-- Published: Wednesday, 26 July 2017 | Print | Disqus

By: David Haggith

The Great Recession was so great for the only people who matter that it is time to do it all again. Time to shed those bulky new regulations that are like clod-hoppers on our heals and dance the light fantastic with your friendly bankster. Shed the encumbrances and get ready for the new roaring twenties.

The banks need to be able to entice more people into debt because potential borrowers with good credit and easy access to financing are showing no interest in taking the banksí current enticements toward greater debt. That could indicate the average person is smarter than the banks and apparently recognizes they are at their peak comfort levels with debt. The banks, on the other hand, want to reduce capital-reserve requirements in order to leverage up more.

Thus, President Trump, blessed be he, is working (in consort with the Federal Reserve) on cutting bank stress tests in half to once every two years and working to significantly reduce the amount of reserve capital banks are required to keep. He also wants to make the stress tests a little easier to pass. Such are the plans of his Goldman Sachs economic overseers to whom Trump has given first chair in various illustrious White House departments.

That should all go well. Why maintain a high bar on matters of national economic security? After all, we know stress tests are needless regulations because Alan Greenspan told us prior to the Great Recession that banks are naturally self-regulating for the obvious reason that self-preservation is in their own best interest. (Just like sharks in a feeding frenzy are more concerned about self preservation than about getting the biggest chunk of meat the quickest.)

Banksters in all their brilliance are, of course, applauding the changes as something that will boost jobs and expand the economy. Thatís the sales pitch for deregulation. The truth, of course, is that the banks want to leverage up more so they can invest more money in stocks now that the Fed has stopped QE and is even looking at rewinding QE. That is how banks make their money these days, since fewer people want to take on additional loans anyway. (Those they buy stocks from will also just reinvest in other stocks, continuing the cycle that has been going on since 2009.)

Not only are people sitting tight on loans, but with immigration tightening up there will be fewer new people to seek new housing and new loans down the road. Banks see this coming. Thatís the real reason the federal government long maintained loose immigration policy: more people equals more customers and more GDP growth and cheaper labor due to more and tougher competition in the labor pool!

(Full disclosure note: I am one of the oddballs that thinks we have enough people, thanks ó of any color or nationality, including my own. I love different colors and cultures (including my own); I just donít want more people. I donít agree with an economic foundation that is predicated on the unsustainable notion that you have to keep overpopulating and developing real estate forever in order to have a sustainable economy. Letís all become Mexico City in order to succeed forever and improve our standard of living? Thereís a worthy goal!)

We need to deregulate banks so the money will trickle down

Thatís the party line.

On the one hand, banks face a growing apathy toward taking on more debt in the general marketplace and a slower-growing marketplace. On the other hand, why should banks want to make loans that always have an element of risk anyway when the stock market remains virtually risk free under central bank guarantee? I mean, if youíre working with money given to you by the central bank, why not invest it all where that same central bank has your back, telegraphing to you that the stock market is where they want it invested?

Nevertheless, to get to where they have more money again to invest in stocks, banksters need to tout the goal of improving wages in the job market. Evidence of their real desire to boost jobs can be seen in Bank of America, the United Statesí second-largest bank. It is in the process right now of expanding its layoffs in order to streamline operations and boost profits to shareholders. It is also replacing higher-paid employees with lower-paid ones.

Wasnít the Fedís goal of bringing the job market up to ďfull employmentĒ supposed to translate into wage improvements for the middle class? Whatever happened to that central-bank objective? Who benefited more from the Fedís efforts to create full employment than banks to whom all the Fedís free money freely flowed? So, if you donít see it happening in banks, you wonít see it happen anywhere. And it clearly ainít happeniní.

Ah well, once again, money didnít trickle down. It got caught in the banksí multiple filters. The banksters, richer than they have EVER been, are actually working to reduce the amount they have to pay employees by getting rid of the more expensive ones so that the one percent who run the banks can be richer still.

Surprise! Money doesnít even trickle down when you are an employee closest to all the free money that is supposed to trickle down. (And it never will!) The Federal Reserve talks a good game about wanting to see wage growth and about being concerned about growing income disparity, but its member banks donít seem to be getting with the program. So, if the Fed cannot even persuade its member banks, after all these years of their recovery program, to improve wages in the lower tiers by giving them lots of free money to distribute, it certainly cannot persuade anyone else with less of a connection to the free money.

Obvious or what? Surely, you never really believed the upper crust would let wage inflation happen!

So, letís deregulate the banks all over again in order to improve jobs and help the economy grow! Letís buy into the same promise again Ö and again Ö andÖ.

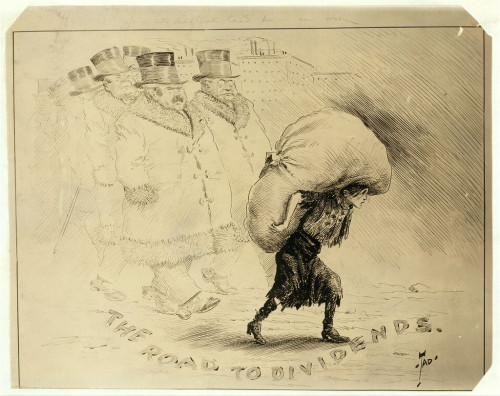

Now that the same banks are even more too big to fail, itís certain to be the last fandango this time. So, grab your favorite fat bankster while you can, and letís have us one big whoop-ass dance! Come on, Everyone! Of course, you will be expected to caddy all of his or her money on your back while you dance with him so he can enjoy the dance. You cannot expect a man or woman of such rotundity to carry a load when he or sheís so fat! And, who knows, maybe a single coin will spill out of that money bag this time and finally be yours! It could happen! Bet your life on it; bet your nationís life on it. If you shoulder the entire money bag on your back, there may be a coin spill out for you Ö maybe.

Some music to dance to with your favorite bankster:

(Enjoy the sample.)

The one coin that I hope will fall from their money bags:

(Enjoy the image)

And something to wear while you dance:

(Lightweight and breathes; makes it easier for you to carry more of their money on your back, and itís their favorite color, making it more likely theyíll pick you to dance with.)

David Haggith

http://thegreatrecession.info/

| Digg This Article

-- Published: Wednesday, 26 July 2017 | E-Mail | Print | Source: GoldSeek.com