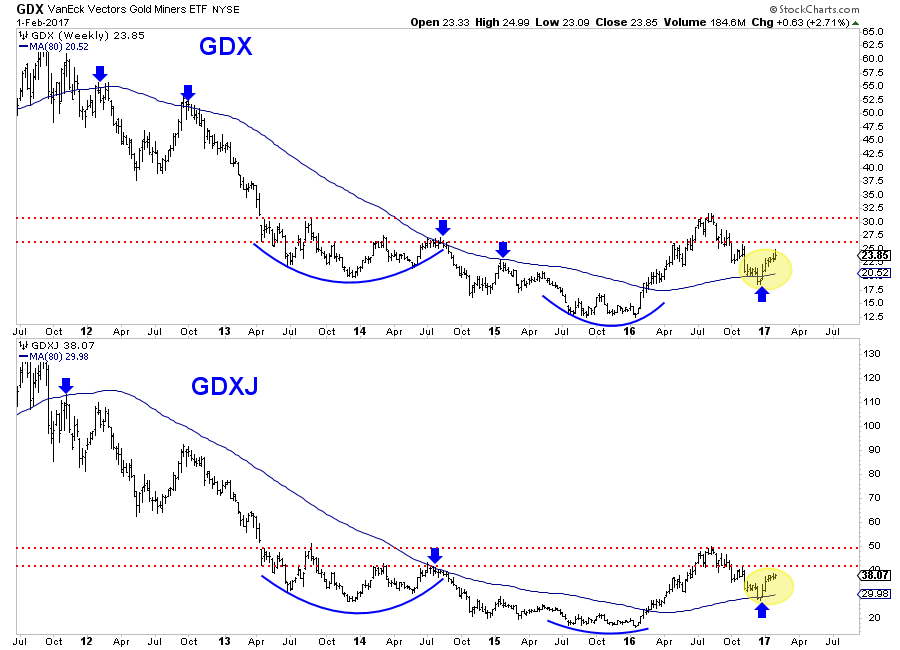

Take a look at a weekly chart and you will notice the significance of those aforementioned targets. The bar weekly charts of GDX and GDXJ are shown below. GDX $26 and GDXJ $41 mark the strongest resistance moving forward. Those levels have been tested 8 times in the past four years compared to the 2013 and 2016 highs which have been tested only 3 times. It’s unlikely the miners break resistance ($26 and $41) on the first try.

GDX, GDXJ Weekly

The miners continue to lead as they are on the cusp of higher highs in this recovery while Gold is further away from breaking its resistance at $1220. As we noted in our last missive, a pullback from resistance (the upside targets) is likely. The question though is will the pullback be something bullish or will it evolve into a multi-month correction? We have accumulated a number of juniors gradually but are maintaining some cash in advance of the next correction. For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

Jordan Roy-Byrne, CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Thursday, 2 February 2017 | E-Mail | Print | Source: GoldSeek.com