-- Published: Friday, 16 June 2017 | Print | Disqus

By: Arkadiusz Sieron

One of the most important economic debate today is whether the economy will experience reflation or deflation (or low inflation) in the upcoming months. Has the recent reflation been only a temporary jump? Or has it marked the beginning of a new trend? Is the global economy accelerating or are we heading into the next recession? It goes without saying that it is a key investment issue because of the implications for different asset classes, including the precious metals. Let’s try to outline the macroeconomic outlook.

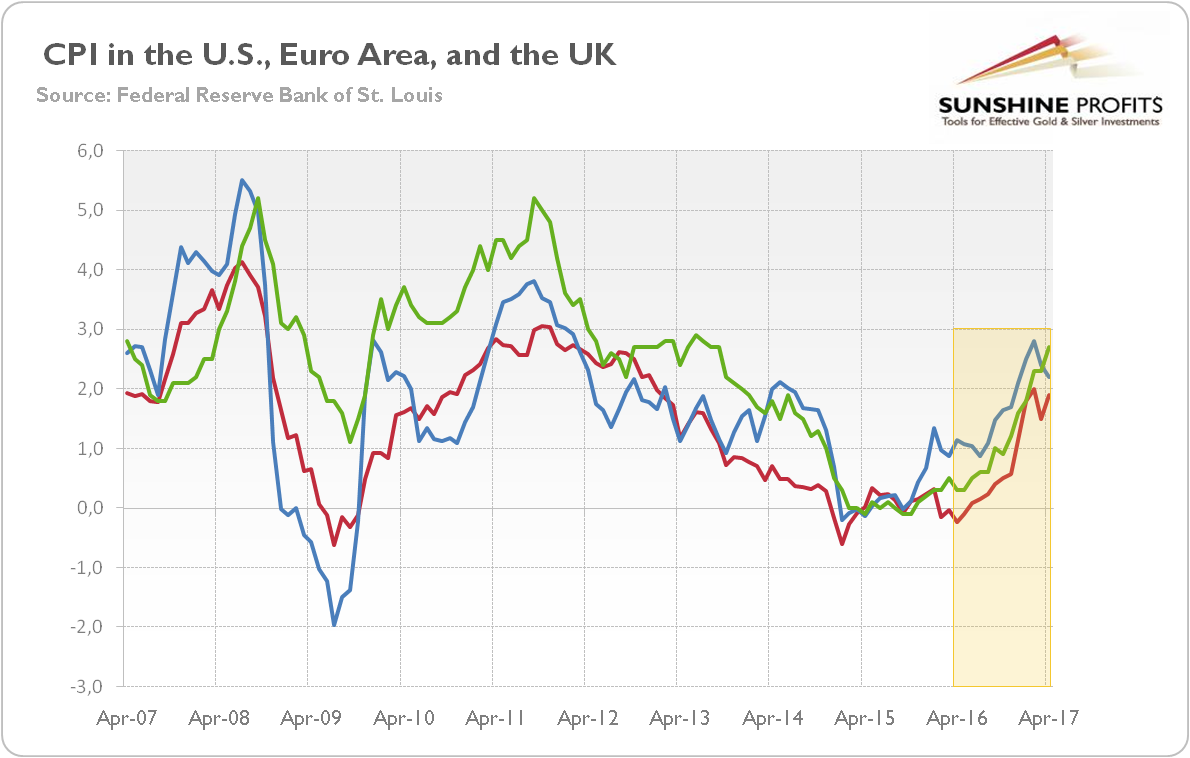

As one can see in the chart below, inflation has recently risen both in the U.S. and the euro area. And inflation in the UK has really accelerated recently. It’s true that there was a slowdown in the U.S. after a peak in February, but the level of inflation rates remains much higher than in 2014-2015.

Chart 1: The CPI rate year-over-year for the U.S. (blue line), the Eurozone (red line), and the UK (green line) over the last ten years.

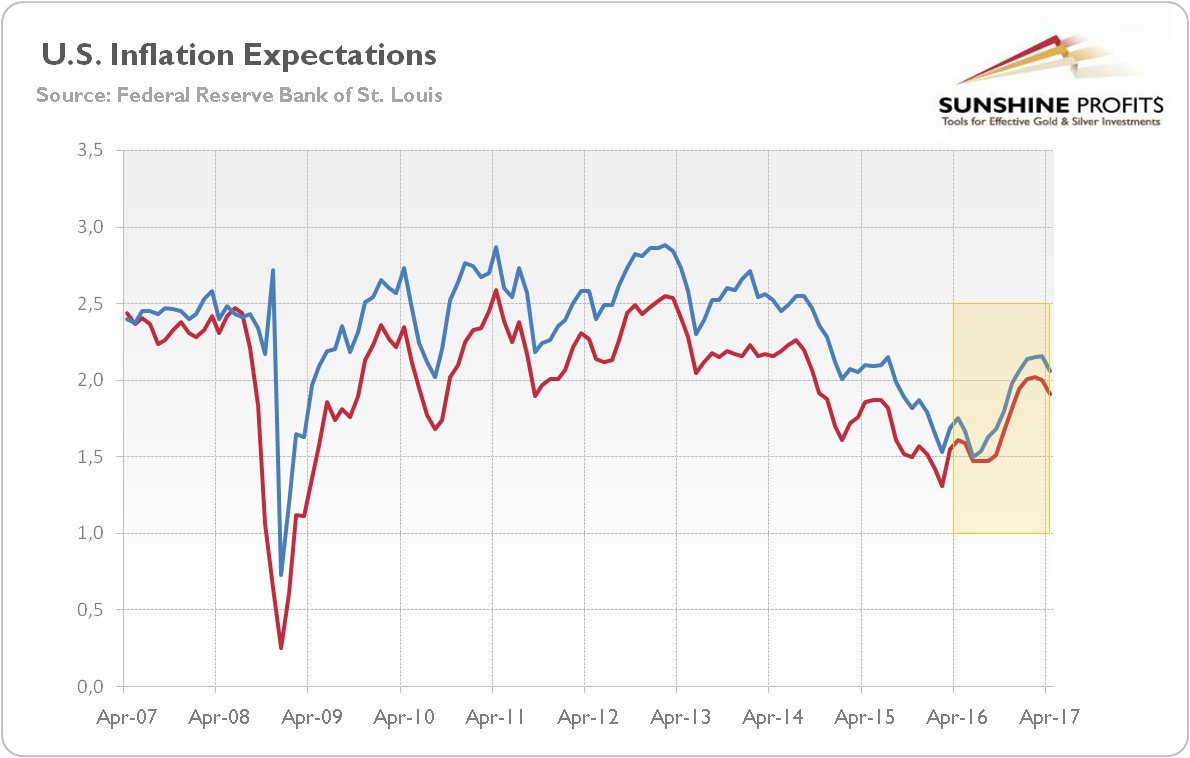

The same applies to inflationary expectations in the U.S. As the chart below shows, there was some pullback in expected inflation rate by the markets, but we do not anticipate a return to the lows of early 2016.

Chart 2: The monthly averages of U.S. spot inflation expectations derived from 10-year Treasuries (red line) and the forward inflation expectations derived from 5-year and 10-year Treasuries (blue line) over the last ten years.

Why do we believe that? Well, indicators of global growth have picked up since 2016. And worries about deflation in Japan and the Eurozone have practically vanished. Actually, Germany, which is Europe’s largest economy, grew 0.6 percent in the first quarter of 2017, accelerating from the previous year and outstripping other developed countries, including the U.S.

Admittedly, the American economy slowed in the beginning of the 2017, but there is the well-known seasonal adjustment bias in the U.S. GDP data. The growth rate remains solid and the official data should be much better in the upcoming quarters. Moreover, the rest of the world economy has been accelerating. The IMF upgraded its forecast for global growth in April. The world economy is expected to increase 3.5 percent this year, up from 3.1 percent last year.

Surely, there are risks to reflation. For example, Trump’s ability to deliver his proposed tax cuts is still under question – especially after latest political turmoil associated with Comey’s firing which can derail implementation of highly expected fiscal stimulus.

However, reflation is something bigger than expansionary fiscal policy (and the new administration may deliver something finally). Actually, last year, reflation started in China. We agree that China’s economic transition from export-led growth to a model based more on consumption and services may be turbulent and lead to an economic slowdown, fueling deflationary forces. There are some legitimate reasons to worry about the credit cycle in China, but the recent slowdown in momentum (the producer price inflation peaked in February 2017) may be only temporary pullback. In November, there is China’s National People’s Congress, and it is unlikely that the country will not meet its official GDP growth target set at 6.5 percent for 2017.

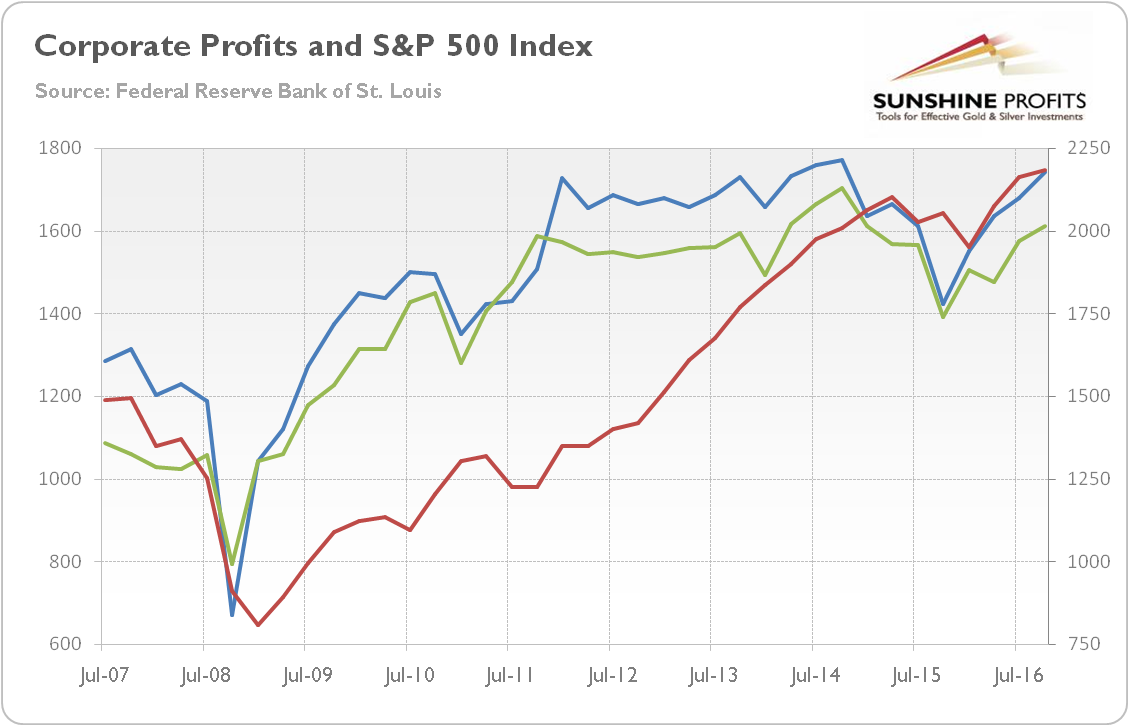

And one more thing: corporate profits. They have been accelerating since the end of 2015, when nobody even thought that Trump could become the POTUS and cut taxes. It shows that the reflation trade – although hit by vanishing optimism about quick implementation of Trump’s pro-growth agenda – is something more than blind faith in the new administration. Stock prices have rallied because corporate profits have also risen, as one can see in the chart below.

Chart 3: U.S. corporate profits after tax without inventory valuation adjustment and capital consumption adjustment (blue line, left axis, in billions of $), U.S. corporate profits after tax with inventory valuation adjustment and capital consumption adjustment (green line, left axis, in billions of $), and S&P 500 index (red line, right axis, index) between 2007 and 2016.

Summing up, after the burst of the 2008 global financial crisis, some investors started to worry about high inflation, while others feared of deflation. Neither extreme scenario has come to fruition – instead, the world entered a period of low inflation. In 2016, reflation has emerged, which got an additional boost after Trump’s victory in the presidential election. Recently, the faith in Trump’s ability to deliver pro-growth actions in a smooth manner has faded. However, it’s premature to abandon the reflation theme. Unfortunately, it’s bad news for the gold market. The acceleration in economic growth, but with inflation kept under control, would increase the real interest rates, putting downward pressure on the yellow metal.

Arkadiusz Sieron

Sunshine Profits