-- Published: Sunday, 10 September 2017 | Print | Disqus

By John Mauldin

Just Get the Direction Right

The Future of the Global Economy

The Bubble of Government Promises

It’s All About Supply, Not Demand

Boston, Chicago, Lisbon, Denver, and Lugano

If you establish a democracy, you must in due time reap the fruits of a democracy. You will in due season have great impatience of public burdens, combined in due season with great increase of public expenditure. You will in due season have wars entered into from passion and not from reason…

– Benjamin Disraeli, prime minister of England, novelist

In any bureaucracy, the people devoted to the benefit of the bureaucracy itself always get in control, and those dedicated to the goals the bureaucracy is supposed to accomplish have less and less influence, and sometimes are eliminated entirely.... In any bureaucratic organization there will be two kinds of people: those who work to further the actual goals of the organization, and those who work for the organization itself. Examples in education would be teachers who work and sacrifice to teach children, vs. union representatives who work to protect any teacher including the most incompetent. The Iron Law states that in all cases, the second type of person will always gain control of the organization, and will always write the rules under which the organization functions. [Pournelle's law of Bureaucracy]

– Jerry Pournelle, prolific science-fiction writer, August 7, 1933 – September 8, 2017

This letter will be the first of a series in which I outline my vision for the next 5–10–15–20 years of global economics. I understand that there is a substantial amount of hubris involved in such an undertaking, so I will approach the topic gingerly.

Why even risk such prognosticating? As longtime readers know, I am actually writing a book on what I think the next 20 years will look like, technologically, geopolitically, sociologically, and economically. The book is called The Age of Transformation. The basic thesis is that we are going to see more change in the next 20 years than we’ve seen over the past century. Consider how much different the world will be if a century’s worth of change is compressed into the next 20 years.

If you do not resolve to adapt to that level of change in your life and in the lives of your loved ones, you will not be ready to fully participate in the society of 2038. You’ll also fail to reap the full rewards of all the years of hard work and dedication you have put in, preparing for your retirement.

This series on the future of the global economy will shape my outline for the last 25% of the book. The book will expand greatly on this series. I feel comfortable opening up my thought process to you, and I welcome the feedback I’m going to get, because it will only improve the book. Thoughtful comments from friends are always welcome.

The first 40–50% of the book will focus on the technological and biological transformations that will happen in the next 20 years. In general, that is the rainbows and puppies section of the book. There are any number of books out there that deal with this broad topic in different ways, but nearly all of them have a somewhat techno-utopian slant. And for good reason. Living longer and healthier in a world of greater abundance, where the things we want cost less? What’s not to like?

The next 25–30% of the book will deal with the geopolitical/sociological/demographic changes that will inexorably force themselves on us in conjunction with this technological revolution. Some of those changes will be a reaction to the very technological forces that are driving the change. This section will conclude with the most difficult chapter of the book, the one that I have wrestled with the longest over the last two years, the chapter on the future of work. For some of us that will be quite a bright future; for others who are unable to adapt, not so much. Globally, hundreds of millions of jobs that are currently filled by humans will simply not require humans in the future. We will have to move on to other occupations.

This level of labor transformation is nothing that we haven’t done in the past. Many of you will recall that 80% of Americans toiled on farms in 1800. Today that number is less than 2%, who produce massively more per capita in much better conditions. But that change played out over more than 10 full generations. The changes I am talking about are going to happen in less than one generation. The transformation of employment will be one of the most difficult social and political problems that societies all over the developed world will face. It’s not just that there won’t be jobs, but that many of the new jobs will require different sets of skills and be in a different locations from where many of us live today. And while our ancestors may have set out boldly from other corners of the world to give America a try, never to see their home-countries and loved ones again, that propensity for relocation seems to have diminished in present-day culture. How many Americans relish the notion of moving from region to region anymore?

The last section of the book will deal with the future of the global economy. And there we have some issues, as my kids would say. I don’t think we end up in some techno-dystopian, cyberpunk Blade Runner-type world, but the tools we use to measure the economy and the things we are measuring are going to experience a great deal of volatility. Depending on which side of the volatility you find yourself on, it may be either extraordinarily beneficial or harmful. The purpose of my book will be to help you see the general direction and power of the unfolding transformations, so that you can adapt your strategies for the benefit of your family, friends, and businesses.

The massive amount of research that I’ve had to work through has forced me to change my opinions more than a few times as I’ve waded through material and prepared to put words on the screen. I’m deeply grateful to the 120 volunteer researchers who gave me literally tens of thousands of pages of material to read and sort through on an extraordinarily wide variety of topics.

I am ultimately optimistic, and the book itself will be optimistic about the future, but there are difficulties that we as a society will face. We will have to devise different, and in some cases heretical, ways of operating in order to bring the benefits of transformation to as many people as possible in our global society. Make no mistake, political turmoil lies ahead. The current dysfunction in Washington will seem almost quaint, by comparison, as the country and the world lurch from one vision of the future to the next.

Just Get the Direction Right

In trying to predict the future, I feel like a Daniel Boone sort of explorer, leading a band of compatriots through the wilderness; and we come to the top of a new pass and peer into the distance. Way off, 50 miles away, there appears to be another pass in the direction we want to go. The problem is that, between here and there lie more mountains, valleys, rivers, and potentially hostile natives. It’s not clear how we get there from where we’re standing. So our intrepid team plunges on, trusting that our instincts and skills will take us to that far-off pass, and then to the next one beyond that.

Now we’ve just reached the top of that pass, and we’re peering far into the blue distance. I’m just trying to get the direction right. The actual path we’ll take is still a great unknown.

With that thought in mind, let’s survey the main forces that will drive the future of the economy, and in the coming weeks we will dive more deeply into each of those forces. What we learn will serve as the backbone for the final section of the book, which I will write in the coming weeks.

The Future of the Global Economy

Right up front, I’m going to utter the four most dangerous words in economics: This time is different. Oh, I admit a lot of things will be the same, but anyone who expects the future to look like the past is in for a rude awakening.

There are three main economic forces that are imposing themselves upon the world, whether we like it or not. Two of them are the largest bubbles in the history of man.

1. The bubble of global debt

2. The bubble of government promises

3. The shifting of the supply curve

I know longtime readers will be familiar with the first two, but the last one is going to have a few of you scratching your heads. Let’s take up each briefly.

There is considerable debate over the exact amount of global debt. You first have to find it, and parts of it get hidden in many out-of-the-way pockets. But broadly speaking, global debt is about 325% of GDP, and likely over $225 trillion as I write. (I am assuming that over the last nine months debt grew at roughly the same rate as in the preceding nine months, even though we know the growth of debt has been accelerating.)

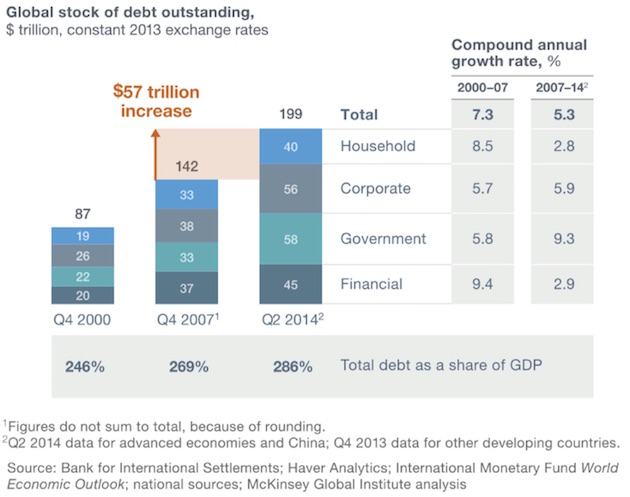

This chart from McKinsey is almost three years old, but it does show the growth of debt over time, and we know that global debt has grown by about $26 trillion in the last two years.

The above chart requires a few observations. First, notice that the growth of household and financial debt has decelerated. Corporate debt continues to grow at roughly the same pace as before. The real acceleration of growth in debt is coming from government borrowing. Second, we are on a pace to grow the debt by significantly more between 2014 and 2021 than we did in the previous seven years. Last, global debt is growing faster than global GDP. We are borrowing money faster than we are creating wealth.

US government debt is about 100% of GDP, or $20 trillion, and growing around $1 trillion a year. Forget what they say when they talk about budget deficits. They lie, because they don’t want to admit what the true deficit is. However, you can determine the true deficit simply by looking at the amount of money the Treasury has borrowed at the end of the year and see that another $400–$500 billion of “off-budget” debt has been added. If I ran my regulated investment businesses with the same sort of spurious accounting, the SEC and a raft of other agencies would shut me down faster than you can say “MD&A” and ban me forever from participating in the financial industry. As they should. You simply cannot lie when you have a public trust. Well, you can’t unless you are Congress and the government. Then you can pass laws that allow you to lie. But I digress.

To be able to compare our debt to that of other countries, we have to include state and local debt, which is another $3 trillion. That means total US government debt is 115% of GDP. That is certainly less than the 250% of debt-to-GDP that Japan finds itself saddled with, but Japan does offer us a clue as to how we are going to have to deal with our burgeoning government debt in the future. If you had told me 10 years ago that Japan could essentially monetize well over 100% of their GDP and not have their currency fall through the floor, I would have laughed at you. (I know, I know, monetize is not the correct technical term, as the Bank of Japan is simply buying the Japanese debt and putting it on its balance sheet.) Since the yen didn’t collapse, we start having to look for other causes and effects. We will get into that in later letters.

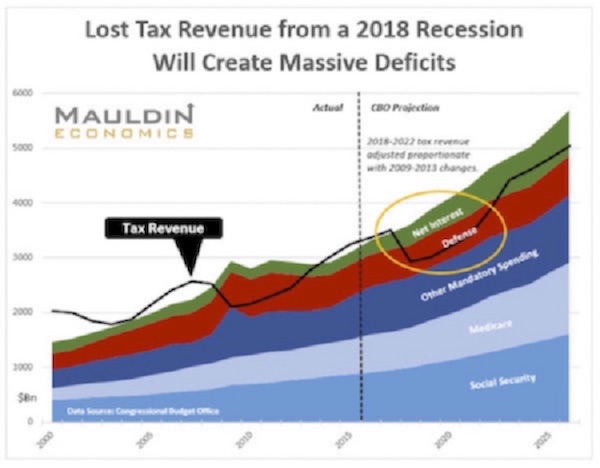

When the next recession blows in, it will likely balloon the US government deficit up to $2 trillion a year. The Obama administration took eight years to run up a $10 trillion debt after the 2008 recession. It might take just five years after the next recession to amass the next $10 trillion. Here is a chart my staff created in late 2016, using Congressional Budget Office data, that shows what will happen if the next recession comes in 2018 and revenues drop by the same percentage as they did in the last recession (without even counting likely higher expenditures next time). And on top of the $1.3 trillion deficit that this chart predicts, you can add the more than $500 billion in off-budget debt that I mentioned above, plus higher interest rate expense as rates rise. I will update this chart for the book and later letters, but it gets the general direction right.

By the early to mid 2020s, barring substantial increases in taxes or reductions in government benefits and entitlements, the deficit will be approaching $2 trillion annually. There will be weeping and wailing and gnashing of teeth.

If you are in the top 25% of income earners in the United States, you have a big target painted on your income and wealth. The imposition of a VAT seems almost guaranteed, as that is the only real way to boost revenues to offset the increases in entitlement spending. And because the Republicans don’t want to impose a VAT now as part of major tax reform, it will end up being imposed by a future Democratic administration and congressional majority that will not be interested in reducing income taxes. I cannot believe the shortsightedness of the Republican Party leadership, with their futile belief that somehow or another they are going to develop a “pure” Republican majority that will look like the current conservative bloc. Their intransigence is the main reason that things can’t happen in DC. You can simply look at the demographic trends and political forces at play and understand that they’re not going to budge on a VAT. Sigh.

We will go into the debt bubble in greater detail, but it is the next bubble that will drive macroeconomic change in the US.

The Bubble of Government Promises

The US government balance sheet features unfunded liabilities in the range of $80 trillion to $200 trillion, stemming from future entitlement program burdens that are, in effect, government promises of future largess. No constituency is going to vote to reduce their entitlements. (Well, other than the very well–off, who don’t actually need those entitlements.)

Unfunded pension liabilities at the state and local levels have swollen to roughly $4–$6 trillion in the United States. And that may be understating the severity of the problem.

It’s easy to cite Illinois or New Jersey, but let’s look at a state like Kentucky. The State of Kentucky released a remarkably candid self-appraisal of their pension liability issues earlier this year. The report makes for very sobering reading if you are a resident of Kentucky. If you optimistically (and unrealistically) assume between 6.75%–7.5% compounded returns for the future, Kentucky still ends up $33 billion underfunded. To bring that number into focus, total State of Kentucky spending last year was $32.7 billion, which makes the underfunded portion of their pension liability larger than the entire state budget. But wait, it gets worse.

They asked themselves, what if we have to assume a more realistic discount rate for future returns? Assuming returns just north of 5%, the unfunded portion rises to $42 billion. Assuming a more realistic 4% (given the likely returns on their fixed-income portfolios), unfunded liabilities rise to $64 billion, roughly twice the state budget. If you assume a discount rate equal to the 30-year Treasury rate of 2.7%, the unfunded liability climbs to $84 billion – seven times more than the annual general fund spending would allow.

Now, this is all before we take into account a potential recession, which has in the past meant an average 40% loss on stock market equities, which would make Kentucky’s (and everyone else’s) pension woes even worse. Further, as we shall see in future letters, the massive increases in debt, both in the US and globally, will make the next recovery and future growth even more laggardly than the tepid recovery we have experienced in the past decade.

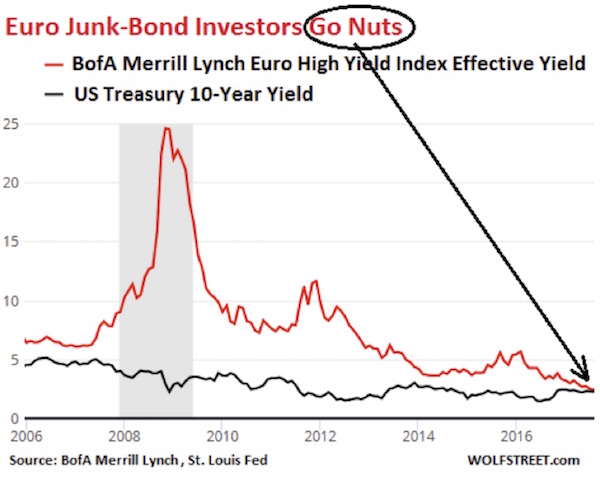

The next financial crisis will not look anything like the last financial crisis did. But it will rhyme. This next chart depicts an extreme example of what is happening around the world. Scary levels of junk-bond debt with covenant-lite options – coupled with the Frank Dodd rules that don’t allow banks to operate in the corporate bond market as market makers – are going to mean that corporate debt, from the worst right on up to the best, will take a massive yield hit, as the flight for cash rhymes with what we saw in 2009.

Remember, in a crisis you don’t sell what you want to sell; you sell what you can sell. And at a bargain-basement price. We have monster mutual funds and ETFs investing in these high-yield corporate markets, and the redemptions from them are going to force selling into a market where there are no buyers. If you’re wondering what will push the country into recession, look to the financial markets. That’s where the excesses are being created. And for the record, I could spend another four pages showing charts like the one above.

It’s All About Supply, Not Demand

Neo-Keynesian economists in the government and at the Fed have been doing everything they can to stimulate demand in terms of dollars spent, believing that they will stimulate a recovery. They are missing part of the equation. Let’s go back to economics 101 and look at possibly the first graph you ever saw in that class: the classic supply and demand equilibrium price graph.

If you push the supply curve to the right, i.e., you provide more of a particular good, then the price of that good is going to go down to find a new equilibrium.

I was talking with an economist yesterday who has John Deere as a client. As he was touring their factory, they pointed that they were making the same parts for 40% less today than they did just a few years ago. Improved quality and lower prices.

Everybody latches onto the fact that real wages haven’t risen all that much in 40 years. Well, if you look just at the standard economic numbers, that is true. But compare what you could get 40 years ago to what you can buy today (assuming equivalent purchasing power). Do you think TV quality was anywhere close to today’s? Telecommunications? Automobiles? Almost everything is far better today, more abundant, and less expensive than it was in 1977. The same amount of money today buys a far more desirable basket of goods.

Not to mention that some of those goodies didn’t even exist back in 1977, like our computers and cell phones. Our automobiles were clunkers that maybe got 12 miles to the gallon and started to go belly up at 70,000 miles. And don’t even get me started about the quality of healthcare. We all bitch and moan about the cost of healthcare, much of which is government-generated, but oh my, the quality of care is so vastly superior.

Personal example: My family has a history of tinnitus. Mine has been getting steadily worse over the last 10 years, to the point that I have to consider hearing aids. I sat down two days ago with my audiologist, who gave me a loaner pair of hearing aids until the latest and greatest from Switzerland show up in about four weeks. Those will connect to my iPhone and computer. I kid you not. And when she began to explain the power of the microchips in those little devices, I was totally blown away. The amount of real-time, instantaneous analysis that these hearing aids can perform on the sounds around you is truly stunning. They can change the output to your auditory nerve on the fly, depending upon the acoustic characteristics of your situation.

Shane came home, and it was some time before she noticed that I even had the hearing aids in. You can barely see them unless you’re looking. Then we went to dinner at the local watering hole and sat outside, where I admit it has been hard for me to carry on a conversation, and I was amazed at everything that I could hear.

Or ask somebody about their latest knee or hip replacement. Or whatever. Anybody who wants to go back to the good old days of 1977 is welcome to them. Count me out.

Let me wrap up here. I am telling you that in the next 20 years the amount of high-quality goods that are going to be supplied to the world is going to drive the prices of almost everything down – except of course the cost of government, which is only going to go up. Fact: The poverty level in the US has been flat for almost 40 years, but spending on government poverty programs is up 900%. Government has no incentive to be efficient. And in fact, as Jerry Pournelle told us at the beginning of the letter:

In any bureaucracy, the people devoted to the benefit of the bureaucracy itself always get in control, and those dedicated to the goals the bureaucracy is supposed to accomplish have less and less influence, and sometimes are eliminated entirely. [Pournelle's law of bureaucracy]

In any event, the ever-increasing amount of supply is going to be massively deflationary over time and will offset the massive needs for quantitative easing and debt relief, etc. We are going to do things in the next 20 years that simply defy our current imagination – mostly because we will be forced into them in order to avoid utter disaster.

Let me close with this note to the wise. We are putting the finishing touches on the next Strategic Investment Conference, to be held March 6–9 in San Diego. We are going to spend a great deal of time on these issues that will be so utterly critical to us as we learn how to steer our portfolios through future storms. You should look at your calendar and set aside those dates. We will be accepting early-bird registrations within a few weeks. See you there.

Boston, Chicago, Lisbon, Denver, and Lugano

I want to first thank all my readers who have been generous with their time and money in helping the victims of Hurricane Harvey. The toll is staggering, with tens of thousands of homes totally destroyed and another hundred thousand damaged and requiring repair that will take a long time to complete. To put this disaster in perspective, if the Houston area were a country, it would be the 17th largest by GDP in the world.

And now here comes Hurricane Irma. As I work on final edits while flying to Boston, I meditate on the fact that Florida is even bigger than Houston. I have been in contact with many friends who are planning to ride the storm out in Florida, and I will admit I worry about them. And the entire country will be faced with another large relief effort. Floridians will be in our thoughts and prayers and hopefully benefit from our efforts and money in the next few days.

Tomorrow I have to take a quick flight to Boston, where I will spend a few days. But then I’ll be home until the end of the month, when I fly up to Chicago for a couple days (Sept. 26–28) for a speech to the Wisconsin Real Estate Alumni Association. Then I’m off the next day to Lisbon. I return to Dallas to speak at the Dallas Money Show on October 5–6. You can click on the link for details. I will speak at an alternative investments conference in Denver on October 23–24 (details in future letters). I will again be in Denver on November 6 and 7, speaking for the CFA Society and holding meetings. After a lot of small back-and-forth flights in November, I’ll end up in Lugano, Switzerland, right before Thanksgiving. Busy month!

And just for the record, I probably have about one third of The Age of Transformation done or nearly so. I am not going to set an ETA for the final copy, because I know the editing and rewriting process is going to be grueling and time-consuming. There are going to be numerous copies out there for people to read and provide comments on – either the total book or sections. I want this one done right.

I was saddened to learn yesterday of the death of one of my science-fiction heroes, Jerry Pournelle, who has given me so many hours of reading pleasure over the last (at least) five decades and has contributed some gems to this letter. Little-known fact: Back in 1985 he was kicked off of ARPANET, the precursor to the Internet, because he had the temerity to write about it in one of his columns. Those early intrepid Internet explorers from MIT? They were all afraid that if Congress found out what they were doing, they would shut the thing down as a boondoggle, as it was still being funded by DARPA. The back-and-forth messaging is actually a hilarious read, as viewed from 2017. But their brainchild was just another one of those inventions that has radically shaped and improved supply. I doubt anyone remembers those internet pioneers very much anymore, but in any case, Jerry Pournelle’s stories will live on for a long time. May he rest in peace (or stir up a bit of trouble where it needs stirring).

Time to hit the send button. Your assignment is to figure out how to get to San Diego. As for me, I have to deal with my inbox. Have a great week!

Your optimistic about humanity but concerned about government analyst,

John Mauldin

subscribers@MauldinEconomics.com

Copyright 2017 John Mauldin. All Rights Reserved.

| Digg This Article

-- Published: Sunday, 10 September 2017 | E-Mail | Print | Source: GoldSeek.com