-- Published: Sunday, 4 June 2017 | Print | Disqus

By Jordan Roy-Byrne CMT, MFTA

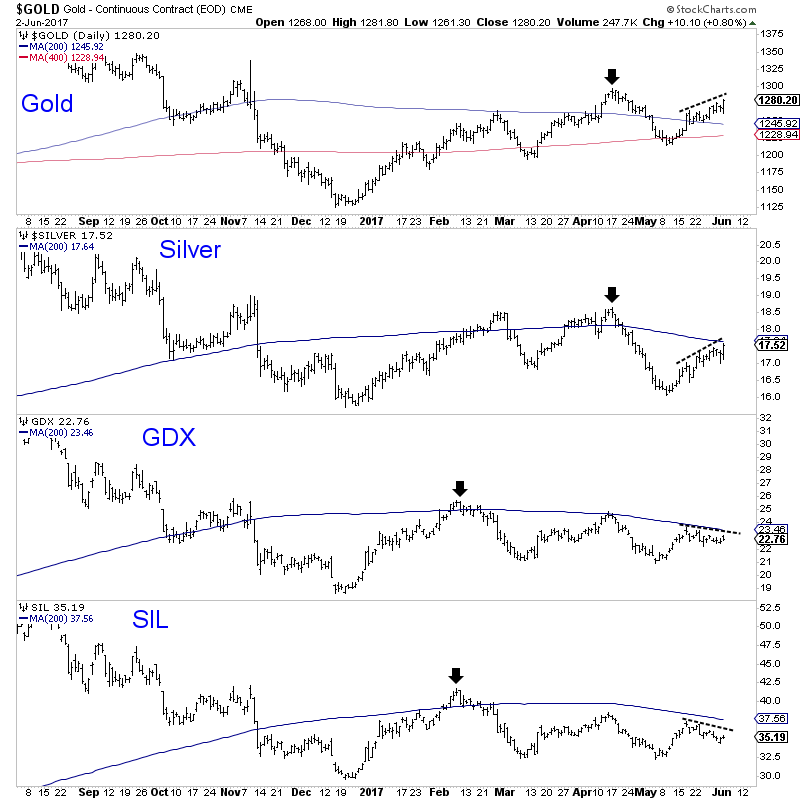

If looking at Gold only in a vacuum, it looks good. Its uptrend since the start of the year remains intact and it has pushed above its 50 and 200-day moving averages. It closed the week at $1280/oz and could test $1300 next week. But looks can be deceiving. Considering the US Dollar index closed at a 7-month low today, Gold is lagging a bit. Moreover, both Silver and the gold miners have not confirmed Gold’s recent rise. In fact, the miners are lagging the metals “bigly.” At the moment the miners are not so oversold but a reversal in Gold could be the catalyst that pushes miners to oversold extremes.

Both gold and silver miners are sporting another bearish divergence. The early April divergence (new highs in metals but not in the stocks) preceded a selloff into May and now we must be on guard for the May divergence causing a selloff in June. Since the middle of May both Gold and Silver have climbed higher while the shares (GDX, SIL) have not. The shares are again lagging the metals while Silver is again lagging Gold. These divergences are an obvious warning sign.

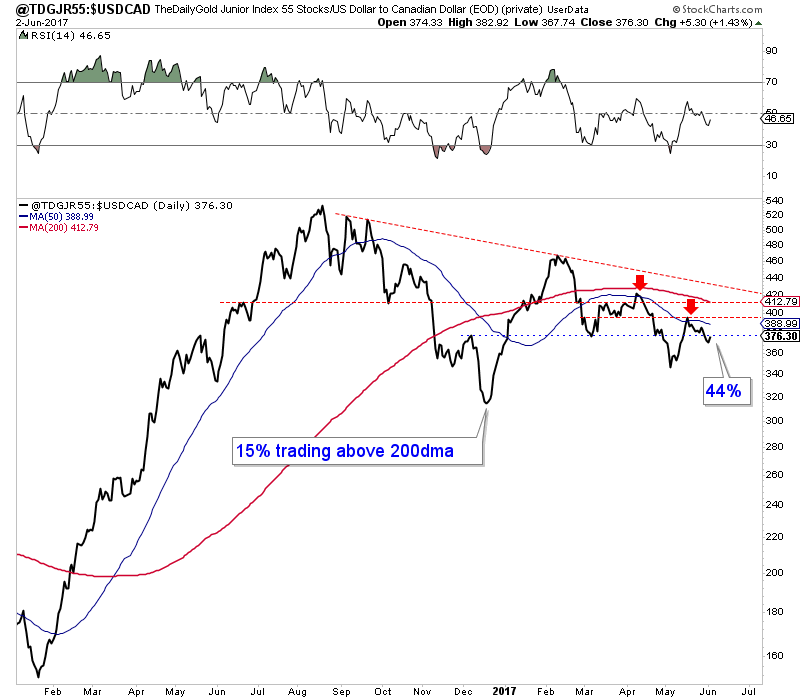

The miners and even the juniors are not so oversold at the moment and would be susceptible to losses should Gold form a bearish reversal soon. Here are a few factors to consider. The bullish percentage index (a breadth indicator) for GDX remains at 39%. I would deem anything below 20% as very oversold. Meanwhile, from our 55-stock junior index charted below, 35% of the stocks are trading above their 50-day moving average while 44% are trading above their 200-day moving average. That is a bit high considering the bearish technicals of the index, which remains below falling moving averages and has room to fall before reaching strong support.

We should note that because of the GDXJ rebalancing a number of “senior” juniors are nearing extreme oversold levels. Considering GDX’s proximity to its 50-day moving average, we estimate that GDXJ could be trading 5% lower than it should be due to the rebalancing. However, aside from some individual companies in the GDXJ, the gold mining sector is not that oversold.

Given the weakness in the US Dollar and strength in Gold, one would think the gold stocks would be trading materially higher. In our view, the relative weakness in the sector is not an opportunity but a warning that Gold could reverse soon. We’ve seen this movie before and it usually plays out negatively for the bulls. Unless taking advantage of “fishing line” type of declines in individual GDXJ stocks we think it’s prudent to wait for a lower risk opportunity. We continue to wait patiently as we expect lower prices and a good buying opportunity in select juniors at somepoint this summer. For professional guidance in investing in this sector consider learning more about our premium service including our current favorite junior exploration companies.

Jordan Roy-Byrne CMT, MFTA

Jordan@TheDailyGold.com

| Digg This Article

-- Published: Sunday, 4 June 2017 | E-Mail | Print | Source: GoldSeek.com