These missives that I construct periodically usually have as their genesis a "Eureka!" moment while reading a research piece or a written commentary from one of the thousands of self-styled market authorities or if I have the random luck of catching an interview on Bloomberg or (UGH!) CNBC. During a normal week, I will text myself a quick note or leave myself a voice note when and if an idea comes to mind so when I am travelling, it is usually preferable that I be close to a decent WiFi signal in order for my ramblings to be relevant.

During the past two weeks, I found myself swept up in a wondrous journey to the land of my ancestors and rather than bore you all with the bark and rings of my Family Tree, suffice it to say that walking through castles built in the 10th century that are still intact and more magnificent today than they were when constructed is, to put it mildly, awe-inspiring. Just walking up the side of the hill in front of the walls gives one a sense of just how dangerous it was to live and how important was the need for protection and strategic advantage. That is relevant to the topic of valuations in today's bond and stock markets as there has never been a greater need for that very protection and strategic advantage, so by merely looking at Rock of Cashel Castle, you get a sense of that urgency through the imagery.

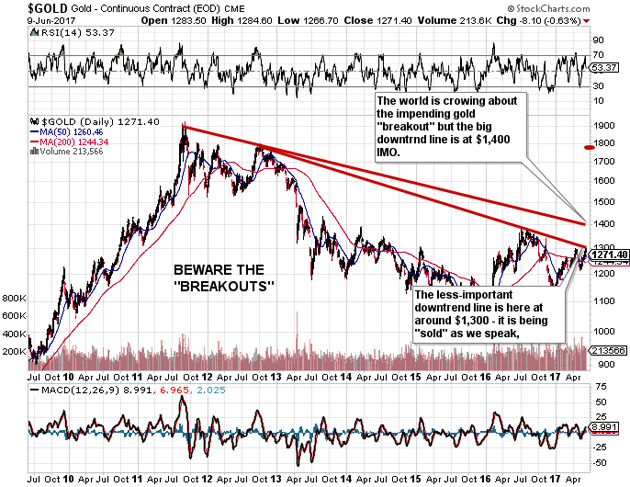

During the trip through Western England and Ireland, the only notes I could make were through photographs taken on my phone and after downloading 453 pictures to a 4-gig data stick, I took the time to go through them and, as I did, I was able to reclaim the thoughts I had as they related to gold, the gold miners and global markets. The larger story of the first week was that gold had "BROKEN OUT" above a six-year downtrend line and was now poised for a move of several hundred dollars to the upside. Sadly, as long as I have been writing this missive, I have contended that as valuable as technical analysis is for some markets and certain commodities, it is ineffectual for any and all markets that are "rigged." The markets that are "rigged" are defined as "all markets deemed important to the national security of the United States" and that means debt markets (bonds), equity markets (stock, ETFs), and precious metals (gold, silver).

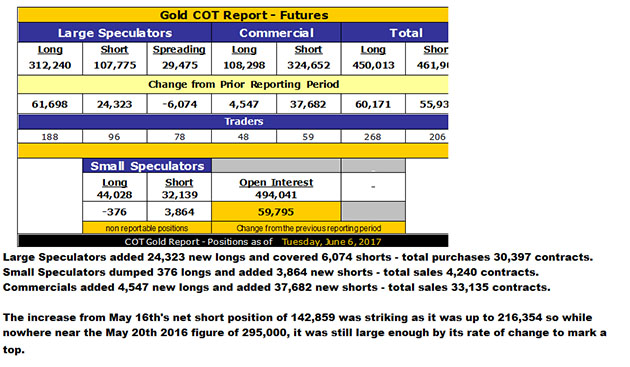

All three of these markets are targeted by the Working Group on Capital Markets ("Plunge Protection Team") with the first two (debt and equities) manipulated higher while the third (precious metals) is manipulated lower. The purpose of this is to insulate the almighty U.S. dollar from attack because to successfully undermine the U.S. dollar would undermine the fundability of the U.S. military and its propensity to protect nations abroad such as the U.K. and Japan. Now, since the U.S. dollar has been under pressure since the end of December 2016, these Interventionalists are intent upon keeping all markets levitated in order to insulate bank collateral from unexpected markdowns. So, with the world all rejoicing and in full voice, the siren of the majestic "Gold breakout!" was in no fewer than fifty separate commentaries that I have read since last Sunday and I watched as if it was a beer bottle sliding off the edge of a table in suspended slow motion as the Commercial Traders fed over 70,000 contracts out into a $50/ounce rise and capped the rally at exactly the point where the "technicals" turned "long term positive."

COT Gold, Silver and US Dollar Index Report - June 9, 2017 | GoldSeek.com

Whatever the rationale might have been for a "breakout," the memory-challenged algorithms trading the futures decided after the pattern-recognition software spit out a "BUY" signal, that they should pile into gold futures leading up to last Tuesday's 30,397 gluttonous buying frenzy. The Commercial traders under express instruction and guidance from their bullion bank masters at 33 Liberty (and at the Bank of Japan and the European Central Bank) did it again—they set up the trade like a Titleist 3 on the 18th tee at Augusta National. So here we sit at $1,271.40 after an assault on one of the downtrend lines drawn between $1,800 in late 2013 and the top last year at $1,380, and, once again, I beseech you to ignore any and all technical analysis when trading gold other than to recognize its importance to the bullion bank criminals that rig markets on a regular basis.

I have written about the ineffectiveness of technical analysis since 2001 with missives like "Sell breakouts; buy breakdown" (2013), "Trade and think like criminal" (2015) as well as a few others. When the net short position of the commercial traders undergoes a sharp and rapid change in response to a technical "signal," I will always "Follow the Commercials" (2015). Sell Breakouts; buy breakdowns – always.

Global markets have now moved into (what I believe is) the final, parabolic, public-entrapping vertical ascent that typically punctuate established trends with cataclysmic reversals. The problem I have with making such a bold statement is that the body bags are lined up at the side of the road with those that have fought this move firstly since the 2008 Meltdown and then after the 2016 U.S. elections.

The large banks with their supercomputers and unlimited cheque books have now successfully hijacked the markets and appear to have eliminated the need for protection while smashing volatility (the VIX) to a 9.5-11 range with only three harmless pops to over 15 since the Trump election. Their skillful suppression of all volatility by way of indiscriminate bludgeoning of the VIX has allowed the large portfolio managers to glide over the financial landscape completely unhedged such that current mantra is that to buy volatility insurance is a stupid way to shave points off your performance because the government-supported, bank-driven interventionalists have ensured that any and all dips will be bought.

In fact, that narrative forms the basis for my persistent warnings because it has been eight years since the Armageddon-like March lows in the S&P were made and with the exception of a couple of blow-offs, long-term stock and bond investors have been richly and abundantly rewarded not, however, by brains, but by extremely good fortune and loyalty to the central bank motto that they will do "whatever it takes" and they most certainly have done that.

The issue of "moral hazard" is now moot because politicians everywhere look to the role the central banks have played in rescuing a decayed and corrupt political and financial system and all they need to use as their benchmark is the S&P or the FTSE or the NIKKEI. With every central banker in "PRINT" mode with zero exceptions, my old and now VERY relevant phrase "One can NEVER underestimate the replacement power of equities within an inflationary spiral" has been the ONLY rule in my quiver of investment arrows to which I have adhered.

Valuations are now ridiculously aberrant; sentiment is outrageously complacent; and risks are spiralling into uncharted waters based on historical data, but—and this is an enormous "but"—the "invisible hand" has continued to save stocks and bonds and cap the rallies in the precious metals with astounding consistency. So, in the interest of the health and well-being of my favorite dog and the mental sanctity of my better half, I refrain from making big bets against the serial manipulators. In another life and in another era, I would be "balls to the wall" short this bloated pig of a stock market but trying to play this in a rigged casino where there has been ZERO chance of winning using conventional analytics has been and continues to be a mug's game.

Our beloved junior explorers as represented by the TSX Venture Exchange are now backing off despite (in some cases) positive results and rising gold and silver prices. It also doesn't help that despite new highs in global equities, base metals are now well off the highs of early February when copper traded up to $2.76/lb and zinc up to $1.345/lb. Copper has since retraced to $2.58/lb but zinc has undergone a mini-crash with the current price around $1.0988, which is an 18% correction. The amount of "heat" I took back in late March when I penned "Buy Precious, Sell Base (Metals)" is now rather irrelevant with gold having traded up from the date of the missive through $1,295 from $1,248 and zinc down from $1.25/lb. to under $1.10/lb.

While it was actually a call on the US dollar, it was, nevertheless, an on-the-money call but it hasn't benefitted anyone holding the junior explorers as my current darlings, Canuc Resources Corp. (CDA:TSX.V) ($0.375) and Stakeholder Gold Corp. (SRC:TSX.V) ($0.245) have retraced along with most of the other TSXV names. Both companies are fully funded and are a few short weeks from the commencement of exploration on their respective projects with CDA (market cap: $15.75 million) drilling the highly prospective silver-gold San Javier in northern Sonora while Stakeholder (market cap: $5 million) is drilling the Goldstorm project tied onto Seabridge's Snowstorm project in Elko County, Nevada. (The Canuc project at San Javier is under the direction of ex-Tinka V.P. Exploration John Nebocat [discoverer of the Ayawilca deposits] while Stakeholder's Goldstorm project is under the direction of ex-Newmont Mining V.P. Exploration Robert Cuffney.)

Finally, I know that many of you out there have been rendered "weary" by the length of time it is taking for the precious metals to break free from the shackles of intervention, collusion, manipulation and fraud. While I like to fancy myself as somewhat immune to the debilitating impact of the psychological poundings of capped breakouts and coordinated assaults, it actually DOES have an impact when I sit down to write these commentaries. There are only so many topics to discuss and when they all converge around the criminality of central bank and government management of the global economy and politics through the financial markets, the mind sort of "shuts down" in attempting to utilize creativity to get a point across.

However, my recent trip into the U.K. and Ireland allowed me to reflect outside of the warmth of my comfort zone upon the state of the global economies and based upon conversations that I have had over the past month in Bristol, Cheltenham, Dublin, Limerick and good old Oshawa, Ontario, the main focus for EVERYONE is housing. The main collateral in the portfolios of the global banking cartel has always been real estate and because the wonderchild financial engineers have found a way to lever up their balance sheets, the only way that another meltdown could be averted was to reflate the collateral.

Now, with housing bubbles being reflated everywhere, affordability is no longer important (in terms of carrying costs); all that matters is equity. As long as you bring enough skin into the transaction, bankers EVERYWHERE will allow you to step up to the wicket of land speculation and that is exactly what it is – rampant and blatant speculation.

In order to keep the flow of money moving in the direction of that all-important bank collateral, these timely interventions serve to train the millennial horde of selfie-snapping, Facebook-posting newbies that "Gold is bad" and that "Stocks, bonds, and housing are good" and only through this constant pounding in both actual and psychological warfare has the public narrative been able to reshape the accepted methods of inflation hedging.

While 40 years ago my mentors were busy reaping the rewards of sound money philosophies and practices through gold ownership in the late 1970s, today's synthetic narrative allows the new generation to abandon the historical use of precious metals in favor of cryptocurrencies and blockchains with little regard for the risk associated with the old adage that "Possession is nine-tenths of the law." Only through a cataclysmic confiscation by way of cyber warfare or attack will the sheer veracity of that adage be felt; only AFTER such an event will the true value of physical ownership and possession of gold and silver be truly appreciated and ACTED UPON.

In the meantime, my loved ones cower under beds and sheds, my friends look upon me with wonderment and pity, the dart board is filled with tattered pictures of CNBC anchors past (Simon Hobbs) and present (Brian Sullivan), and my ball-and-chain hammers stays beside me at the ready.

Such is the life of a seasoned and very stubborn gold and silver bull.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Canuc Resources Corp. and Stakeholder Gold Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Consulting fees for corporate finance work for Canuc Resources Corp. and Stakeholder Gold Corp. My company has a financial relationship with the following companies mentioned in this article: Canuc Resources Corp. and Stakeholder Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canuc Resources Corp. and Stakeholder Gold Corp., companies mentioned in this article.

All charts and photos courtesy of Michael Ballanger.