-- Published: Tuesday, 21 March 2017 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

With the Trump euphoria pushing the broader markets to new all-time highs, it has impacted precious metals demand considerably… especially in February. Precious metals investors believing the White House “Grandiose plans”, of making American great again, have cut back seriously on their precious metals buying.

There seems to be a percentage of the alternative community that believe Trump will actually put the U.S. back to the way it was in the 1960’s. And that is, back to a manufacturing powerhouse with high-paying jobs. While this would be a wonderful thing to do, the disintegrating ENERGY situation in the future just won’t allow it to happen.

IT WAS A ONE-TIME DEAL, and that period has come and gone…. FOREVER

Regardless, Western demand for precious metals declined considerably in February versus the same month last year. I used to spend more time publishing articles on gold and silver demand, but have refocused my analysis on how energy will impact the precious metals, mining and the overall economy.

However, Louis at Smaulgld.com does an excellent job publishing articles on precious metals demand. So, I have used some of his data and one of his charts.

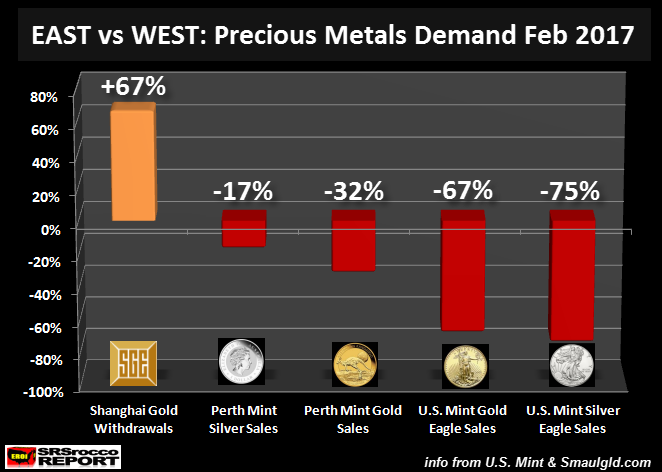

As I stated above, the Trump market euphoria has taken the wind out of precious metals buying recently. According to the data from Smaulgld.com and the U.S. Mint, sales of gold and silver have plummeted in the West (especially USA), but surged in the East:

As we can see, Shanghai Gold Exchange withdrawals surged 67% in February versus the same month last year, while Perth Mint silver sales declined 17%, Perth Mint Gold sales dropped 32%, U.S. Gold Eagles fell 67% and Silver Eagle sales plummeted 75%.

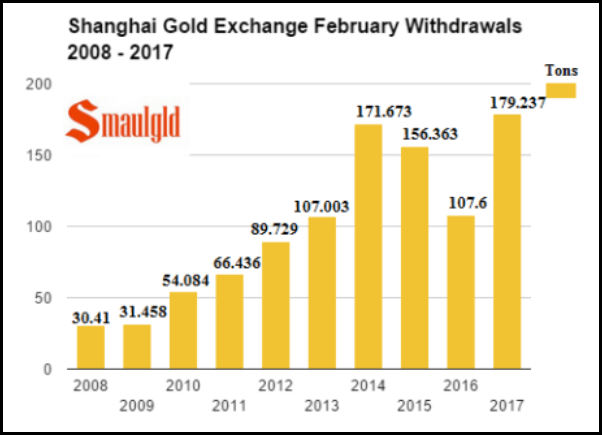

According to Louis’s article, Shanghai Gold Exchange February Withdrawals Highest On Record, he published the following chart:

Chinese Shanghai Gold Exchange withdrawals were 179 metric tons (mt) in February compared 107 the same month last year. Gold withdrawals from the Shanghai Gold Exchange are a pretty good proxy for the physical metal demand taking place in China. We must remember, global monthly gold mine supply is approximately 265 mt. Which means, Shanghai Gold Exchange withdrawals of 179 mt accounted for two-thirds of global gold monthly mine supply. That’s a heck of a lot of demand… from just one country.

If we tally up the decline in U.S. Gold Eagle and Perth Mint gold coin sales in February versus last year, they equaled 67,806 oz. However, Shanghai Gold Exchange withdrawals increased 2,315,000 oz in February compared to the same month last year. So, we can clearly see that the increase in just Chinese demand, via the Shanghai Gold Exchange withdrawals, more than made up for the decline in Western retail official cold coin purchases.

Unfortunately, the Royal Canadian Mint does not publish their Gold or Silver Maple Leaf sales until the end of each quarter. That being said, Canadian Gold and Silver Maple Leaf sales parallels what is taking place in U.S. Eagle sales. Thus, Gold & Silver Maple Leaf sales are probably down considerably as well.

I would imagine most precious metals investors came across this article published on Zerohedge a few days ago, Demand For Physical Gold Is Collapsing. It seems as if the intent of this article was to generate a lot of READS. Because, if we look at what is taking place in China, there is no collapse in physical gold buying. Matter-a-fact, there was a record amount of gold withdrawn off the Shanghai Gold Exchange last month.

The author of that article, needed to include a footnote stating the following:

Western physical precious metal demand (especially in the USA) decreased significantly due to the Trump Market Euphoria, while Shanghai Gold Exchange withdrawals hit a new record in February as the Chinese realize the U.S. economy and Dollar is still toast.

I am completely dumbfounded by recent decline in precious metals demand and sentiment in the West. While I can understand the reason precious metals investors believe Trump will make America great again, the future ENERGY DYNAMICS will not allow us to return to the good ‘ole days of a manufacturing super-power. Rather, the upcoming collapse will change our lives forever.

When the Dow Jones Index and broader markets finally crack, there won’t be too many SAFE HAVENS to invest in. Along with a collapse of the Dow Jones Index, Real Estate prices in all sectors will head down the toilet. Investors scrambling for something to protect wealth will move into precious metals. Unfortunately, there won’t be much available supply… only at MUCH HIGHER PRICES.

So, this current downturn in Western physical gold and silver purchases do not phase me one bit. It only indicates that most Americans are completely insane when it comes to sound fundamental investing.

IMPORTANT NOTE: I will be publishing an article on the continued disintegration of the Global Oil Industry. I provide data showing how Mexico’s national oil company, PEMEX, is literally BANKRUPT. By looking at the data, logic suggests that the global oil industry is in serious trouble.

Lastly, the data for the Perth Mint sales came from two articles at Smaulgld.com, Perth Mine Silver Sales Slump In February and Perth Mint Gold Sales February Drop 32%. Sales of Gold & Silver Eagles were found on the U.S. Mint website.

Check back for new articles and updates at the SRSrocco Report.

| Digg This Article

-- Published: Tuesday, 21 March 2017 | E-Mail | Print | Source: GoldSeek.com