-- Published: Tuesday, 7 February 2017 | Print | Disqus

Source: Michael J. Ballanger for The Gold Report

Precious metals expert Michael Ballanger discusses why technical analysis does not work in the precious metals arena.

I have a great number of friends that pride themselves on being "technical analysts" and many of them are actually very good, especially the ones that are students of market history and even more so the ones that are "old" and by that, I mean "older than me." I love the guys that can tell you what happened in the fall of 1987 and recite off the top of their head that intraday high and intraday low of Tuesday October 20, 1987, when the Dow Jones had its first 500-point intraday swing, especially when they can tell you what they had for lunch that day.

Most impressive, though, are those analysts that will make a technical assessment and state categorically that the next move will be "up" or it will be "down" and that brings me to the ones that I detest—the "wafflers," the ones that tell you that the next direction is up unless we get a breakdown through point B in which event the next direction will be down. You know them; they fire up a chart of weekly gold prices and paste arrows on the "big, ugly, red candle" that now MIGHT be pointing to a down market UNLESS gold rises and NEGATES the signal. The wafflers are the types of market forecasters that give race track touts are good name; they are constantly being drawn into these traps that are set by the bullion banks and their legion of tape manipulators and in doing so, they take their ovine subscribers with them.

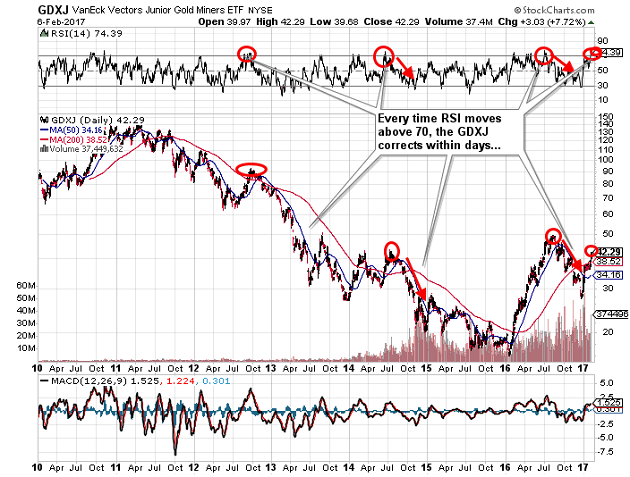

Below is the chart of the candle that was supposed to send shivers through the hearts of the gold bulls and, as you can see, it was precisely the "fake-out" that I wrote about last week, the type of tape-painting exercise that these amateur technical "analysts" fail to decipher, because in the end, technical analysis simply does not work with any degree of reliability in the precious metals arena because the interventionalists read those same charts and backed by central bank financial muscle, they will slam anything that the sheep will act upon and especially "big, ugly, red candles."

I posted the chart above on January 29th.

Here is what I wrote on January 27th:

"I took advantage of the weakness on Thursday morning to add to the GDXJ under $36 and added a spec position in the Feb $35 calls at $2.45 with the thinking that that "big, ugly red candle" is one big, ugly, red FAKE-OUT planted by the Commercials to accelerate selling volume into which they will continue to reduce their still-large short position (126,374 contracts) such that by Wednesday, the HUI and their junior brethren (GDXJ) have continued their advance."

I told you that I was going to take advantage of that signal and BUY the GDXJ (VanEck Vectors Junior Gold Miners ETF)vFeb $35 calls at $2.40 and I did and although I have been trading them, I exited the position today with the GDXJ up over $7.00 from the "big, ugly, red candle" bottom on Feb. 1 and got a print at $7.00 to close out the position. The shares I bought at $35.63 are now comfortably ahead but I also exited the position at $41.50 and will remain sidelined due to an RSI (relative strength index) screaming into the 70s where we have seen just too many trading tops for my liking. For the record, now that the chart shows a clear TECHNICAL BREAKOUT above the 200-dma, I have used that as an excuse to get ahead of the bullion bank heathens that are going to lure in all of that guru's subscribers that waited for a week to enter the market and now that they have, the Cretins will pounce. With the RSI above 70, the stage is set for a reversal.

Things seem to be normalizing these days as spouse and dog are now talking to me again. Since taking the pledge of cranberry tea and mango coconut spritzers on January 1, the two other inhabitants of this house are finding themselves lured into an odd sense of complacency where sudden noises from snowmobiles screaming across lovely Lake Scugog send them both scurrying under beds. I am sure they secretly await the moment where a treasured framed photo of old Auntie Gertrude goes sailing across the room or a quote machine is found hissing in a snow bank, the steam rising off and into the woods. Alas, no such unpardonable occurrences will return to this humble abode as long as gold and silver are left to their own devices and away from the malodorous, muddling hands of the bankster vermin. And that is precisely why my partner vacuums while watching BNN and how Fido has learned to read a quote screen.

After all, forewarned is forearmed.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. My company Bonaventure Explorations Limited owns 1,000,000 warrants at $0.10. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Gem International Resources Inc. My company has a financial relationship with the following companies mentioned in this article: Gem International Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.

| Digg This Article

-- Published: Tuesday, 7 February 2017 | E-Mail | Print | Source: GoldSeek.com