-- Published: Wednesday, 10 May 2017 | Print | Disqus

By Frank Holmes

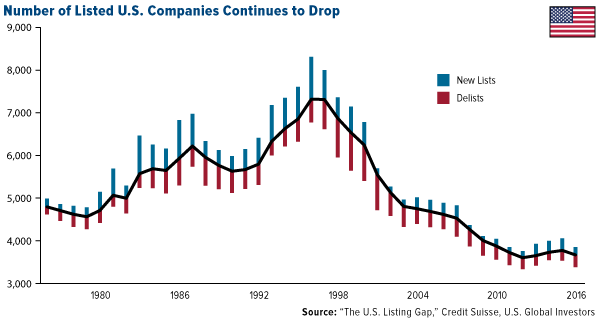

In the last 20 years, the U.S. stock market has undergone an alarming change that too few people are aware of or talking about. Between 1996 and 2016, the number of listed companies fell by half, from 7,300 to 3,600, according to a recent report by Credit Suisse. This occurred despite the U.S. economy growing nearly 60 percent over the same period.

click to enlarge

What’s even more flummoxing is that the U.S. seems to be the only developed country that lost so many stocks. Most other countries actually gained around 50 percent.

This matters because the U.S. stock market accounts for a little over half of the entire global equity market, meaning a huge (and growing) number of investors and fund managers now have fewer options to choose from than they did only a couple of decades ago.

So why’s the pool of publically-traded companies shrinking? We can point to a few different culprits.

For one, merger and acquisition (M&A) activity has strengthened in recent years, and when an M&A takes place, a company is consequentially delisted (if it was listed before the deal). The same thing happens, of course, when a company goes out of business.

Another reason could be the growth of private capital, which allows companies to raise funds without having to go public. Between 2013 and 2015, the amount of private money invested in tech start-ups alone tripled from $26 billion to $75 billion, according to consulting firm McKinsey. As a result, more and more software firms are managing to reach $10 billion in value before their IPO. Think wildly successful companies like Dropbox, Airbnb, Pinterest, Uber—all of which, for now, have avoided selling shares to public investors.

Unintended Consequences

My belief is that, out of all the reasons for fewer U.S. stocks and IPOs, the most impactful has been the surge in federal regulations over the last two decades. Rising costs associated with being listed on an exchange and meeting compliance standards have prohibited IPOs for all but the very largest U.S. firms. Small businesses—which, according to the American Council for Capital Formation (ACCF), account for more than half of all U.S. sales and 66 percent of all new jobs since 1970—are increasingly less competitive.

This partly explains why more and more companies are delaying going public. Back in 1980, Apple’s IPO came a mere four years after Steve Jobs, Steve Wozniak and Ronald Wayne founded the company in Jobs’ garage. Amazon waited only three years after Jeff Bezos founded it in 1994. Today that number has risen dramatically. It’s now estimated that the average age of a tech firm at the time of IPO is 11 years.

Some might disagree that regulations have had much of an effect on the U.S. equity market, but I believe the evidence is incontestable.

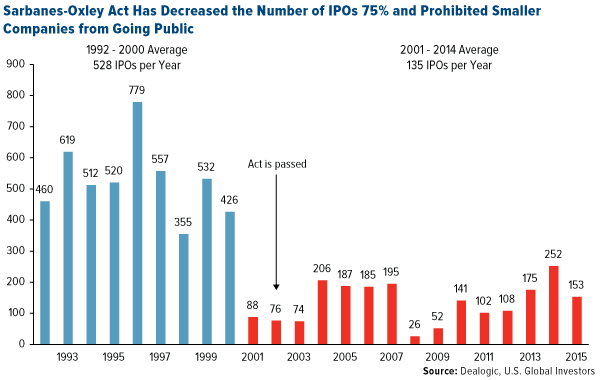

Consider the Sarbanes-Oxley Act (SOX), signed by President George W. Bush in 2002. Its goal, to prevent massive corporate fraud such as we saw from Enron and WorldCom, is an admirable one. But SOX has had several unintended consequences, as I’ve explained before. Because SOX’s requisite internal control procedures are so costly and cumbersome—necessitating additional compliance and accounting positions, not to mention hundreds of hours in compliance-driven tasks—smaller firms are inevitably at a disadvantage.

As a result, many small to mid-sized companies are delaying going public, or avoiding it altogether, to escape the regulatory burden. Before SOX, there were an average 528 IPOs a year. Since it was enacted, that number has fallen to 135, a decline of nearly 75 percent, according to Dealogic data. Last year, only 111 IPOs made it to market, a far cry from the 779 that took place in pre-SOX 1996.

click to enlarge

Other legislation has deterred even more companies from pursuing an IPO, including the Dodd-Frank Wall Street Reform Act.

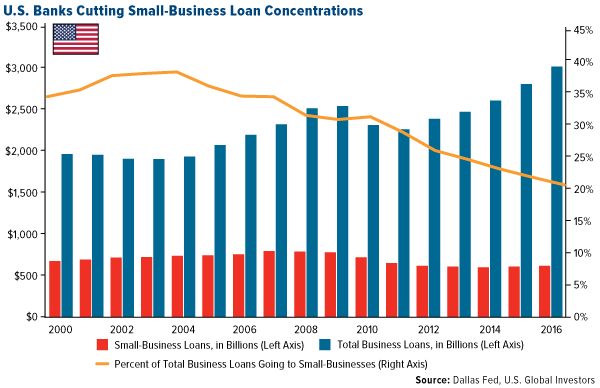

Consider also that small business loans have all but dried up for small businesses. In 2004, small business loans represented about 40 percent of commercial banks’ loan portfolio. Today, it’s closer to 20 percent, according to the Federal Reserve Bank of Dallas. This pullback in lending can be blamed on several factors, the Dallas Fed writes, “with regulatory burden among the most prominent”:

Large banks have indicated they are less likely to make small loans because the cost of processing a $100,000 loan is comparable to that of a $1 million loan. As a result, large banks have significantly reduced loans below a certain threshold, typically $250,000, or have stopped lending to businesses with revenue less than $2 million.

click to enlarge

It’s little wonder that, in an August 2016 survey conducted by the National Federation of Independent Business (NFIB), small-business owners said “unreasonable government regulations” were their second-highest concern, following “cost of health insurance.” More than 33 percent said regulations were a “critical” problem.

In another survey, this one conducted by the Center for Capital Markets Competitiveness (CCMC), nearly 80 percent of corporate treasurers, CEOs and CFOs said they had seen their business negatively affected by changes in the financial markets following the implementation of Dodd-Frank.

Relief Is Coming

But there’s hope. President Donald Trump has pledged to roll back many of the rules that have acted like plaque build-up in the heart of smaller companies seeking to expand. Just this week, the House Financial Services Committee approved a bill to begin gutting many of the provisions in Dodd-Frank. The S&P 500 Index edged up to close at a record high Friday.

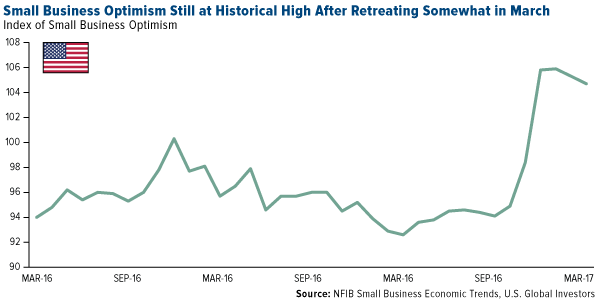

In December, a month after the election, the NFIB’s Small Business Optimism Index soared to 105.8, up from 98.4 in November, a 12-year high. Optimism fell somewhat to 104.7 in March, the most recent month of available data, but it still holds at historically high levels.

click to enlarge

Markets lately were beginning to lose faith in the president’s ability to deliver on a number of his key campaign promises. But after the House gave him a much-needed victory this week by voting to repeal Obamacare and Dodd-Frank, many small business-owners’ excitement about other Trump proposals such as deregulation and corporate tax reform is likely to be rekindled.

Until Trump can streamline regulations, however, it’s probably wise to focus on large-cap stocks, especially those that have an attractive dividend yield and are buying back their stock.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The National Federation of Independent Business’s (NFIB) Index of business optimism is based on responses from 1221 member firms.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2017

| Digg This Article

-- Published: Wednesday, 10 May 2017 | E-Mail | Print | Source: GoldSeek.com