-- Published: Sunday, 12 February 2017 | Print | Disqus

By Jordan Roy-Byrne, CMT, MFTA

The precious metals sector has reached the upside targets we’ve written about since the start of 2017. Gold has touched almost $1250/oz ($1246/oz high) while GDXJ exceeded our $41 target and GDX nearly reached $26. The glass half empty case is the sector is now at strong resistance levels and any immediate upside will be difficult to sustain. On the other hand, the gold stocks are showing the internal (strong advance/decline line) and relative strength (leadership against Gold) that bodes for additional gains. There may be some more upside potential but the risk of a medium term correction looms in the background.

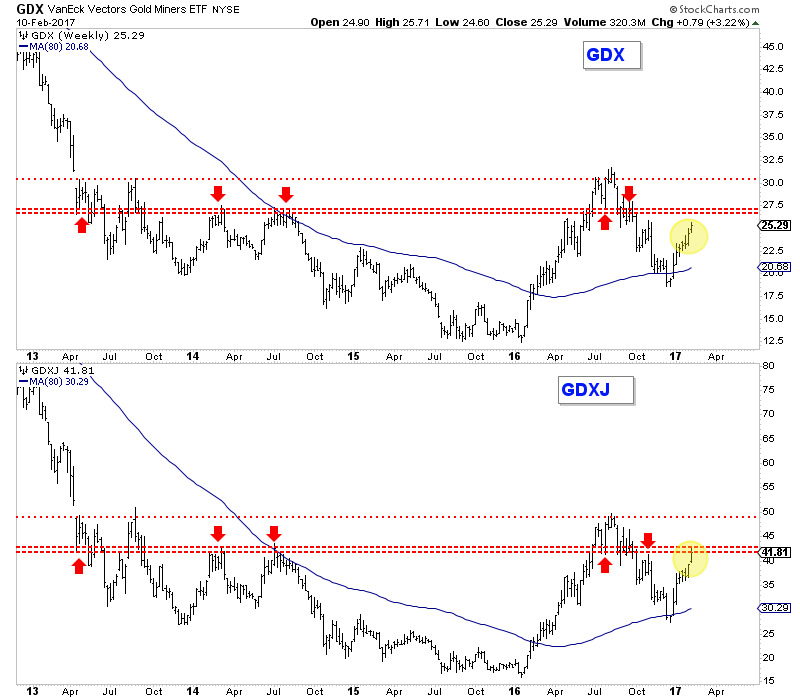

The image below shows the weekly bar charts for GDX and GDXJ. If the miners can make a weekly close above the strong red lines then there is a chance the rally can come very close to the 2016 highs before the next sustained correction. For GDX that is a close above $27.24 and for GDXJ that is a close above $42.60. It is also quite possible that GDX peaks at $27 while GDXJ, given its relative strength exceeds $42.60 temporarily.

GDX, GDXJ Weekly Bar Charts

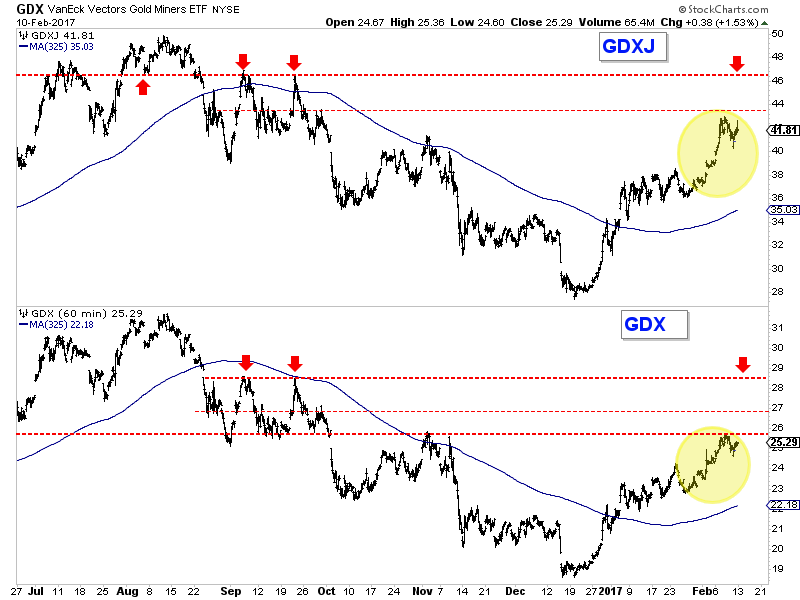

The hourly bar charts (shown below) provide better insight for the next week or two. The miners appear to be digesting the strong gains achieved since the end of January. Look for another week or two of consolidation and digestion. Ultimately, if the miners make a daily close above recent highs then the upside targets are +$46 for GDXJ and +$28 for GDX. We are currently more confident in GDXJ than GDX.

GDX, GDXJ Hourly Bar Charts

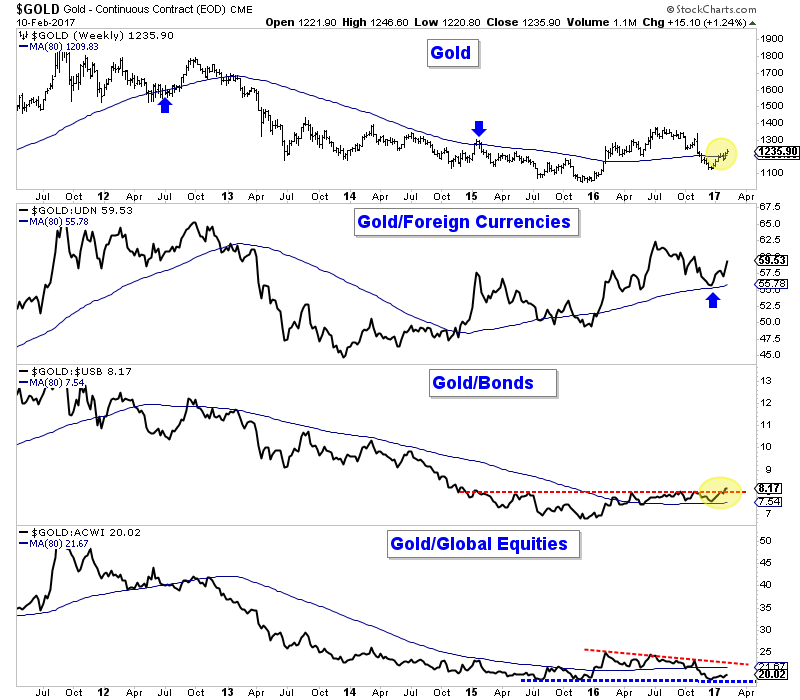

Turning to Gold, it has lagged the miners but nearly reached $1250/oz this week. It closed the week at $1236/oz. There is a strong confluence of resistance at $1250/oz and we note the 200-day moving average at $1266/oz. If the rally has a bit more time left then Gold has a good shot to reach $1266/oz. Also, as we noted a few weeks ago, Gold’s performance against the other asset classes will help inform us if Gold can hold onto recent gains or if it’s headed for a big retracement. The bullish scenario would entail Gold maintaining recent gains against foreign currencies and bonds while showing strength against global equities.

Gold & Gold Ratios

Gold and gold stocks appear to have a bit more upside potential but the medium term outlook urges caution and patience. The miners and Gold are nearing strong resistance at a time when the US Dollar index could be firming around 100. Regardless of where and when this rebound ends, the precious metals sector could be poised for a big move higher following the next medium term correction or consolidation. For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

Jordan Roy-Byrne, CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Sunday, 12 February 2017 | E-Mail | Print | Source: GoldSeek.com