-- Published: Thursday, 27 April 2017 | Print | Disqus

Source: Michael J. Ballanger for The Gold Report 04/26/2017

The tariff the Trump Administration plans to slap on Canadian lumber imports should lead to a further weakening of the Canadian dollar, a move that precious metals expert Michael Ballanger says can only help the bottom line of Canadian gold producers.

Over the past 40 years, the British Columbia lumber business has always taken great glee in plucking the chin hairs out of Uncle Sam's beard by legislating protection for its markets by way of subsidies and tax credits with political parties catering and pandering to the voting workers in an industry that dominates the provincial workforce ranking second only to agriculture.

Each time one of the grey bristles was plucked from that star-spangled beard, the Big Man would flinch and growl and wave his massive arm as if to swat away the irritant but NEVER would Uncle Sam do anything but make noise. Now, with news that the Trump Administration intends to slap a 24% tariff on Canadian lumber exports to the U.S., the first cannonball in the dismantling of NAFTA has sailed across the bows of the Mexican and Canadian frigates moored in the harbor of international trade.

The Canadian dollar has been smoked for a 0.65% haircut Tuesday and that trend is NOT going to end any time soon because of the old adage that "there is never only one cockroach"; these U.S. politicians will have a sitting duck target in their northern neighbors because Canada has absolutely zero leverage in the negotiations. With that, the Americans are bound to graduate from the obvious lumber bogeyman to other things like pipelines and banking and livestock, because once politicians see the popularity meter rising, they will seize upon this protectionist bandwagon like flies to manure.

As this movement gains popularity and as more and more Canadian export industries are revealed as targets by the media-hungry, tweet-crazy American Commander-in-Chief, the lower the Canadian loonie will go and the happier I will be as a shareholder of gold-producing Canadian companies.

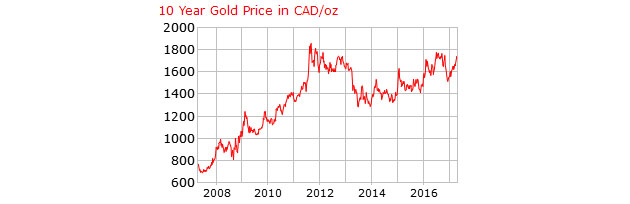

These two charts clearly illustrate how currency fluctuations have benefitted Canadian gold miners with particular emphasis upon those with Canadian mines and operations. They are selling a product sitting within CA$115 of the 2011 high while its U.S. counterpart is around US$639 from the same peak price. Everyone in the Canadian banking business loves a weak Canadian dollar because it invites all manner of foreign investors piling into Canadian assets with the prime recipient being real estate. Forget the impact it has on fruit and vegetables and orange juice, just buy a 1,500 square-foot house for CA$1,000,000 and your capital appreciation will cover the additional cost of living fivefold! Buy now and sell that starter home in six months for $1,400,000 to a Chinese family immigrating from Beijing with CA$10 million granted to them by an associate of the Communist Party with instructions to "own real estate."

However, it IS a tremendous earnings windfall for Canadian miners selling their products in USD while incurring all extraction costs in CAD. Furthermore, when one glances at the chart of the USD Index (shown below), it is painfully clear how the Trump Effect for "Make America Great Again" has now eluded the USD since the New Years Day peak and has been in a downward spiral ever since.

Currency debasement around the globe has created a "race to the bottom" in terms of purchasing power, which translates into monetary inflation of global dimension emanating from every central banker on the planet. Synonymous with this is the urgent call to suppress the precious metals while supporting stocks and bonds in the interest of "national security" in much the same manner that Germany and Japan did during WWII.

The problem with trying to fight the stock market and these innumerable interventions is that one should "never underestimate the replacement power of stocks within an inflationary spiral" or, in this case, a "reflationary spiral." As I have been raging about for at least the last 30 years, the only way I could earnestly short common stocks with absolute confidence would be if there was an implied "guarantee" that government would adhere to a sound money policy where currency debasement was punishable by way of life imprisonment. And as Kyle Bass said in Michael Lewis' "Boomerang," that will happen "when pigs fly out of your a--!"

About 11:00 a.m. Tuesday, I tweeted that I had "pinched both nostrils and bought 10,000 JNUG [Direxion Daily Junior Gold Miners Bull 3X ETF] at $4.32 with a stop at $3.98 and a $6.50 target with full knowledge that I could get stopped out before the end of the day. As it turned out, JNUG came off the canvas after a low of $4.26 and closed at $4.55 despite a late-day decline in gold prices.

Since the JNUG trades off the GDXJ [VanEck Vectors Junior Gold Miners ETF], I surmised that the RSI [relative strength index] being at around 30 is as good an entry level as you can get so I took on the JNUG to play the oversold bounce even though MACD [moving average convergence divergence] and histograms look like they need to do a little more work down here.

I am going to buy 30,000 JNUG into this pullback so it could be said that today I took a 1/3 position. I won't necessarily chase the bounce if it turns out that Tuesday was the low but I will add if they take JNUG down under $4.00 mid-week. Of course I will be heavily medicated and barricaded in my office by that point burning Washington Capitals figures dressed up like bankers and firing darts at pictures of our illustrious Prime Minister shaking hands with the Dalai Lama—you know—a NORMAL day for me when the metals are under attack.

I urge all Canadians to batten down the hatches because 76% of our exports go to the U.S. and if Uncle Sam decides to get tough with Canada, there is little the country can do except adapt to the changes. I have to laugh with the Canuck politicians threatening to sue the U.S. because they are violating the free-trade agreement but since that was a contract drawn up ages ago, I offer the immortal words of Ray Kroc, the thief who stole the immortal restaurant chain from the two original McDonald brothers, "Contracts are like hearts; they are meant to be broken." If the Americans decide to use Canada as the poster child for protectionist changes to American market access, there are going to be a great many broken hearts out there and they won't all be in British Columbia.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Michael Ballanger.

| Digg This Article

-- Published: Thursday, 27 April 2017 | E-Mail | Print | Source: GoldSeek.com