-- Published: Thursday, 6 July 2017 | Print | Disqus

Precious metals are “real assets” and “best defence” against bail-ins and cashless society in the economic crisis which is “on its way”

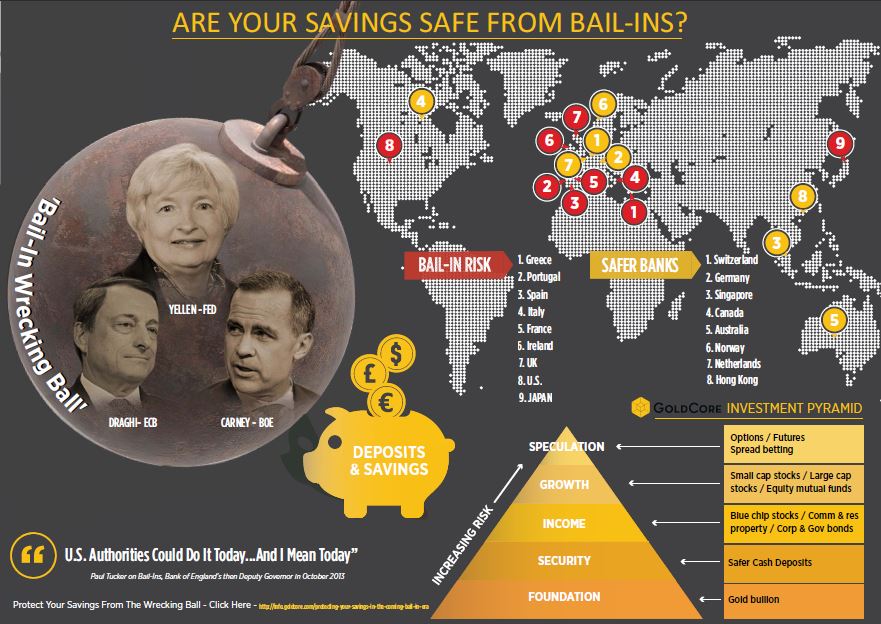

The risks posed to investors and savers from the coming economic crisis and the threat of bank bail-ins, negative interest rates, ‘helicopter money,’ capital controls and the “cashless society” has been looked at in an excellent and timely article by economist John Adams, writing in the Daily Telegraph.

While the article is focused on how these risks threaten Australia and Australian investors and savers, the risks outlined are ones which threaten even those with modest amounts of wealth and all exposed to the western financial system.

John Adams writes:

“Globally, household, corporate and sovereign debt are at unprecedented levels. They are also linked through a fully integrated global financial system and an array of complex financial derivatives.

Given the scale of the system, the probability of a global stock, bond and real estate crash, coupled with a wave of corporate, bank and sovereign defaults via rising interest rates, increases dramatically.”

“Worryingly, the monetisation of government and corporate debt, nominal or real negative interest rates, “helicopter money” (issuing freshly created money directly to citizens), bank bail-ins, capital controls and the eradication of cash through financial digitisation are all being contemplated by American and other international central bank officials.

Such measures seek to, in effect, trap citizens to keep their money in the financial system and to allocate their money into particular asset categories, thus preventing bank runs or hoarding which can occur when confidence in political, economic and financial systems collapse.”

…

“Thus it is up to individuals to think about what they can do to mitigate their own risks.

Eliminating all forms of debt, improving personal cash flow and maintaining cash reserves to guard against bouts of unemployment or to purchase cheap assets is best under a deflationary scenario.

Alternatively, acquiring real (or physical) goods or assets such as precious metals is the best defence to offset any loss of currency purchasing power, noting that the Governor-General has the legal power to confiscate personal gold holdings via Part IV of the Banking Act 1959.

Nevertheless, Australians must remain vigilant in the coming months and years ahead, conduct their own independent research and prepare themselves for a volatile unstable economy.”

Excerpts from Daily Telegraph Australia

News and Commentary

PRECIOUS-Gold steady as US policymakers split on rate hike outlook (Nasdaq.com)

Asia shares drop on Fed minutes, oil edges up after big drop (Reuters.com)

Asian markets adrift amid global uncertainty (MarketWatch.com)

US Mint June gold coin sales slide 92% year on year to 0.19 m (Platts.com)

Ex-Glencore traders aim to cut out middlemen with online concentrate platform (Reuters.com)

ANC mulls nationalisation of Reserve Bank – but says independence should be guaranteed (TimesLive.co.za)

May showed strong demand at 398.8 tonnes which is well in excess of global gold production at 269 tonnes per month. (Source: Goldchartsrus.com)

Central bankers are playing a giant game of Jenga with markets (MoneyWeek.com)

Steve St. Angelo: Prepare For Asset Price Declines Of 50-75% (ZeroHedge.com)

Illinois – Poster Child for the Coming Sovereign Debt Crisis (ArmStrongEconomics.com)

India tax hike could boost illegal bullion, jewelry sales (Reuters.com)

Keep Eye on Sovereign Debt for Next Minsky Moment (Bloomberg.com)

Gold Prices (LBMA AM)

06 Jul: USD 1,224.30, GBP 946.14 & EUR 1,077.51 per ounce

05 Jul: USD 1,221.90, GBP 945.87 & EUR 1,078.45 per ounce

04 Jul: USD 1,224.25, GBP 947.32 & EUR 1,078.81 per ounce

03 Jul: USD 1,235.20, GBP 952.09 & EUR 1,085.00 per ounce

30 Jun: USD 1,243.25, GBP 957.43 & EUR 1,090.83 per ounce

29 Jun: USD 1,246.60, GBP 959.88 & EUR 1,093.14 per ounce

28 Jun: USD 1,251.60, GBP 976.25 & EUR 1,101.91 per ounce

Silver Prices (LBMA)

06 Jul: USD 16.01, GBP 12.36 & EUR 14.09 per ounce

05 Jul: USD 15.95, GBP 12.36 & EUR 14.09 per ounce

04 Jul: USD 16.15, GBP 12.48 & EUR 14.23 per ounce

03 Jul: USD 16.48, GBP 12.72 & EUR 14.49 per ounce

30 Jun: USD 16.47, GBP 12.69 & EUR 14.44 per ounce

29 Jun: USD 16.83, GBP 12.98 & EUR 14.76 per ounce

28 Jun: USD 16.78, GBP 13.08 & EUR 14.78 per ounce

http://www.goldcore.com/us/

| Digg This Article

-- Published: Thursday, 6 July 2017 | E-Mail | Print | Source: GoldSeek.com