-- Published: Wednesday, 15 March 2017 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The low oil price continues to wreak financial havoc on the largest oil producer in the Middle East. While the Mainstream press has published articles forecasting a rebound in Saudi Arabia’s financial outlook, due to higher oil prices this year, it seems like the Kingdom’s problems are just beginning.

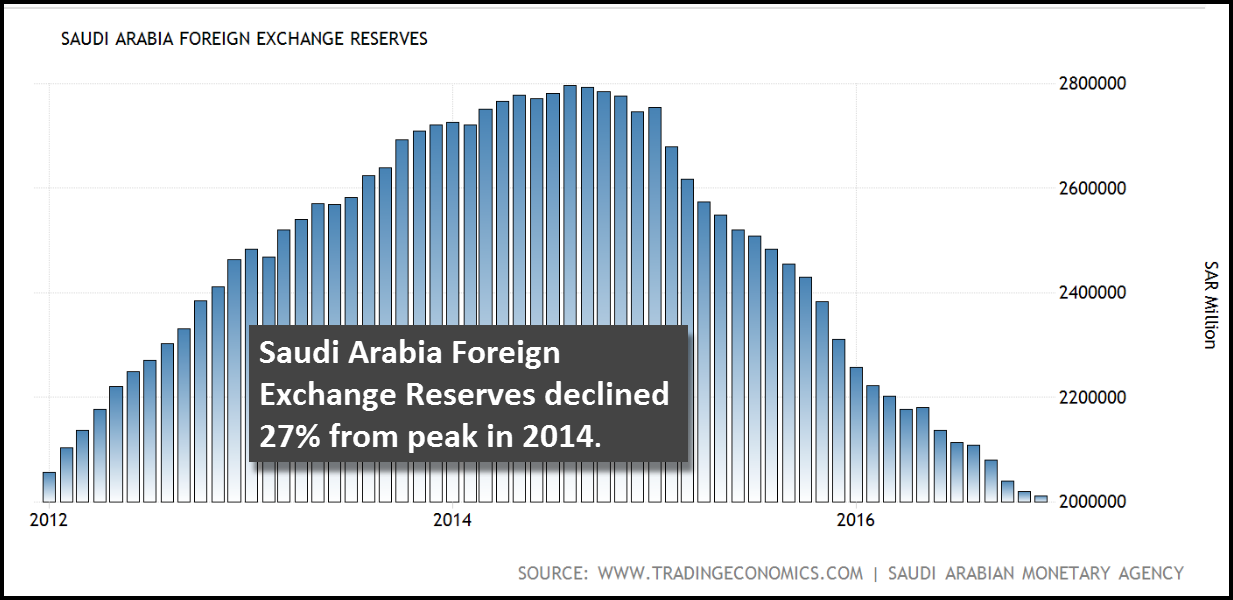

In order to make up for falling oil revenues, Saudi Arabia has been liquidating its foreign currency reserves at a pretty good rate over the past two and a half years. I discussed this in my article, Bankrupting OPEC… One Million Barrels Of Oil At A Time. In that article I published this chart:

Due to the rapid oil price decline, Saudi Arabia liquidated 27% of its foreign currency reserves. At its peak, Saudi Arabia held $797 billion in foreign currency reserves. In just two and a half years, Saudi Arabia’s currency reserves declined $258 billion (U.S. Dollars) to $536 billion currently (Dec 2016).

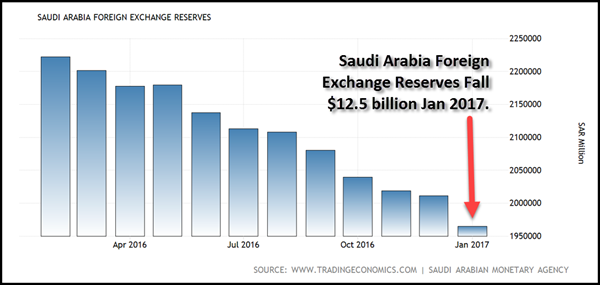

I also published the following chart showing Saudi Arabia’s foreign currency reserves declined in 2016, even as the oil price recovered from a low of $30.7 in January to a high of $53.3 in December:

Now, what’s even more interesting… is that Saudi Arabia’s foreign currency reserves took another BIG HIT in January, by falling $12.5 billion in just one month:

Saudi Arabia’s foreign currency reserves fell from $536.3 billion in Dec 2016, to $523.8 billion in January. The chart displays the figures in Saudi Arabia Riyal. They were converted to U.S. Dollars. This is a pretty good drop in just one month. Moreover, this occurred even as the oil price increased to $54.6 a barrel in January versus $53.3 in December.

I would imagine some would assume that this fall in exchange reserves may have been due to the recent Saudi oil production cut. While it is true that Saudi Arabia has cut oil production, as well as exports, this only accounts for a small portion of the $12.5 billion decline in foreign currency reserves.

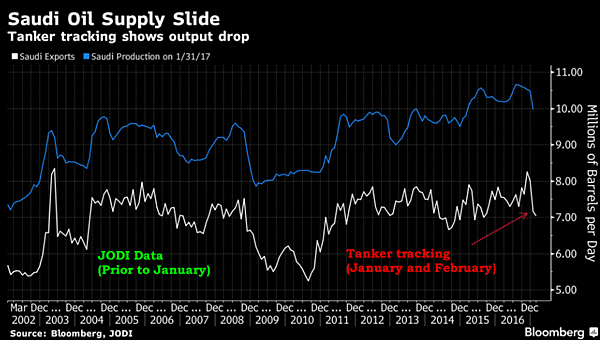

For example, according to the Bloomberg article, Saudi Arabia Oil Tanker Tracking Shows Exports Slide In February:

While Saudi Arabia has the ability to store crude — meaning that its exports aren’t perfectly correlated with production — a month-on-month decline in exports would support the country’s assertion it’s cutting back. Exports fell from about 7.16 million barrels a day in January, according to Bloomberg calculations based on industry standard cargo sizes.

Saudi Arabia exported about 7.64 million barrels a day in October, according to figures from the Joint Organisations Data Initiative. Riyadh-based JODI collates data including production and exports directly from countries. Shipments exceeded 8 million barrels a day in both November and December. The deal to cut supply took effect at the beginning of the year.

The article states that Saudi Arabia’s oil exports declined from 8+ million barrels per day in November and December, down to 7.16 million barrels per day in January. If we do some simple math, we have the following:

JAN 2017 = 1 million barrel per day cut x 31 days = 31 million barrels X $54.58 = -$1.7 billion

If we assume that Saudi Arabia was paid spot price of $54.58 for each barrel (they didn’t, they have long-term contracts), then they would have lost $1.7 billion in oil revenue for the 1 million barrel per day cut in exports in January. So, if we subtract the $1.7 billion in lost oil revenues in January from the $12.5 billion in foreign exchange reserve liquidation, there’s a difference of about $10.8 billion.

For whatever reason, Saudi Arabia had to sell off another $12.5 billion of its foreign exchange reserves in January to make up for lost oil export revenue. To make matters even worse, Saudi Arabia To Slash Capital Expenditures by 71%:

With the largest budget shortfall among the world’s 20 biggest economies, Saudi Arabia is planning more austerity measures this year. The kingdom will scrap projects worth more than $20 billion as it comes to terms with cheaper oil.

According to the Saudi government’s bond prospectus obtained by Bloomberg, capital expenditure is expected to fall to $20.6 billion (75.8 billion riyals) this year compared with $70.2 billion (263.7 billion riyals) in 2015. Two years ago, the country’s capital spending was $98.6 billion (370 billion riyals).

Saudi Arabia is in serious trouble if it has to cut its capital expenditures by 71% this year. In addition, the Kingdom is placing its hope on the upcoming Saudi Aramco IPO. Saudi Aramco values its assets at $2 trillion and its five percent initial offering could be worth $200 billion. However, Wood Mackenzie believes Saudi Aramco’s assets are worth much less…. 80% less. From the article linked above:

Now, analysts at Wood Mackenzie have conducted their own study of Saudi Aramco, and came up with a completely different (and much lower) figure. WoodMac puts Aramco’s true value closer to $400 billion, eighty percent less than the Saudi estimate, and it arrived at the figure by considering future demand and the anticipated average price of oil (on which profits will depend), as well as Saudi Aramco’s status as a state-run company.

If I had to choose between these two different asset valuations, I would probably side with Wood Mackenzie. I have read several of their reports and trust their figures over the Saudi’s as they are more objective. Regardless, if the oil price continues to decline, Saudi Arabia will likely have to liquidate more of its foreign currency reserves to fill in the gap from insufficient oil export revenues.

According to the data by the EIA – U.S. Energy Information Agency, Saudi Arabia’s oil export revenues fell nearly 50% from $247 billion in 2014 down to $130 billion in 2015. And the figures for 2016 were even worse. The EIA only has data for the first five months of the year, which reports Saudi Arabia’s oil export revenue was a measly $39 billion. Even though the oil price rebounded towards the end of the year, Saudi Arabia’s oil export revenue was probably less than $110 billion in 2016.

Investors need to keep an eye on the U.S. and global oil industries this year. If we do see continued weakness in the oil price, this could spell BIG TROUBLE for an industry that is the backbone of the global economy.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Wednesday, 15 March 2017 | E-Mail | Print | Source: GoldSeek.com