-- Published: Wednesday, 7 June 2017 | Print | Disqus

By Frank Holmes

With the U.S. dollar taking another hit last Friday on a weaker-than-expected jobs report, gold closed up 1.12 percent for the day today. A Bloomberg gauge of 72 junior miners, however, has lost 15 percent since the end of January, and the rebalance of the VanEck Vectors Junior Gold Miner ETF (GDXJ), which I previously wrote about, is also having a depressing effect on many gold names.

This was a major concern among investors at the International Metal Writers Conference in Vancouver, which I presented at last week. Despite gold gaining 9 percent so far this year, junior gold miners have not followed through with those gains as the GDXJ is set to cut in half its exposure to the junior mining space on June 16.

We’ve Only Just Begun

Other investors aren’t so pessimistic. Every year for the past 11 years, Liechtenstein-based investment firm Incrementum has issued its closely-read “In Gold We Trust” report. The 2017 edition, released last Thursday, raises a number of interesting observations that add some shine to gold’s investment case.

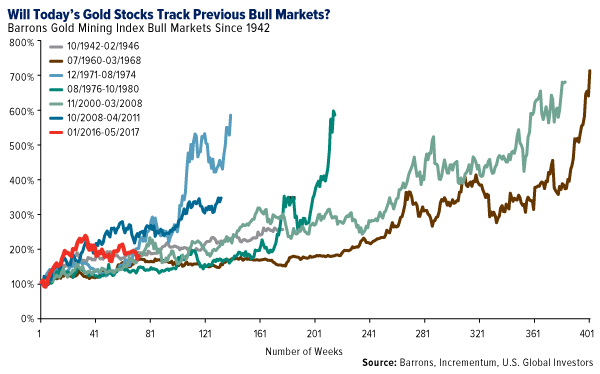

For one, its analysts firmly believe that gold’s price turnaround last year “marked the end of the cyclical bear market,” adding that “the rally in the precious metals sector has probably only just begun.” To illustrate this, the group tracked the performance of every gold stock bull market going back to 1942, using the Barrons Gold Mining Index. The bull market that began last year, highlighted in red below, does indeed look as if it has much more room to run.

click to enlarge

Among the reasons why “prudent investors” should consider accumulating gold and gold stocks now, according to Incrementum, are excessive global debt, the “gradual reduction of the U.S. dollar’s importance as a global reserve currency” and what the group sees as a high probability that the U.S. is close to entering a recession.

Interestingly, the investment firm shows that nearly every U.S. recession, going back 100 years, was preceded by an increase in interest rates.

“The historical evidence is overwhelming,” Incrementum writes. “In the past 100 years, 16 out of 19 rate hike cycles were followed by recessions. Only three cases turned out to be exceptions to the rule”—one in the 1960s, one in the early 80s, the last in the mid-90s.

The U.S., of course, is currently at the start of a new cycle, though the ho-hum jobs report for May—138,000 jobs added, versus expectations for 185,000—casts doubt on a rate hike this month. Nevertheless, Incrementum’s research makes a compelling case that a recession could be imminent, making gold even more attractive as a store of value.

As for gold stocks, Incrementum favors “conservatively managed companies which are not merely pursuing an agenda of growth at any price, but are instead prioritizing shareholder interest.”

This is an apt description of the kinds of gold companies we prefer—frugal, small- to mid-cap names such as Klondex, Wesdome Gold Mines, Kirkland Lake and many others.

http://www.usfunds.com/

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every invest.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 03/31/2017: Klondex Mines Ltd., Kirkland Lake Gold Ltd., Wesdome Gold Mines Ltd., VanEck Vectors Junior Gold Miners ETF (GDXJ).

The Barrons Gold Mining Index is the longest-running gold index, going back seven decades.

| Digg This Article

-- Published: Wednesday, 7 June 2017 | E-Mail | Print | Source: GoldSeek.com