-- Published: Monday, 3 April 2017 | Print | Disqus

By Bob Loukas

As the days and weeks continue to pass, gold is struggling to show us anything close to the strength seen during the 2016 rally. And the more gold continues to perform in a lackluster manner, the more I begin to consider that 2016 strength as a bear market counter-rally. If that were true, it would mean the action since the 2016 top is a continuation of the bear market that started in 2011!

Of course, gold has yet to fail in such a fashion, so there is still enough evidence to support the bear market ended over a year ago. And if the equity markets are near the top of an eight year bull market, then we could expect gold to outperform (inversely correlated) in the coming years. With the equity markets at fairly extreme levels, forecasting longer term, across varying asset classes, is difficult to do. Therefore, for the time being it is best we appreciate just how difficult and extreme the current landscape, rather than trying to force any one specific viewpoint dogmatically.

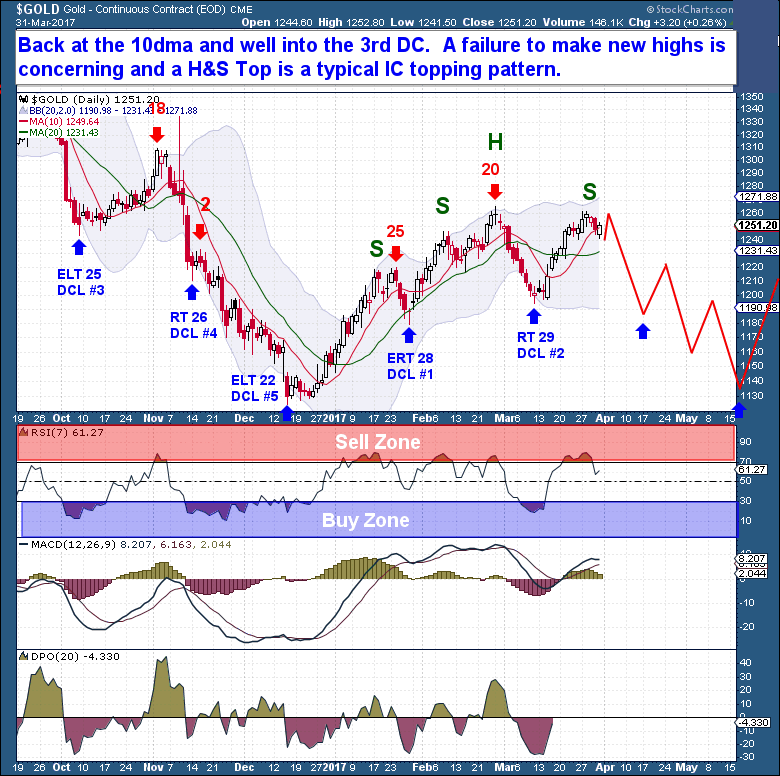

The Daily Cycle (DC) is still showing us somewhat of an uptrend, although gold remains barely above the 10-dma. The clear failure to make new highs in this 3rd DC cannot be ignored and such action is rarely bullish. In fact, most Investor Cycle (IC) tops occur from a similar profile, where the 3rd DC fails to better the 2nd DC in the early portion of the advance. Therefore, a failure to make new highs is concerning, because it leaves behind a H&S topping pattern, which then becomes the impetus for a multi-week, IC decline.

One point about the above gold chart is that we could still see a good spike next week that makes new 2017 highs. In such an event, I suspect the bulls will become concerned they’re missing out on a rally and jump onto the trade. In my opinion, this late in the Daily Cycle, that would be something I would completely ignore and view as a trap being set. After a few days of breaking out, I would in fact be interested in trading short the gold Cycle, once we see a confirmed closing Swing High.

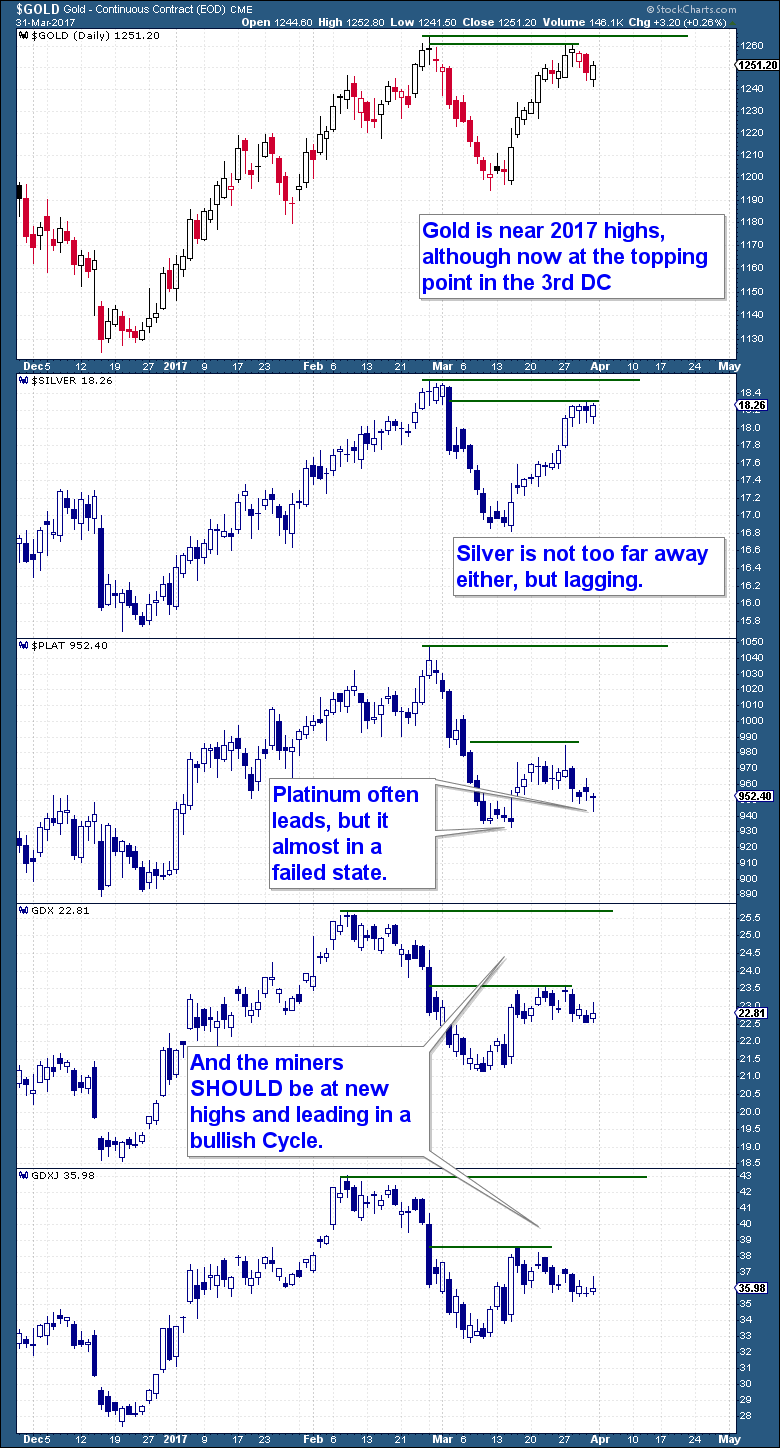

Besides the unfavorable Cycle counts, the main reason why I am now concerned with a Gold Decline is due to how the satellite assets within the gold Cycle are trading. For example, the precious metals miners and platinum generally lead the gold Cycle and are indicative of future performance.

In that case, they’re telling us a completely different story. Firstly, none of these assets made a 3rd Daily Cycle high, so we do not have a bullish confirmation. And in all the charts below, each asset is well below the 2nd DC high and trending lower already. I’m afraid to say that gold and these satellite assets never trade this way during a bull market uptrend.

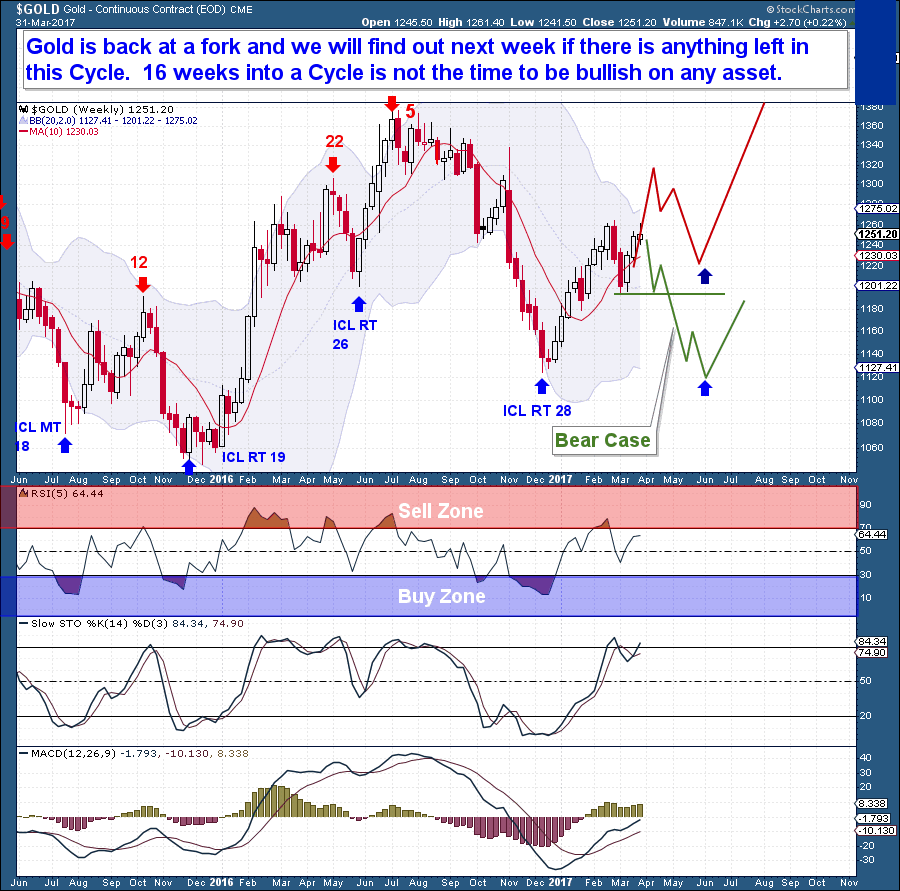

Based on the analysis I presented, we should consider that gold is now back at a fork. I believe we will find out next week if there is anything left in this Cycle, whether it wants to attempt to make a run higher for another week or two, despite the poor showing to date. Whatever the outcome though, be warned that upside gains in the intermediate term a likely limited.

Remember that 16 weeks into a (typical 20-24 week) Cycle is not the time to be bullish on any asset. Of course we do occasionally see situations where an asset surprises, despite the evidence. But in this case, I strongly caution all members to limit or cease their attempts to capture gains on the long side. It’s a time to play defense now, understanding that the best time to push the pedal is before week 10 of any Cycle.

https://thefinancialtap.com/#fintap

| Digg This Article

-- Published: Monday, 3 April 2017 | E-Mail | Print | Source: GoldSeek.com