-- Published: Friday, 9 June 2017 | Print | Disqus

By: Mark O'Byrne

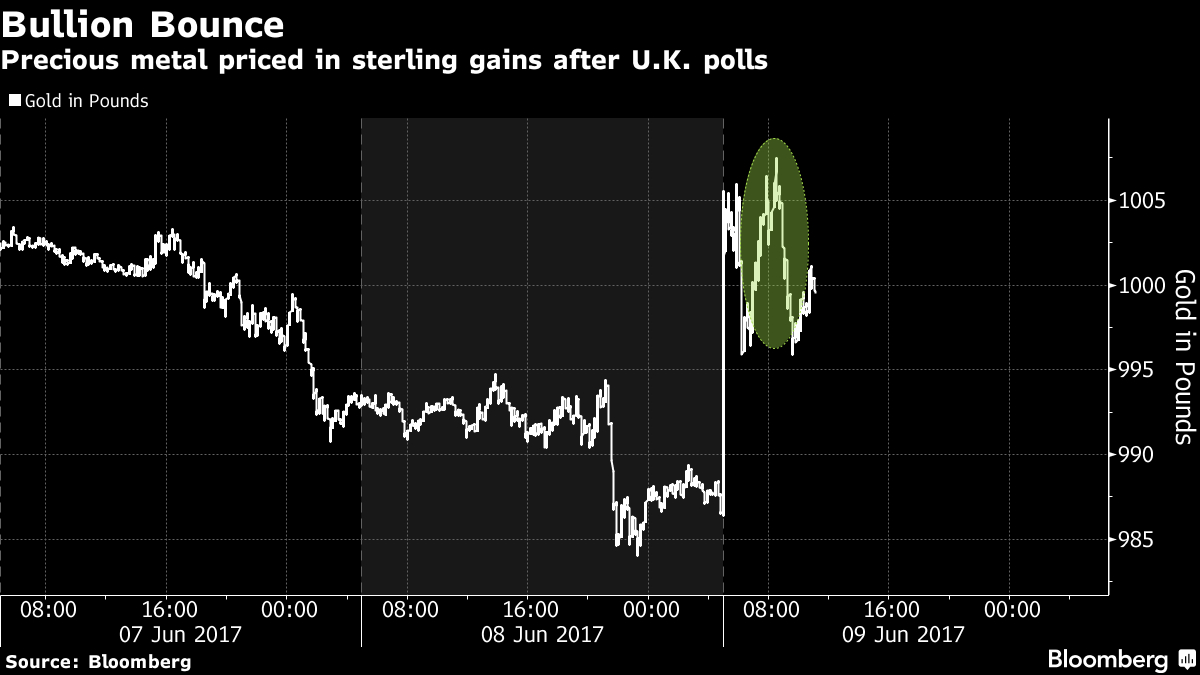

– Gold in pounds rises 1.5% from £986/oz to £1,001/oz after shock UK election result

– Gold reaches 7 week high and surges 6% in the last 30 days from £942/oz to £1,001/oz

Gold in pounds – 1 month

– Very robust gold sales experienced by gold brokers, including GoldCore, in the UK this week and today

– May’s ruling Conservative party loses overall majority and prospect of hung U.K. parliament

– PM May vulnerable from within Tory Party and Corbyn has called for her to resign

– Corbyn and Labour party on the rise which may pose risks to vulnerable London property market and UK economy as investor sentiment towards UK sours further

– Vote set to boost political turmoil in UK, complicate Brexit talks with EU whose hand is strengthened

As reported by Bloomberg News this morning:

Gold priced in sterling surged to the highest level in more than seven weeks as Prime Minister Theresa May failed to win an overall majority in the U.K. election, signaling further political turmoil less than a year after Britain voted to leave the European Union.

The outcome throws into doubt May’s future as prime minister just days before negotiations are due to start on the country’s exit from the EU.

Instead of increasing her majority to strengthen her hand in talks with European leaders, May has lost seats and the Conservative Party has fallen short of an absolute majority in parliament.

“The weakness in the pound has pushed up gold prices in sterling,” said Madhavi Mehta, an analyst at Kotak Commodity Services Pvt in Mumbai. “The pound has weakened amid prospects that the Brexit negotiations will be long and arduous.”

Spot gold rose as much as 2.2 percent to £1,007.52 pounds an ounce before trading at 1,002.34 pounds by 3:32 p.m. in Singapore. Bullion in the U.S. currency retreated 0.4 percent to $1,272.93 an ounce, extending its decline from a seven-month high of $1,296.15. It’s heading for the first weekly drop since early May.

The Conservative Party was on course to win 318 seats, down from 330 held at the start of the campaign and short of the 326 seats needed for an overall majority. Jeremy Corbyn’s Labour Party will take 261 seats, a gain of 29 seats, according to BBC projections.

The shock results came after a day when the European Central Bank kept interest rates unchanged and former FBI Director James Comey gave testimony to a Senate panel about meetings with President Donald Trump that centered on whether the president sought to quash part of a federal probe into Russian meddling in the 2016 election.

While bullion prices in dollar terms have come off seven-month highs, assets in the SPDR Gold Trust, the largest exchange-traded fund backed by the metal, have expanded to 867 metric tons, the highest level since December.

Full article on Bloomberg

Mark O'Byrne

Executive Director

| Digg This Article

-- Published: Friday, 9 June 2017 | E-Mail | Print | Source: GoldSeek.com