Stemming from the virtual absence of underwhelming economic data… the cumulative weight of growing confidence – as relative as it may be, continues to list US markets towards what we suspect will become another surprise “Come about!” in investors optimistic expectations towards the US economy. How much water markets may take on – or whether it becomes a capsizing Minsky moment, is another question entirely. Considering the Trump cards that could be played along the spectrum of possible outcomes (both bullish and bearish), the gap between risk and reward for nearly every type and duration of investment strategy remains profoundly wide. That being said, we remain largely risk adverse until there's greater clarity on monetary or fiscal policy, and still favor the short side of the dollar and the more safe haven positions in precious metals and long-term Treasuries, as we suspect the long run of "not bad" to mediocre grades comes to pass. The economy is surely not failing, but don't kid yourself – the bar hasn't been raised for some time.

What’s not in question – and which we take our bearings from, is that equities, yields and the US dollar have trended with investors relative expectations with the data, well before the outcome of the US election even came into focus. Looking back, this has increasingly been the case since the Fed left ZIRP in December 2015; with the most recent updraft beginning last summer after investors immediate fears with the Brexit vote went largely unfounded in the markets. And while animal spirits and narratives were certainly rekindled and reframed after the election, a positive reversion was already underway for months with respect towards participants respective expectations within the economy. Vacillating between poles of optimism and pessimism – as the index measures levels relative to consensus, we would speculate that the Citigroup US economic surprise index now reflects that expectations have largely caught up with the data, with a much greater probability that subsequent “surprises” will trend towards the negative pole.

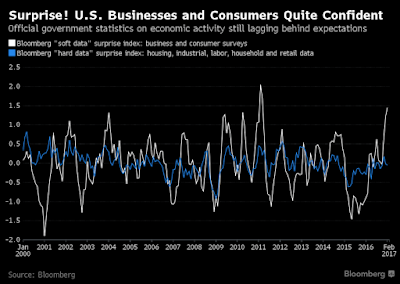

Moreover – and as recently described by Matthew Boesler of Bloomberg (see Here), there has been a growing gap between business and consumer confidence surveys and actual economic activity. The difference between these so called “soft” and “hard” data series has only been wider once before in 17 years of data, in February 2011. It seems reasonable to believe that the gap reflects the sharp shift in business and consumer sentiment that took place after the Republicans ran the table in November. The abstract concern being – hope springs eternal, or until reality bites. To that end, we’re more inclined to focus on the US macro environment beforehand that was predominantly characterized by lackluster year-over-year growth that was treading water at best – or decelerating from a cyclical high in a historically mature economic expansion at or near full employment.