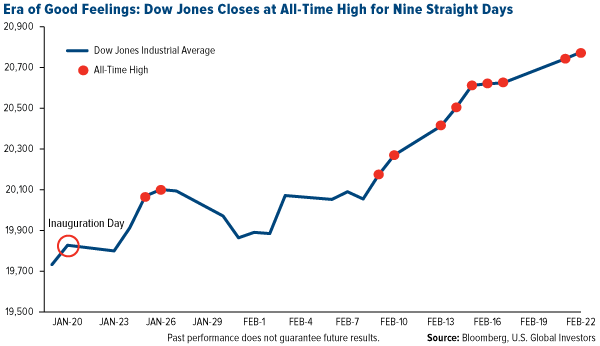

Thursday morning, Treasury Secretary Steven Mnuchin told CNBC that we could expect “significant” tax reform by August, including tax cuts for middle-income Americans and corporations. Like clockwork, the major stock indices rallied to all-time highs in intraday trading. As of yesterday, the Dow Jones Industrial Average has closed at record highs for the past nine days, and it wouldn’t surprise me if this gets stretched out to 10 days—or longer.

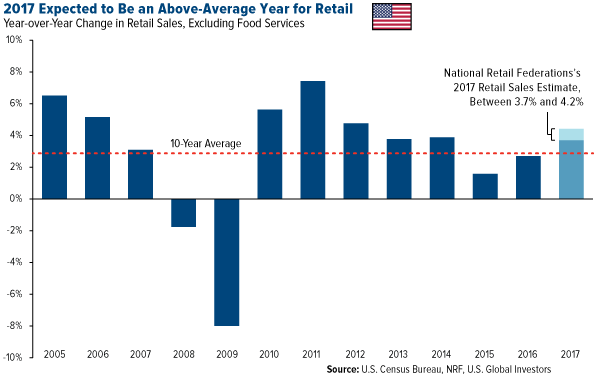

Investors aren’t the only ones jumping on the couch with joy, however. American consumers are expressing levels of confidence we haven’t seen in years, suggesting 2017 could be a banner year for retailers, who already saw a phenomenal year-over-year sales increase of 5.6 percent in January. This, of course, bodes well for the U.S. economy going forward, as consumer spending makes up an estimated 70 percent of the country’s economic activity.

Beside a host of positive economic data—low unemployment, strong household income growth—recent consumer polls and surveys show Americans feel confident about their financial prospects in the coming year and are ready to start splurging.

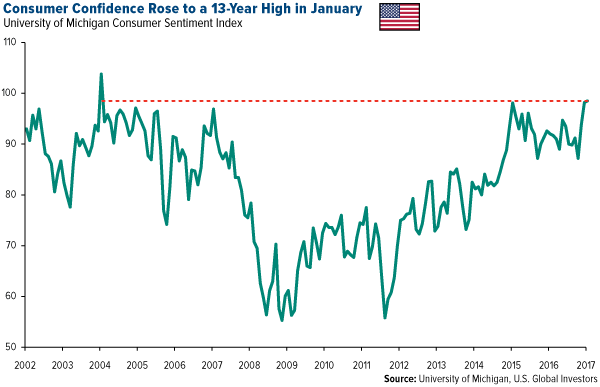

Consumer Exuberance at 13-Year High

The closely watched University of Michigan Consumer Sentiment Index raced up to a 13-year high in January, posting a final reading of 98.5. There’s little doubt that much of this exuberance stemmed from President Donald Trump’s pledges to cut and simplify taxes and deregulate businesses. Although the index cooled to 95.7 in February, this still bodes very well for retailers.

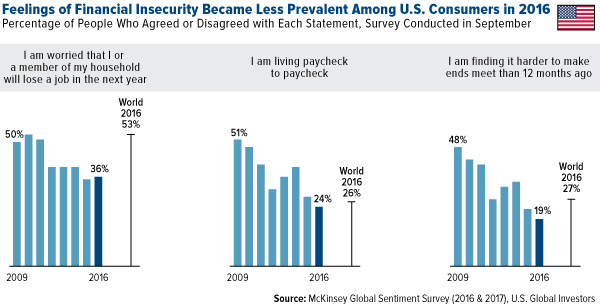

On Surer Financial Footing

According to McKinsey & Company’s recent Consumer Sentiment Survey, conducted online in September, more American consumers expressed feelings of stronger financial security than at any time in the past eight years. When asked if they were living paycheck to paycheck, for instance, less than a quarter said yes, compared to more than half of respondents who answered in the affirmative in 2009. In addition, fewer U.S. consumers said they were using money-saving strategies such as using coupons and loyalty cards or waiting for a sale before making a big-ticket purchase.

U.S. Among the Most Confident Countries

In the fourth quarter of 2016, American consumers were the world’s third-most confident consumers, according to Nielsen’s just-released Consumer Confidence Report. The country moved up an amazing 17 points during the three-month period, the most of any country in the 63-country survey. It was also one of only two countries representing Europe or the Americas to appear in the top 10, the other being Demark at number nine. By all measures, Americans were optimistic about the coming year. Six in 10 said now was a good time to buy the things they wanted, and intentions to spend on vacations rose 11 percent. Meanwhile, recessionary fears dropped dramatically.

| Score | Country | Change from Previous Quarter | |

|---|---|---|---|

| 136 |  | India | +3 |

| 132 |  | Philippines | 0 |

| 123 |  | United States | +17 |

| 120 |  | Indonesia | -2 |

| 112 |  | Vietnam | +5 |

| 110 |  | Thailand | +2 |

| 108 |  | United Arab Emirates | 0 |

| 108 |  | China | +2 |

| 107 |  | Denmark | 0 |

| 106 |  | Pakistan | +5 |

Before moving on, I must say that it’s incredible to see India retain the number one spot for the eighth consecutive quarter, despite the effects of Prime Minister Narendra Modi’s demonetization scheme in November.

Strong Retail Sales Expected… With a Caveat

All of this renewed optimism will translate, hopefully, into stronger retail sales. The National Retail Federation (NRF) projected 2017 sales, excluding automobiles, fuel and restaurants, to grow between 3.7 percent and 4.2 percent from 2016. This would put growth above the 10-year average of 2.9 percent and make it the best year since 2012.

The NRF tempered this enthusiasm, however, by pointing out the risks of Trump’s protectionist agenda, writing that “lawmakers should take note and stand firm against any policies, rules or regulations that would increase the cost of everyday goods for American consumers.”

This attitude was echoed by Walmart CFO Brett Biggs, who told reporters this week that he was most concerned about Trump and House Republicans’ plan for a border adjustment tax.

“Clearly anything that would potentially raise prices for our customers in the U.S. is a concern for us,” Biggs said, according to Business Insider.

This week, Trump met with eight retail CEOs, whose companies represent a combined $270 billion in sales in 2016. Two of these CEOs in particular, Target’s Brian Cornell and Best Buy’s Hubert Joly, voiced their strong opposition to a border tax, as it could significantly raise prices and dampen consumers’ feel-good mood.

With that said, I hope President Trump will make the right decision for American businesses and consumers, with respect to trade. Enthusiasm right now seems to be riding predominantly on tax reform and deregulation, and it’s at risk of being derailed by higher taxes at the border.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The University of Michigan Confidence Index is a survey of consumer confidence conducted by the University of Michigan. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money.

The online Consumer Sentiment Survey was in the field from September 3 to 27, 2015, and garnered responses from at least 1,000 consumers in each of 21 countries, plus another 1,000 consumers across the Middle East and 250 consumers in Taiwan. Because the survey was administered online, the sample largely reflects the characteristics of the typical online population—younger, urban, and more affluent.

The Nielsen Global Consumer Confidence Survey is an online survey of more than 30,000 respondents across countries in Africa, Asia-Pacific, Europe, Latin America, the Middle East and North America. It uses age and gender quotas to ensure the results are representative of Internet users. Scores above 100 indicate optimism.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2016.